Taxes February 6, 2026

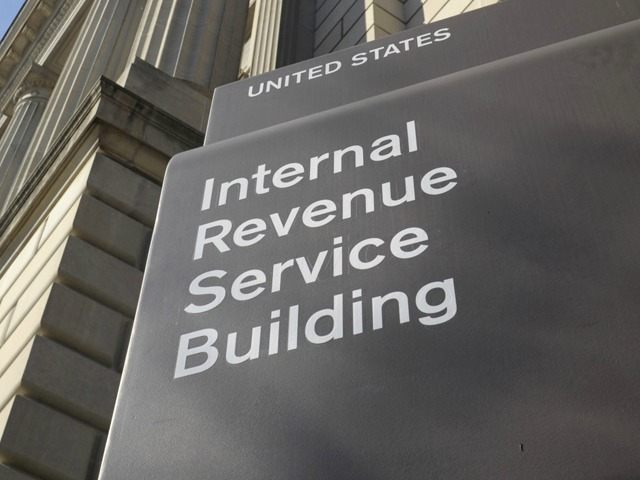

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

January 19, 2016

From the IRS extending select Affordable Care Act reporting deadlines to a delay of the debated Cadillac Tax, 2016 is gearing up to be another active year for government regulations impacting business.

January 19, 2016

The figure that is likely to grab your attention is 52 percent. That is the top tax bracket proposed by Sanders, a plateau that hasn’t been reached since a watershed 70 percent rate was scaled back in the 1980s. The top tax bracket peaked at 91 percent...

January 18, 2016

Reports anticipate that 2016 will be a healthy year for the real estate market, so if you or your clients are considering buying or selling a house this year, here are some tips from professional realtors. The tips can help guide everyone from ...

January 16, 2016

The latest topic added to Thomson Reuters Checkpoint Catalyst highlights the Uniform Division of Income for Tax Purposes Act (UDITPA) and its impact on state allocation and apportionment of income. Checkpoint Catalyst provides detailed information and ...

January 16, 2016

The Intuit ACA Resource Center, a part of the Intuit Tax Pro Center, includes easy-to-use guides and tools designed to make it easy for tax professionals to stay updated on changes in ACA compliance and requirements for reporting client health ...

January 15, 2016

Avalara, Inc. has attained Workday Certified Solution Partner status. Avalara, which is a provider of cloud software for tax compliance, is a Workday software partner. With this certification, Avalara now provides customers with a real-time ...

January 15, 2016

Thomson Reuters has released a special report highlighting key tax developments in 2015 to aid practitioners in 2015 tax return preparation and support 2016 planning.

January 15, 2016

The Internal Revenue Service will open the nation’s 2016 individual income tax filing season on Jan. 19, with more than 150 million tax returns expected to be filed this year. People will have several extra days to file their tax returns this year. Taxpayers have until Monday, April 18, to file their 2015 tax returns...…

January 15, 2016

Carson would also eliminate deductions for charitable contributions, mortgage interest and state and local income taxes, while repealing the alternative minimum tax (AMT), the earned income credit and the rules for depreciation.

January 14, 2016

Playing the lottery is a form of gambling. As a result, the usual federal tax rules apply to income and losses resulting from gambling activities. Generally, you can only deduct your losses from wagering up to the annual amount of your income from ...

January 12, 2016

How do you know if someone has filed a tax return using your Social Security number? And what do you do then? This is happening more and more—the latest General Accounting Office (GAO) report says that IRS paid out over $5.8 billion in fraudulent returns.

January 12, 2016

The American Institute of CPAs (AICPA) has submitted comments to the Internal Revenue Service (IRS) about the IRS’s new policy of issuing estate tax closing letters only upon a separate request four months after filing the estate tax return. The IRS announced changes related to the issuance of estate tax closing letters on the...…