Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

October 9, 2014

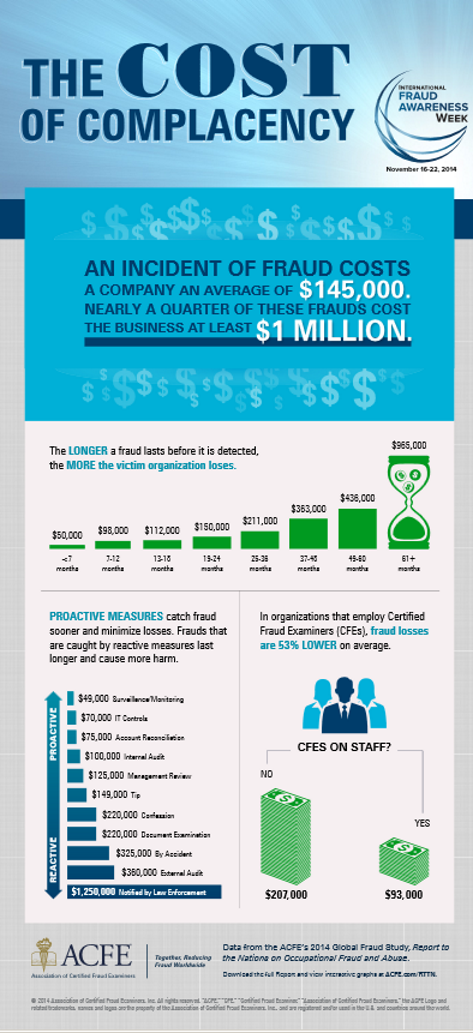

Fraud costs businesses billions directly, but what is the cost of complacency? Research conducted by the Association of Certified Fraud Examiners (ACFE), the world’s largest anti-fraud organization, indicates that the longer a fraud lasts before it is ...

October 9, 2014

The AICPA is urging the Internal Revenue Service (IRS) to act quickly to relieve the administrative burden imposed on small business taxpayers by the tangible property regulations

October 9, 2014

Are you the kind of tax practitioner who waits for business to walk in the door or do you actively pursue it on your own? Usually, the former will result in flat revenue while the latter enables you to better build and grow your practice.

October 9, 2014

Naturally, everyone’s tax situation is different and the landscape changes year to year. However, absent special circumstances such as pending legislation or drastic economic swings, the tried-and-true strategy of accelerating deductions into ...

October 9, 2014

One of the most nerve wracking aspects about tax season for millions each year is the possibility of being audited. For small business owners and those who are self-employed, the chance of being audited is even greater.

October 8, 2014

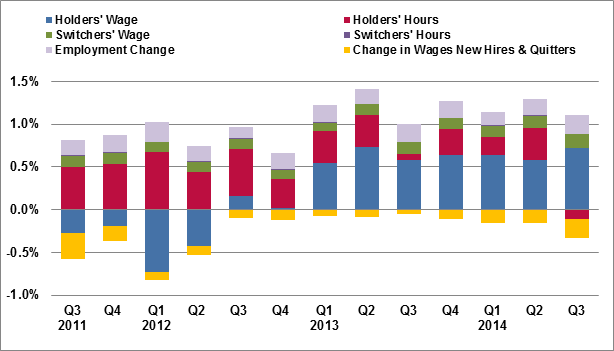

The latest ADP Workforce Vitality Index, which measures the total real wages paid to the U.S private sector, is 110.6 in the third quarter of 2014. The index, part of the ADP Workforce Vitality Report, is composed of a number of metrics including ...

October 7, 2014

What are the tax and financial issues of the Supreme Court's decision not to overturn gay marriage rulings in several new states? Although certain aspects are still being sorted out, here’s a brief summary of the lay of the land in several key areas.

