Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes January 30, 2026

At a Bloomberg forum event in San Francisco, California Gov. Gavin Newsom said the proposed billionaire tax would ultimately degrade the state’s tax base as the ultrawealthy left the state.

Taxes January 30, 2026

The suit was filed Thursday in Miami federal court by the president, his sons Donald Jr. and Eric, and the Trump Organization, which manages the president’s real estate holdings.

Taxes January 29, 2026

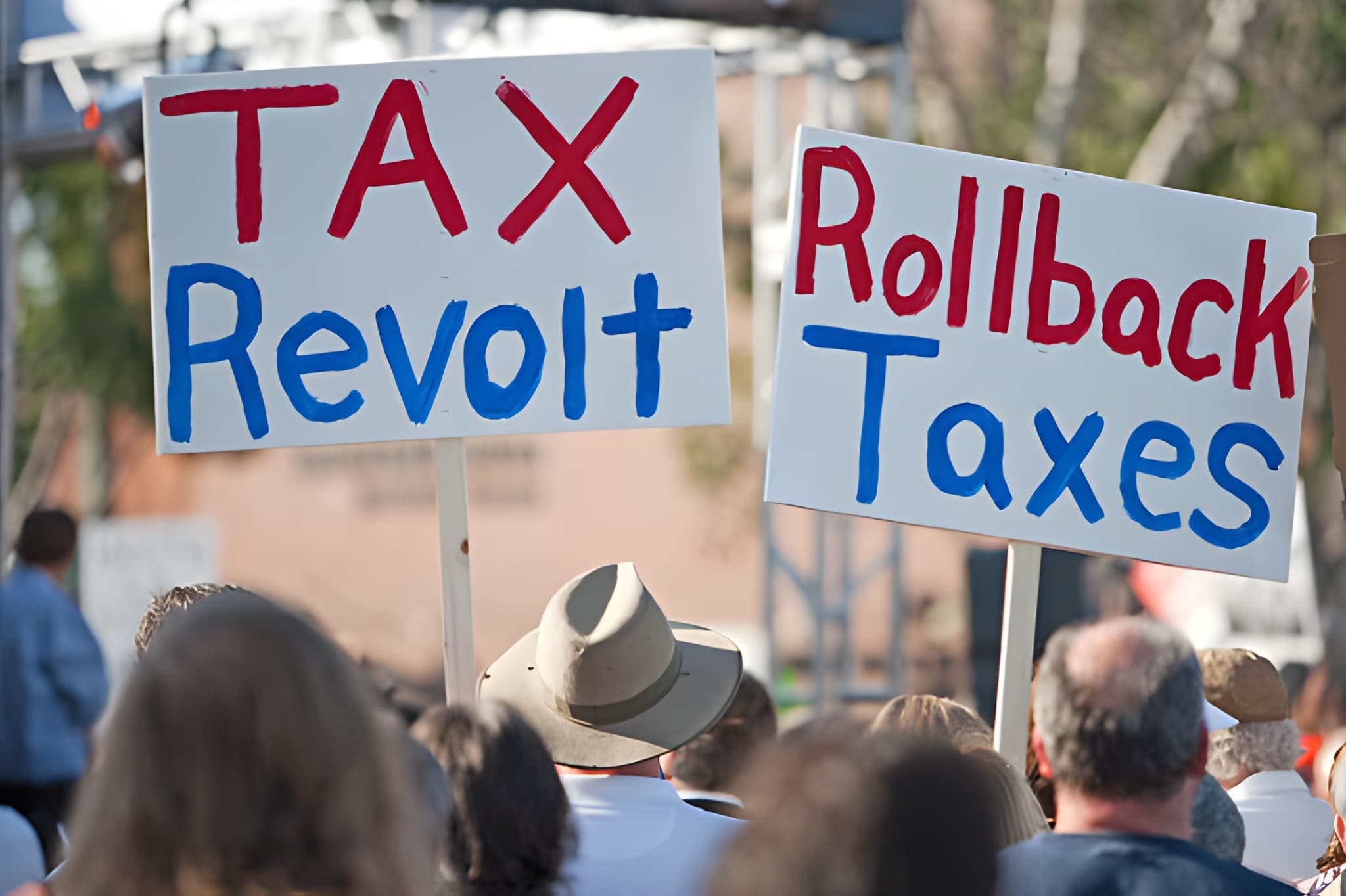

There's historical precedent for tax protests, but there are real-world consequences to not paying taxes that one Connecticut tax preparer said makes such a protest inadvisable.

IRS January 29, 2026

As the 2026 tax season gets underway, the head of the IRS announced a major shake-up, initiating personnel and operational changes intended to improve taxpayer service and modernize the agency.

Taxes January 29, 2026

Inching toward the Nov. 3 ballot is a proposal to reduce the state's personal income tax rate from 5% to 4% over three years, which backers say would save individual taxpayers an estimated $4,000 during that period.

Taxes January 29, 2026

Republican Gov. Mike Kehoe’s bid to replace Missouri’s income tax with sales and use taxes ran into a wall of opposition from some of the state’s major lobbying groups Wednesday.

Taxes January 28, 2026

New York City Mayor Zohran Mamdani lambasted former Mayor Eric Adams for a “fiscal crisis” on Wednesday, laying the blame on Adams for a budget gap that could exceed $12 billion.

Taxes January 28, 2026

As the IRS enters the 2026 tax season facing workforce reductions and implementing major tax law changes, National Taxpayer Advocate Erin Collins warns in a new report that taxpayers could encounter more challenges when filing their taxes this year.

Taxes January 28, 2026

Dozens of public school advocates gathered outside of the Governor’s Office in the West Loop Tuesday morning, demanding that Pritzker choose not to participate.

Taxes January 28, 2026

City Council member Nithya Raman took her own shot at rewriting the tax, saying she too believes it is holding back housing production. But council members refused to take up Raman's proposal on Jan. 27.

Taxes January 27, 2026

The IRS released frequently asked questions on Tuesday regarding how an executive order from President Donald Trump will impact the way taxpayers receive tax refunds and make tax payments.

Taxes January 27, 2026

The Treasury Department and the IRS on Jan. 23 issued a fact sheet containing frequently asked questions related to the new tax deduction for qualified overtime compensation under the One Big Beautiful Bill Act.