Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes August 26, 2025

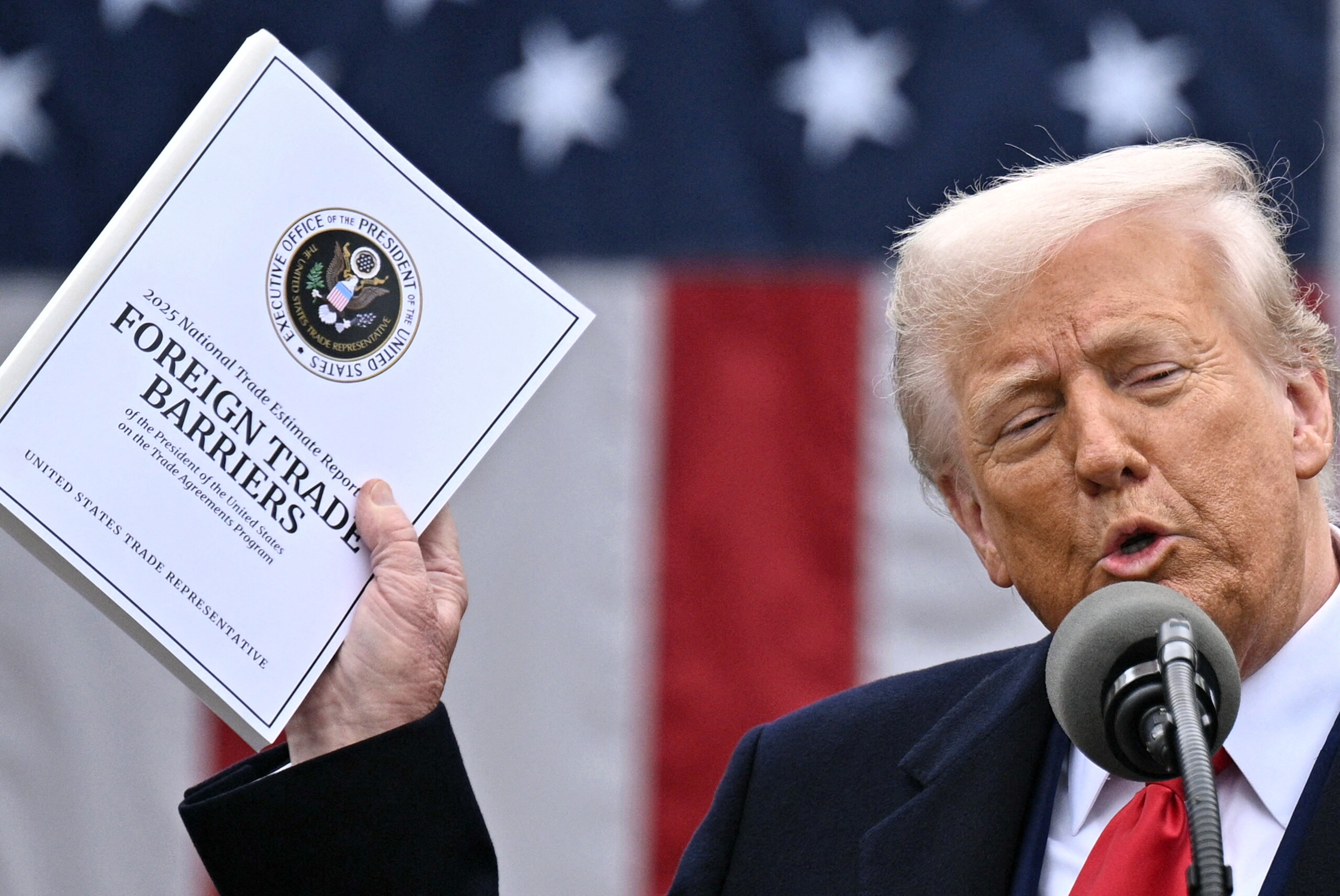

The president threatened to impose fresh tariffs and export restrictions on advanced technology and semiconductors in retaliation against other nations’ digital services taxes that target U.S. technology companies.

Taxes August 25, 2025

For individuals, the rate for overpayments and underpayments will be 7% per year, compounded daily, the IRS said on Aug. 25.

Taxes August 25, 2025

Kim Brown, 40, of Augusta, GA, pleaded guilty to two counts of aiding and assisting in the preparation and filing of false income tax returns, according to the U.S. attorney for the Southern District of Georgia.

IRS August 25, 2025

Taxpayers have through Sept. 5 to fill out a survey that will be presented to Congress, as the Biden-era program that allows taxpayers to file their taxes for free is at risk of being shut down.

Taxes August 25, 2025

A fight over taxes consumers pay for cannabis products has prompted a standoff between unusual adversaries: child-care advocates and the legal weed industry.

Taxes August 25, 2025

Kylie Leia Perez, who lives in Tampa, FL, and uses the stage name “Natalie Monroe,” owes the IRS at least $1.6 million in back taxes, the U.S. Attorney's Office said on Aug. 14.

Taxes August 24, 2025

Retaliatory tariffs during Trump’s first term prompted domestic turmoil for some key industries in Republican-lean states, including Kentucky bourbon and Wisconsin-based Harley-Davidson motorcycles.

Taxes August 22, 2025

Alabama’s county commissions issued a call to action at their summer conference in Orange Beach: protect the state’s internet sales tax system.

Taxes August 22, 2025

Georgia legislators have been reducing the individual and corporate income tax rate for years — it will fall to 5.19% this year under a law signed by Gov. Brian Kemp in April.

State and Local Taxes August 22, 2025

Avalara’s AI-infused solution generates actionable insights and creates data-driven compliance plans that identify potential overpayments, penalties, and other risks.

Taxes August 21, 2025

MySky is acquiring the State Tax Guide from Jet Support Services Inc (JSSI), expanding the capabilities of its MySky Tax solution.

Taxes August 21, 2025

Between 2015 and 2022, Dawson did not pay to the IRS the taxes withheld from his employees’ paychecks. He also used RPC Group’s business accounts to pay for personal expenses.