Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

March 16, 2016

The IRS seized more than $150,00 from a convenience store owner’s bank account in 2014 – virtually all the money he had in the world – even though he did absolutely nothing wrong. It has taken the taxpayer nearly two years to get the money bank and ...

March 15, 2016

Thomson Reuters Checkpoint has just released a special report, European Commission Presents Anti-Tax Avoidance (ATA) Package, summarizing the ATA Package to help businesses plan for the latest developments in advance of implementation.

March 15, 2016

The Protecting Americans from Tax Hikes Act of 2015 (PATH Act) may be the last significant tax bill of the Obama administration. With the 2016 presidential election looming, tax directors are closely watching how America’s choice will impact the tax ...

March 15, 2016

In cases where a tax return was not filed, the tax law provides most taxpayers with a three-year window of opportunity for claiming a refund. However, if no return is fled in time, the money becomes the property of Uncle Sam. For 2012 tax returns, the ...

March 14, 2016

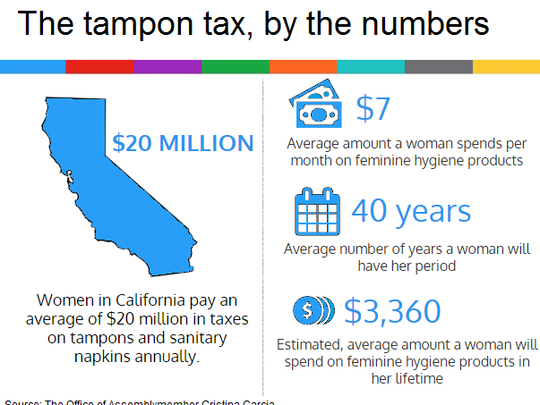

Court papers note that the state doesn’t tax other hygiene items like Rogaine, foot powder, dandruff shampoo, ChapStick, facial wash, adult diapers and incontinence pads, but tampons and sanitary pads are subject to sales tax.

March 14, 2016

There are a variety of industries that find themselves with a unique tax conundrum…they are required to calculate and file both sales and excise taxes to run their day-to-day business. So, what’s the big deal?

March 14, 2016

Just when you thought you had a handle on the rules for taxing goods and services, you come face to face with the new compliance bully on the block: “sometimes taxable.” Businesses must correctly deal with these sometimes exempt and sometimes subject ...

March 14, 2016

Can’t file your tax return by the April 18 deadline? Taxpayers can request an automatic six-month extension of time to file the return, but what many don’t know can cost them.

March 14, 2016

The new TAP members will join 41 returning members to round out the panel of 73 volunteers for 2016. The new members were selected from more than 1,000 interested individuals who applied during an open recruitment period last spring and the pool of ...

March 14, 2016

The Internal Revenue Service says that federal income tax refunds totaling $950 million are waiting for an estimated one million taxpayers who did not file a federal income tax return for 2012. To collect the money, these taxpayers must file a ...

March 13, 2016

Essentially, employers now have until June 29, 2016 to get all their ducks in a row. The new Notice also explains the rules for a new target group.

March 4, 2016

With public accounting firms facing increased competition for skilled staff, it’s more important than ever that companies take a strategic approach to recruiting and hiring. Above-average compensation packages can go a long way in helping your ...