Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

January 14, 2015

Already the most-disliked federal agency, the Internal Revenue Service is about to see its reputation take another dive as customer service sinks to worst level since 2001, according to National Taxpayer Advocate Nina E. Olson.

January 14, 2015

If you're an employer or a professional tax preparer, the beginning of the new year can be almost as challenging as April when it comes to taxes. That's because its time to send off millions of W-2 and 1099 forms to staff and contractors, and dealing ...

January 12, 2015

Downloadable and printable IRS Tax Form 1040 for Tax Year 2014 (for taxes being filed on or before April 15, 2015).

January 12, 2015

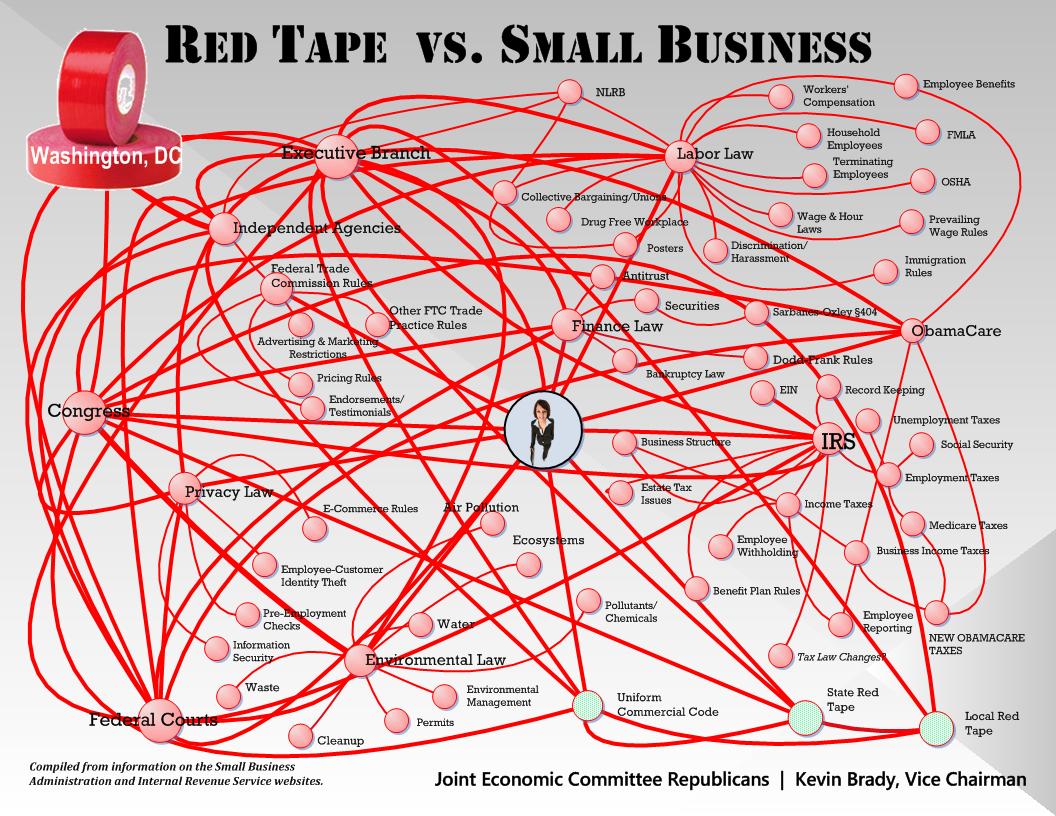

With the New Year in full swing, small business owners are focused on implementing their strategic plans for 2015. An important component of those plans should include monitoring potential regulatory changes and understanding how they may impact the small

January 12, 2015

As part of end-of-year tax legislation by Congress, the half-million dollar maximum deduction was retroactively preserved for 2014, as were a couple of other related provisions. But these extensions authorized by the Tax Increase Prevention Act ...

January 12, 2015

The National Federation of Independent Business (NFIB) says it supports Rep. Bob Goodlatte and his introduction of a bill that would reduce some regulatory hurdles for small businesses. The legislation is H.R. 185, the Regulatory Accountability Act.

