Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

December 21, 2015

Are you concerned that your company isn’t as ready for a sales tax audit as it could be? Here are the top nine steps you can take with your exemption certificates to ensure your company is audit-ready.

December 21, 2015

Taxation is no longer a once-a-year engagement, at least not for clients with more than a couple of W-2s and 1099s. Complex and high net worth clients require strategic tax planning, which in turn requires their professional to stay on top of changes ...

December 21, 2015

The PATH Act makes more than 20 tax breaks permanent in addition to retroactively extending a slew of others for two or more years. Here’s a roundup of the key individual, business and miscellaneous provisions in the new measure.

December 20, 2015

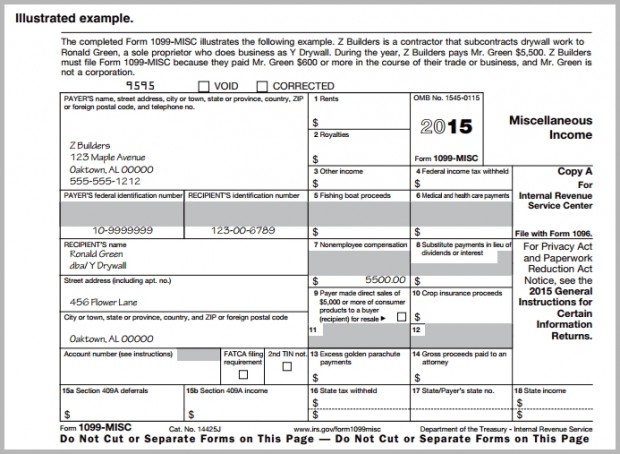

This IRS Form 1099-Misc is for reporting income received from Jan. 1 to Dec. 31, 2015, which the recipient will file a tax return for in 2016.

December 20, 2015

This IRS Form W-2 is for reporting income earned during Jan. 1 to Dec. 31, 2015, which the employee will file a tax return for in 2016.

December 20, 2015

When will you get your income tax refund? If you're one of the millions of Americans who are asking that question (or will be in the coming weeks), we have the answer. It depends on a couple of factors, but the good news is that there are several ...

December 20, 2015

For tax year 2015 - which Americans must file by April 18, 2016 - the has announced annual inflation adjustments for more than 40 tax provisions, including the tax rate schedules, and other tax changes. The tax items for tax year 2015 ...

December 17, 2015

The new “tax extenders” legislation just unveiled by Congress does more than merely extend dozens of expires tax breaks. It also makes several important provisions permanent, with certain modifications, while delaying onerous rules under the Affordable...

December 17, 2015

Now is the time to start thinking about recent tax changes and how they affect your business. Even for the most organized among us, keeping the mountains of tax details straight is a tough and trying task, taking the focus off of the daily ...

December 17, 2015

The Federal Tax Guide offers coverage of a wide range of timely topics most important to tax practitioners as they prepare 2015 returns and plan for the year ahead with new content on health care reform, including individual and employer mandates ...