Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

April 22, 2016

How to keep sensitive client data out of the hands of identity thieves.

April 21, 2016

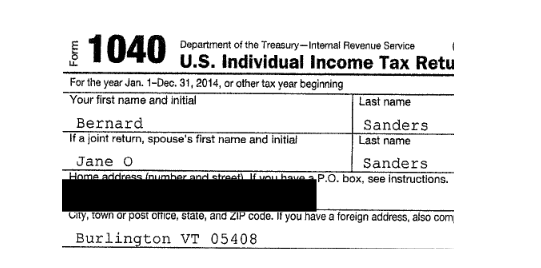

After weeks of prodding from his main opponent for the Democratic presidential nomination, Bernie Sanders finally released the remaining forms and schedules of his 2014 tax return on April 15. The result? No major surprises – the Vermont senator ...

April 20, 2016

Some sorts of money—typically coins, paper money and precious metals—are subject to sales tax in many states. In some states, sales of all types of money are exempt.

April 20, 2016

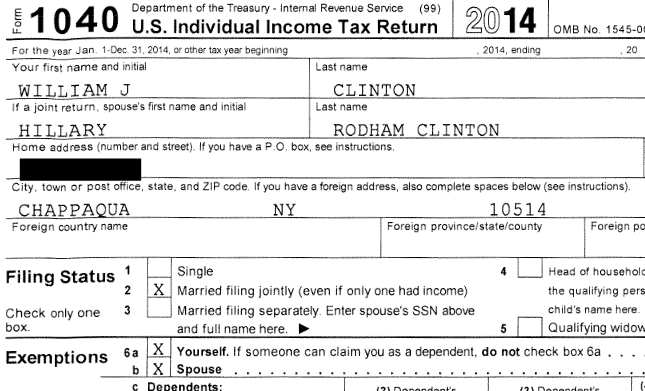

The former Secretary of State and New York Senator, who has been living in a fish bowl since her husband Bill became governor of Arkansas and ascended to the presidency, recently released copies of her joint tax returns for the last eight years.

April 19, 2016

The Obamas claimed claiming more than $145,000 in itemized deductions on their 2015 return, including donations to charity such as the Fisher House Foundation, a longtime favorite. The couple is in line for a refund of almost $23,000.

April 18, 2016

The “Tax Filing Simplification Act of 2016” requires the IRS to develop a free service for filing tax returns directly with the federal government and prohibits the nation’s tax collection agency from entering into agreements restricting the use of ...

April 18, 2016

Clients who don’t adhere to state record keeping requirements run the risk of being penalized by auditors. The exact rules and penalties vary from state to state, but it is definitely in your clients’ best interests to stick to the letter of the law.

April 17, 2016

The basic rules are as follows: The income you realize from a vacation home rental is generally taxable, but you can offset the tax liability with deductions for expenses attributable to rentals, including mortgage interest, property taxes, insurance ...

April 15, 2016

Congress may have more to say about how the IRS “runs its business” in upcoming years. Four new bills marked up and passed on April 13 by the Ways and Means Committee, the tax-law writing body of the House, would dictate IRS certain practices, if enacted.

April 14, 2016

We can’t go back in time and start doing our taxes earlier, but perhaps we can look forward to the passing of the recently introduced Tax Filing Simplification Act of 2016, which promises to simplify and decrease the cost of filing our tax returns.

April 13, 2016

Many of your small business clients, especially those in retail operations, have struggled with responsibilities for collecting and remitting sales and use taxes to the appropriate jurisdictions. This includes issues relating to sales transactions and ...

April 13, 2016

The home stretch of tax season means heavy workloads and long hours for accountants. This time of year, nerves are frayed and tensions are high. It’s no walk in the park for managers either. In addition to your client load, you’ve got to keep your ...