Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

October 19, 2015

A fifth of small-business owners say they would allow an employee with a medical marijuana prescription to use the drug while at work, according to a survey released Wednesday by Employers Insurance.

October 17, 2015

The best tax advice you can get is to speak with a CPA or Enrolled Agent. These tax experts can help develop a tax strategy designed around your specific needs and situation, and they are the only professionals who can represent you before the IRS.

October 17, 2015

As with itemized deductions, the tax benefit of personal exemptions, including exemptions for dependents, is subject to a special phase-out rule. However, unlike deductible expenses that might be moved from one tax year to another, the approach for ...

October 17, 2015

With more than 54,000 taxpayers coming in to participate in offshore disclosure programs since 2009, the Internal Revenue Service today reminded U.S. taxpayers with undisclosed offshore accounts that they should strongly consider existing paths ...

October 16, 2015

(This is part of our series of “sweet 16” year-end tax planning ideas.) The conventional year-end tax wisdom is to push deductible expenses into the current year to offset the tax bill you’ll be paying come April, especially if you expect to be in the same or a higher tax bracket each year. The old...…

October 16, 2015

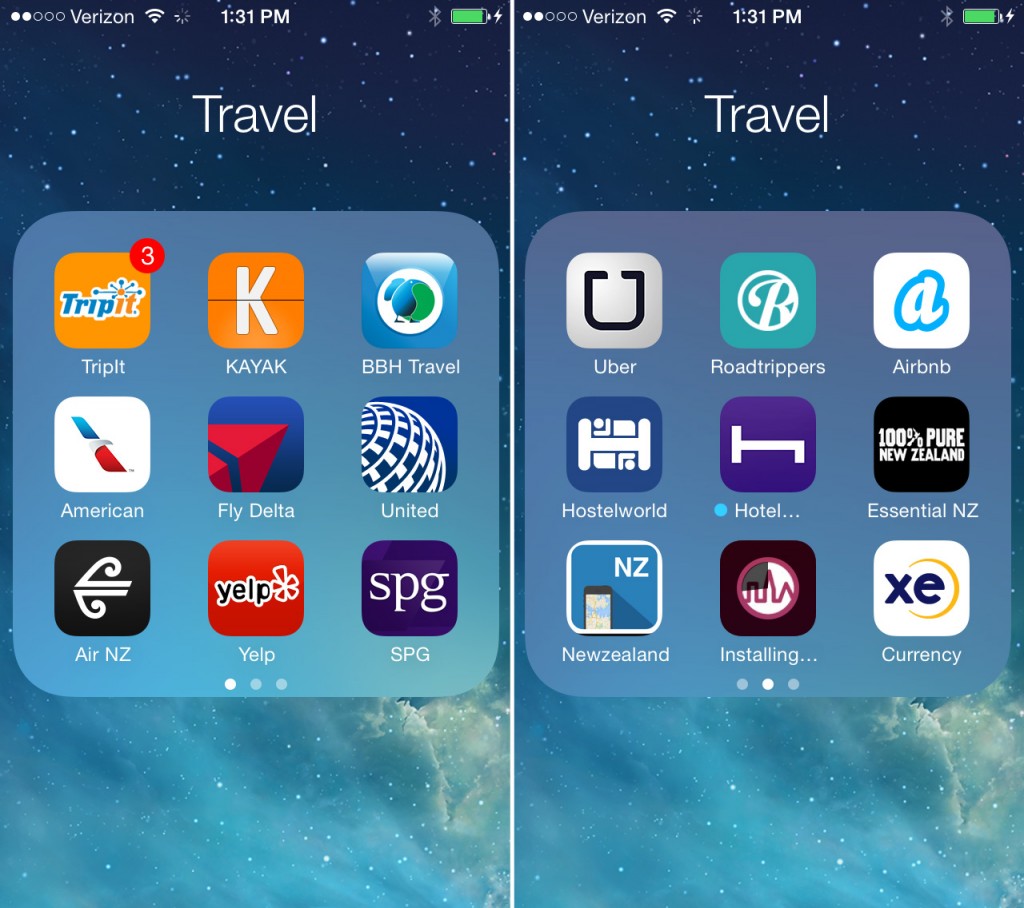

Whether you're traveling for business or personal, alone or with colleagues or friends or family members, domestically or internationally – we all know that getting from point A to point B can cause frustration, confusion, and disorientation. We surveyed

October 16, 2015

TIGTA continues to receive reports of thousands of contacts every month in which individuals make unsolicited calls to taxpayers fraudulently claiming to be IRS officials and demanding that they send them cash via prepaid debit cards, he said.

October 15, 2015

Scams and con artists are everywhere and they'll do just about anything to gain access to your personal information and steal your hard-earned money. One of your best defenses against fraud is learning to recognize scammers' more common tactics and ...

October 15, 2015

W-2 and 1099 Forms Filer, part of the 1099-Etc suite of products from AMS offers payroll and related form processing. While W-2 and 1099 Forms Filer is considered the base program, the entire suite of modules is designed to process payroll, print ...

October 15, 2015

Laser Link, sold by Tenenz, is a year-end compliance and reporting solution. Now compatible with Windows 8+, the product uses forms data entry screens for quick processing.

October 15, 2015

Designed exclusively for accountants, After-the-Fact Payroll is part of AccountantsWorld suite of products. While After-the-Fact Payroll is primarily designed to be used as a payroll system, the product contains numerous features that aid in ...