Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

May 25, 2016

On its tax returns, the company deducted about $4 million in compensation and $7.3 million paid to the sons in 2003 and 2004, respectively. The IRS audited the business and partially disallowed the deductions for compensation.

May 25, 2016

Federal agents have arrested five people who are facing charges of impersonating IRS agents in scams that have persisted for more than three years. Victims lost more than $2 million and were contacted by phone and told they owed back taxes or other fees.

May 24, 2016

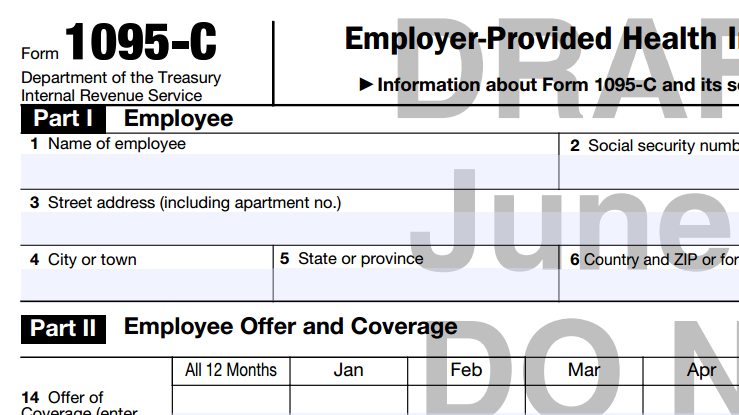

This product is ideal for SMBs with 50+ employees. Based on our experience with hundreds of clients and prospects, a lot of “what you don’t know you don’t know” thinking exists. Given the complexities that we share in this White Paper, your ...

May 24, 2016

There is an opportunity for Congress to modernize the agency so that it better protects consumers from harm while minimizing regulatory costs and better enabling robust innovation in the U.S. economy.

May 24, 2016

The traditional distinction between employees and independent contractors is discouraging companies from offering gig economy workers important support, particularly when it comes to taxes. That'd according to Joseph Kennedy, senior fellow at the ...

May 23, 2016

As a result of the Labor Department's new overtime rules, management positions in restaurants will disappear, limiting career advancement and hurting restaurant employees and owners, according to the National Council of Chain Restaurants.

May 22, 2016

Most expatriate U.S. citizens need to file by June 15, 2016. Taxpayers who need to file an FBAR (Foreign Bank and Financial Account Report) must file by June 30. More than 1 million taxpayers filed an FBAR in 2015. Taxpayers with foreign assets, even ...

May 20, 2016

CPAs, EAs and other tax professionals can register online for the 2016 IRS Nationwide Tax Forums for an opportunity to earn up to 19 continuing professional education credits at any of the five forums held throughout the country beginning this July.

May 19, 2016

In the wake of the entertainer Prince’s death, it has been called “the worst estate planning sin a wealthy artist could commit: leaving no will at all.”

May 18, 2016

Each state determines how these products are taxed differently. When multiple jurisdictions and products are involved, time spent on sales tax management can quickly snowball. Sales tax automation software like Avalara AvaTax takes this tedious ...

May 18, 2016

Here are 10 common “events” that could signal it’s time to make a change when it comes to how you or your clients manage sales taxes.

May 18, 2016

Tax automation provider Avalara, Inc. has introduced the new CertCapture Mobile Scan App, giving businesses the ability to capture and securely submit compliance documents, in real-time, at any point in the sale/purchase transaction process.