Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

August 28, 2015

The Statistics of Income (SOI) Division produces this online Bulletin quarterly. Articles provide the most recent data available from various tax and information returns filed by U.S. taxpayers.

August 28, 2015

The number of health plans affected by the Cadillac tax is projected to grow steadily in the future. Absent any changes, the Kaiser report shows that 30 percent of the plans could be liable for the tax five years after it kicks in and 42 percent ...

August 26, 2015

The IRS needs to lose this case for the callous way they disregarded the importance of safeguarding taxpayer information from data thieves, and because it would finally set a legal precedent for organizations to be held fiscally responsible for losses ...

August 26, 2015

Understanding the deductibility of school costs for children can be challenging. That’s one reason why back-to-school season is a good time to check in with your clients who have kids. It’s an opportunity to combine your mid-year tax planning with a remin

August 24, 2015

No matter how you personally feel on the subject, the reality is that legal Cannabis is becoming a booming business, ripe with opportunities for an accounting practice to work and consult with businesses in the marketplace on a full range of tax ...

August 24, 2015

The system includes a new web-based interface and more search options and the ability to receive automatic delivery of access links to the latest sales tax rates, helping provide accurate sales and use tax rates when and where they are needed.

August 24, 2015

If more than half of the employees are furnished meals for the employer’s convenience, the meals for all employees are treated as being furnished for the employer’s convenience, even if the rest of the employees don’t meet this test. This rule could be cr

August 20, 2015

No matter how you personally feel on the subject, the reality is that legal Cannabis is becoming a booming business, ripe with opportunities for an accounting practice to work and consult with businesses in the marketplace on a full range of tax ...

August 19, 2015

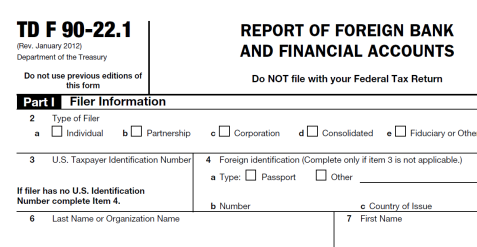

Due to a little-noticed provision in the new highway appropriations bill signed into law on July 31 – the Surface Transportation and Veterans Health Care Choice Improvement Act of 2015 – the deadline for filing an FBAR (Report of Financial Bank and Financial Accounts) has been moved up from June 30 to April 15. But...…

August 19, 2015

The credits apply to eligible students enrolled in an eligible college, university or vocational school, including both nonprofit and for-profit institutions. The credits are subject to income limits that could reduce the amount claimed on their tax ...

August 19, 2015

The IRS has a confession: The data breach involving its “Get Transcript” app was larger than it initially reported. How much larger? About three times as much.

August 19, 2015

The deadline generally applies to Form 2290 and the accompanying tax payment for the tax year that begins July 1, 2015, and ends June 30, 2016. Returns must be filed and tax payments made by Aug. 31 for vehicles used on the road during July.