Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

November 6, 2014

Usually, sin taxes are relegated to perceived vices such as cigarettes and alcohol. But a progressive city in California has approved another sort of sin tax for consumers: an excise tax on artificially sweetened soft drinks. It’s believed that the “soda

November 5, 2014

Now that the dust has settled from the mid-term elections – with the Republican party firmly in control of both houses of Congress – what are the prospects for comprehensive tax reform? Not as favorable as you might think. Although the GOP hopes to break

November 5, 2014

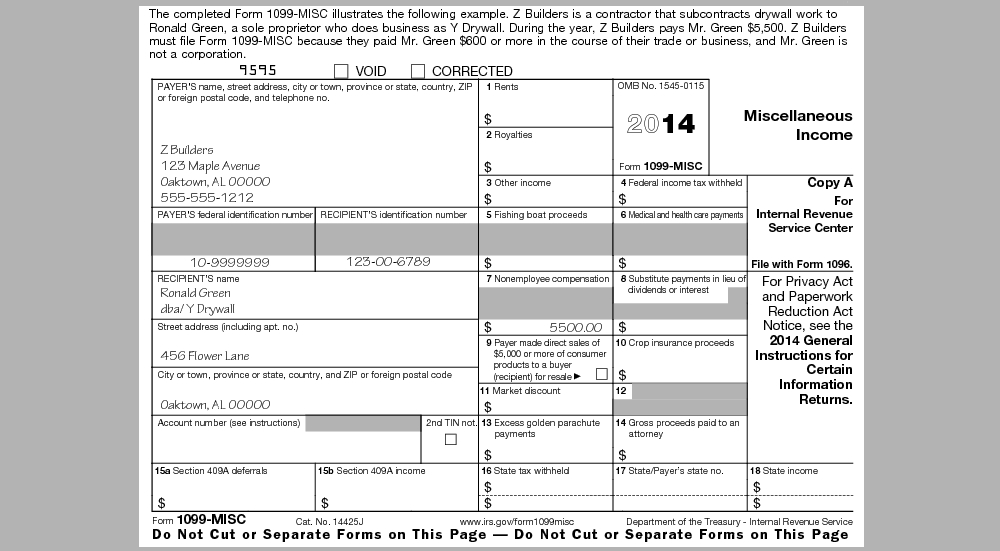

The most frequent use of 1099-MISC is for reporting payments for services to independent contractors, and it is possible to receive more than one 1099-MISC if a recipient performed work for several business entities.

November 5, 2014

When advising clients about important financial decisions, tax advisors have a tremendous responsibility to think about all aspects of transaction in the context of a client’s specific situation.

November 5, 2014

The agency's system of records designed to document wireless device inventory was not consistently updated as changes occurred, which resulted in almost 57 percent of inventory records being inaccurate.

November 5, 2014

The Multistate Tax Foundation (MTF) recently issued its 2015 State Business Tax Climate Index report, a benchmarking report that enables state governments and others to compare their tax systems with other states. Ideally, those states that rank ...

November 5, 2014

The Source Document Processing (SDP) application takes a different approach to tax document automation in that it is a proprietary solution designed to work exclusively with the FileCabinet CS and the UltraTax CS applications. It is also unique in that it

November 5, 2014

The value of 1040SCAN increases with the size of your organization and the complexity of your returns. The modular approach to their products facilitates using this in small practices as well. If you are serious about automating your tax preparation ...

November 5, 2014

ProSystem fx Scan works best when it is used in conjunction with ProSystem fx Tax and the other paperless applications from Wolters Kluwer CCH. However, ProSystem fx Scan can be used on a stand-alone basis, so it has appeal for virtually any tax practice.

November 5, 2014

Life can be funny. There are times when no matter how much we are told something is bad for us, we often ignore the message and continue down our current path. Whether it is smoking cigarettes, excessive drinking, texting while driving, you name it...

November 5, 2014

Year-end planning and preparation for your clients is crucial. With holidays and deadlines fast approaching, payroll practitioners want to work with their clients to ensure they meet all year-end deadline

November 4, 2014

Prior to 2014, parents could generally claim one of three sizeable tax breaks for higher education expenses on their personal tax returns: the tuition deduction, the American Opportunity Tax Credit (formerly the Hope scholarship credit) or the Lifetime Le