Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

November 17, 2015

Turkey and taxes. The U.S. has a long history of both. And in 2010, the two converged in Virginia as part of an annual Thanksgiving tradition where tribal and state leaders pay homage to a more than 330-year-old treaty: then-governor Bob McDonnell was ...

November 17, 2015

Designed to control all aspects of the exemption certificates lifecycle to reduce operating costs, mitigate risks and increase accuracy, the release features a new user interface and provides tight integration with ONESOURCE Indirect Tax Determination.

November 17, 2015

This partnership gives EPiServer the ability to bring indirect tax automation to its growing customer base in Europe and the United States. Avalara’s service allows businesses of all sizes to stay current with constantly changing rates and rules ...

November 17, 2015

Thomson Reuters recently announced the winners of the second annual Taxologist Awards, a program that recognizes exceptional tax departments and professionals who positively impact their organizations by embracing tax technology.

Technology November 16, 2015

From Nov. 2015 - The passage of the Affordable Care Act (ACA) has brought major change to the accounting profession as individuals and companies are increasingly turning to accountants and tax preparers for help in complying with new mandates and insurance decisions.

November 16, 2015

Sales tax bonds– or tax bonds as they are often called– are an umbrella name for a number of different tax bonds that state or local governments mandate from businesses, as a pre-licensing requirement. In these cases, a business license cannot be ...

November 16, 2015

TIGTA found that the IRS recognizes continued efforts are needed to develop and implement systemic processes to detect identity theft. To date, the IRS has taken actions that include defining business identity theft, creating procedures for IRS ...

November 16, 2015

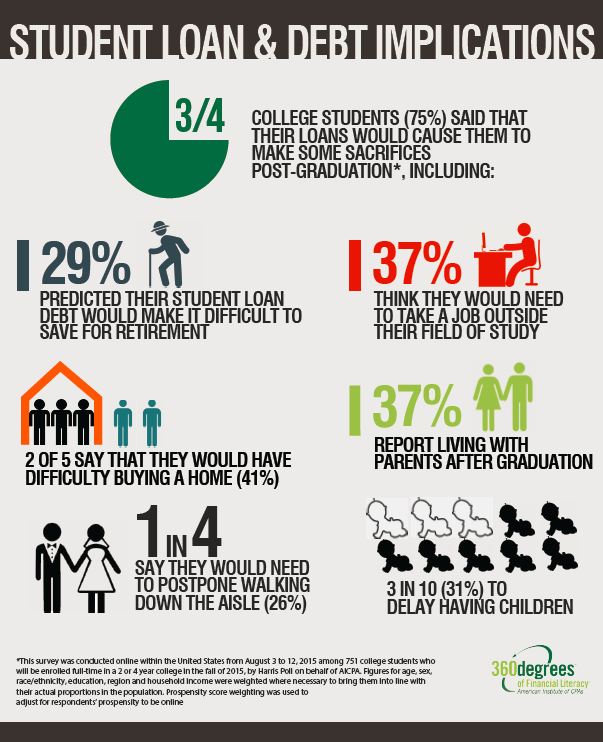

On average, college students who have student loans thought they would be able to pay back their loans in nine years after graduation, with only 18 percent saying that it would take them more than ten years. A quarter of college students with loans ...

November 16, 2015

Anyone who prepares, or assists in preparing, substantially all of a federal tax return or claim for refund for compensation must have a valid PTIN from the IRS. The PTIN must be used as the identifying number on these prepared returns.

November 6, 2015

Tired of 80-hour work weeks? Frustrated that your staff doesn’t want to be held accountable? Stressed about stressing next tax season? As part 1 of a series on “Building your Tax Season,” I wanted to share with you a couple of steps you can take today ...

November 4, 2015

Germano is president and general counsel of Actuarial Benefits & Design Company, which she co-founded in 1989. The company, based in Midlothian, Va., helps business owners assess retirement needs for themselves and their employees, as well as to set up r

November 3, 2015

With tax season looming, now is the time for accounting firms to ramp up their staffing strategy. Determining your needed mix of full-time and temporary professionals — before holiday time-off — will set you on a course for success come 2016.