October 7, 2014

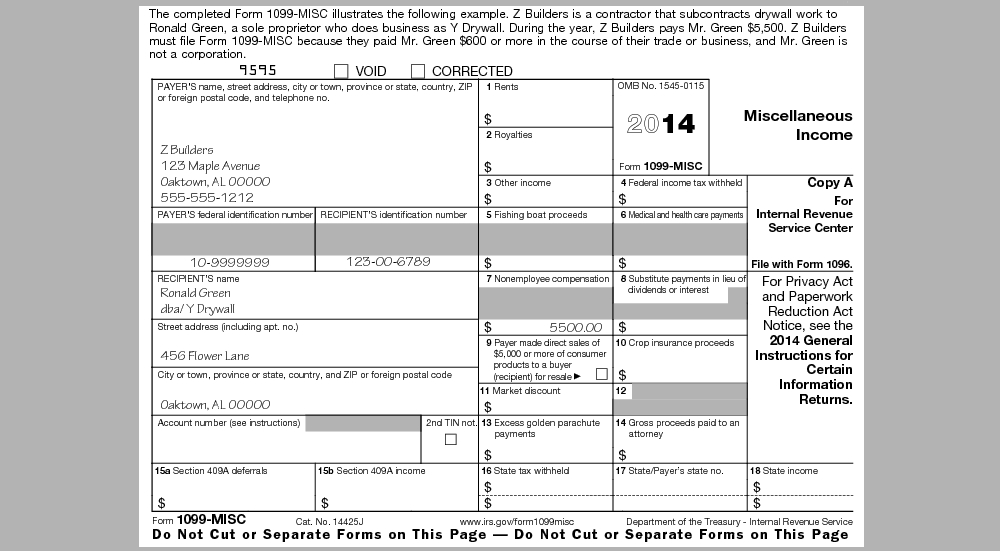

The downloadable official 2014 Form 1099-MISC is available by clicking download. (PDF) Download

October 7, 2014

Right Networks and Track1099 have partnered to offer QuickBooks clients a paper-free and low-cost option for convenient e-filing and e-delivery of 1099-MISC forms this coming tax season.

October 3, 2014

Normally, a taxpayer may deduct travel expenses, including the cost of lodging, only when he or she is “away from home” on business. For this purpose, home means your tax home, usually the area surrounding your principal place of business ...

October 1, 2014

Report says the agency needs to enhance its collection efforts to make more delinquent international taxpayers become compliant with their obligations.

October 1, 2014

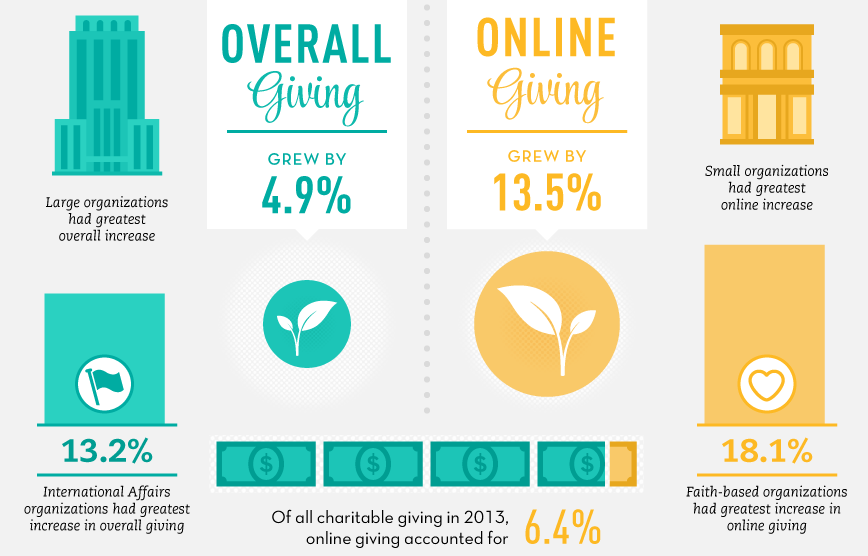

A new analysis of how Americans and Canadians donate to nonprofit organizations shows the greatest overall increase since 2008.