January 12, 2015

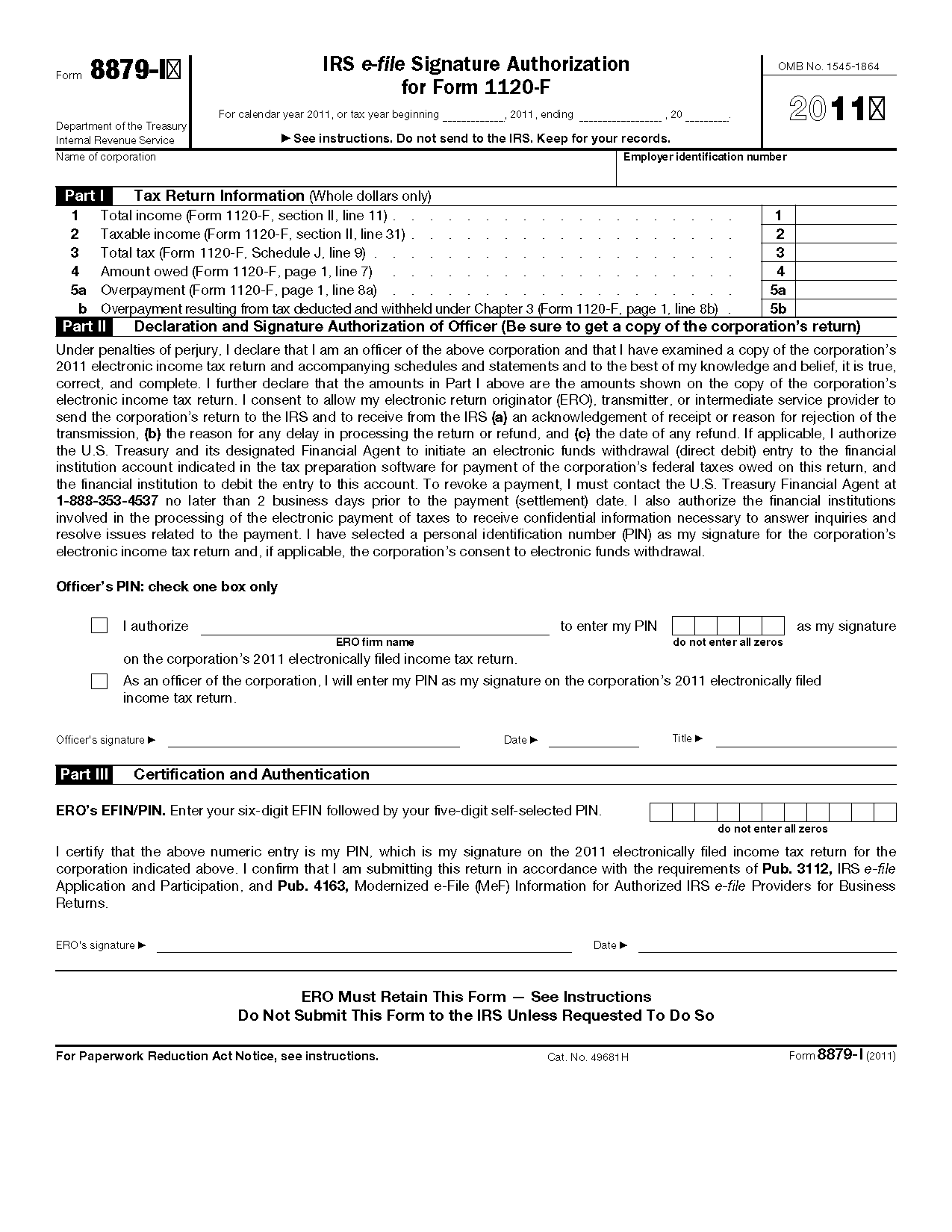

Downloadable and printable version of IRS Form 8879.

January 12, 2015

What $350 million in IRS budget cuts may mean for taxpayers in 2015. First, the odds of getting through to the IRS Help Line in a reasonable time will be less, now that IRS funding has been reduced to three percent less than last year.

January 11, 2015

Printable TY 2014 IRS Form 7004 - Automatic Extension for Business Income Taxes - For Filing in 2015

January 9, 2015

Printable 2014 IRS Form 1041 - U.S. Income Tax Return for Estates and Trusts - For Filing in 2015

January 9, 2015

If you were smart enough to buy qualified small business stock (QSBS) last year, you’re halfway home to a unique tax break. Now comes the hard part: You have to hold the stock for at least five years before you sell it. If you do, your entire gain is tax-free! The tax break for QSBS...…

January 8, 2015

Do you have clients that are selling online? Or are you an online seller yourself? Learn from the experts what online sellers need to know about sales tax both now and in the very near future.