Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

September 16, 2014

Where the IRS is concerned, there’s no such thing as a free lunch. However, your clients may be able to deduct costs of certain meals, including lunches, if they meet the tax law requirements. Generally, write-offs for such meals are limited to 50% of the

September 16, 2014

The accounting firm of McGladrey LLP will acquire the assets of Battelle Rippe Kingston LLP, a Certified Public Accounting firm offering services in the fields of assurance, tax and consulting in Southwest Ohio. The closing is expected to occur on Nov. 1,

September 14, 2014

The Internal Revenue Service (IRS) is not processing complaints against tax preparers in a timely manner, according to the latest report publicly from the Treasury Inspector General for Tax Administration (TIGTA).

September 14, 2014

[This is part of a series of articles on maximizing deductions for travel and entertainment (T&E) expenses.] Normally, you can’t deduct the cost of traveling between your home and your job, even though the travel is, in reality, business-related. The IRS considers “commuting” to be a nondeductible personal expense. However, if you qualify under the IRS’...…

September 12, 2014

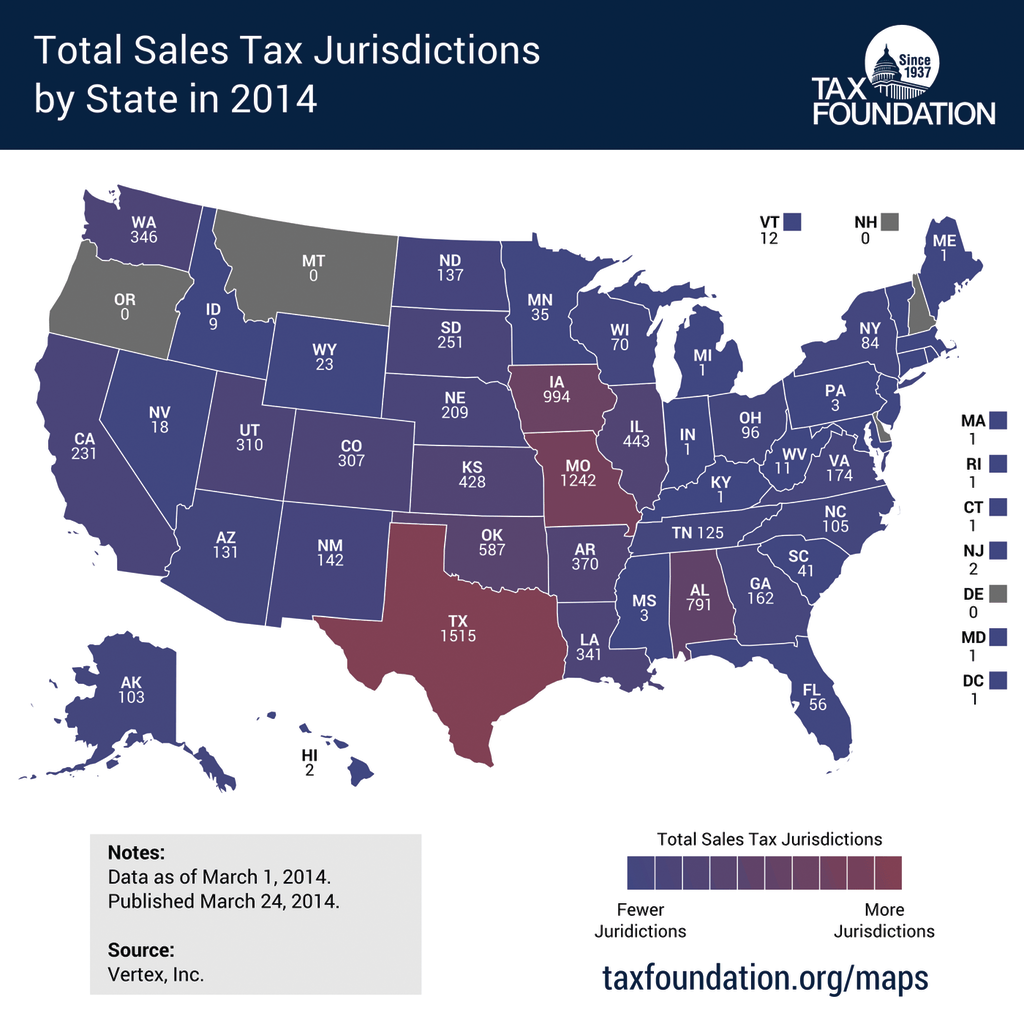

The sales and use tax audit could possibly be one of the biggest challenges that your business clients will face. If you are working with a client who has been selected for an audit, you are now tasked with proving that the client remitted the correct amount of sales tax to the state Department of…

September 12, 2014

Historically, a business' gross revenues follow seasonal patterns and even a small change in gross revenue should result in a small change in the associated accounts. In an attempt to discover why one established contractor was selected for audit, I reviewed their sales tax filings and created the below table.

September 12, 2014

Bloomberg BNA has made significant enhancements to its Premier International Tax Library, a comprehensive resource for international tax research that helps practitioners make more informed business decisions and provide value-added tax guidance.

September 12, 2014

The U.S. job market has steadily improved by pretty much every gauge except the one Americans probably care about most: Pay.

September 12, 2014

Seven in ten Americans support legislation requiring sales-tax collection at the time of purchase, according to a poll of 1,016 U.S. consumers conducted for the International Council of Shopping Centers.

September 11, 2014

A bipartisan majority of the U.S. House of Representatives – 233 members – have signed a letter urging the House leadership to preserve the cash method of accounting for tax purposes, writing that proposals requiring a transition to the accrual method ...

September 11, 2014

First, a federal appeals court invalidated most of the regulations imposing continuing education and other regulatory requirements imposed by the IRS on tax return preparers (Loving, et al v. IRS, Civil Action 12-385 (JEB), U.S. Dist. Ct. DC, 1/18/13). .

September 10, 2014

With more than one million tax payments already processed this year through IRS Direct Pay, the Internal Revenue Service is encouraging taxpayers with upcoming tax payment deadlines to consider choosing this free online system to quickly and easily pay what they owe.