Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

March 31, 2016

They may not know it, but this may be the last year that some of your older clients will be able to claim a medical expense deduction.

March 31, 2016

A new online tool from Expat Tax Tools is aimed at simplifying Form 8621: Information Return by a Shareholder of a Passive Foreign Investment Company or Qualifying Electing Fund. The cloud-based Form 8621 Calculator is designed for smaller companies ...

March 31, 2016

This coverage comes at a crucial time. On June 1, 2016, Puerto Rico will become the first U.S. jurisdiction to adopt a VAT to replace its sales and use tax regime. The transition to this new scheme began in 2015 and has been controversial.

March 30, 2016

Pets were a recurring theme: “I had a client this year tell me his last preparer let him write off the cost of his pet care on Schedule C because he took his dog to work with him every day, so it was considered a work-related expense."

March 30, 2016

Business majors land in the fourth spot, with a projected starting average of $52,236, an increase from the projected $51,508 for Class of 2015 graduates.

March 30, 2016

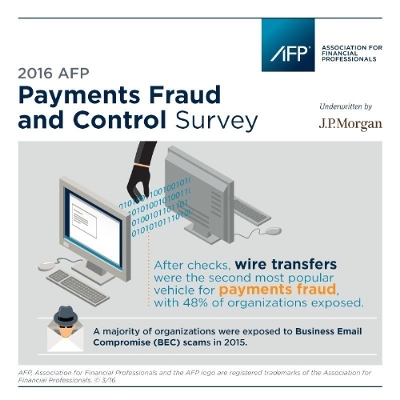

BEC scams, short for business email compromise, are an increasingly common type of fraud which greatly impacts wire fraud. In 2015, 64 percent of organizations were exposed to BEC scams. Though checks continue to be the payment method most targeted by ...

March 30, 2016

The nation's taxing agency is trying to step up its game when it comes to using technology to improve customer (aka taxpayer) interactions. The IRS wiill be hosting its first Tax Design Challenge crowdsourcing competition to encourage innovative ideas ...

March 29, 2016

The research revealed that nearly half of business owners do not know how many fines they incurred in the past 12 months or how much they cost their organizations.

March 29, 2016

No doubt, 2016 will be the most challenging year-end season in a long time. With all W-2 forms due to the Social Security Administration (SSA) by Jan. 31, 2017, and the ability to request only one for-cause filing extension from the IRS, the ...

March 25, 2016

The red-letter due date for filing for individual tax returns – April 18 for most taxpayers around the country – is rapidly approaching. When it’s needed or preferred, you can obtain a six-month extension for filing Form 1040, merely by asking the IRS.

March 25, 2016

With considerably less fanfare than the Bill of Rights ratified as the first amendments to the U.S. Constitution, the 114th Congress quietly approved the “Taxpayer Bill of Rights” as part of the Protecting Americans from Tax Hikes (PATH) Act of 2015.

March 24, 2016

Mortgage rates declined modestly this week breaking a three-week string of increases, with the benchmark 30-year fixed mortgage rate slipping to 3.90 percent, according to Bankrate.com's weekly national survey. The 30-year fixed mortgage has an average of