Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

September 1, 2014

What often sets business taxpayers apart from individuals is the potential for deducting expenses relating to business driving. For virtually everyone else, the cost associated with operating a car or other vehicle is a nondeductible personal expense. However, if you use your own vehicle for business trips, you’re usually entitled to deductions on your federal…

September 1, 2014

What should you be doing in your state and local tax practice this month? Here's your SALT checklist for September.

September 1, 2014

Recent legislation in thirteen states to raise the minimum wage, various increases in some cities across the country, and news that an executive order may soon mandate an increase on federal contracts, means small business owners will face yet another challenge to build, sustain and grow their business in a difficult economic environment.

September 1, 2014

Armanino LLP, the largest independent accounting and business consulting firm based in California, announced today the appointment of Chris Carlberg as its first General Counsel in the firm's history. Chris is responsible for overseeing all legal work for the firm as well as advising on business policy and overall governance.

August 29, 2014

State tax collections fell short of expectations by $281 million last year, providing potential difficulties in the future for the state budget and immediate fodder for this fall's tight governor's race.

August 28, 2014

The Internal Revenue Service continues to warn taxpayers across the country of a series of scam phone calls from people pretending to be IRS officials in order to get sensitive personal information. On Thursday, the agency issued a new consumer alert to provide taxpayers with additional tips to protect themselves.

August 27, 2014

California's health insurance exchange awarded its executive director a one-time bonus of $53,000 after the state enrolled 1.2 million people in Obamacare coverage.

August 27, 2014

Two Miami-Dade women have been charged with preparing dozens of phony income-tax returns and pocketing a chunk of the multimillion-dollar refunds, the U.S. attorney's office said Tuesday.

August 27, 2014

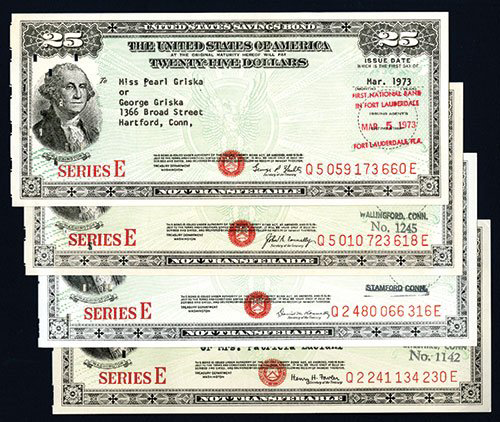

Currently over 50 million individuals own nearly $178 billion worth of U.S. Savings Bonds. Many don’t realize that savings bonds are subject to federal income taxes when they are either cashed in or reach final maturity, whichever comes first. The difference between the purchase price and the cash-in value is considered reportable interest. When savings…

August 27, 2014

Thomson Reuters has launched a new Checkpoint Learning Tax Research Certificate Program designed to help professionals develop foundational tax research knowledge and skills. It is designed to fill in knowledge gaps for entry-level tax professionals and those re-entering the workforce after an extended leave. The program also applies to accounting and audit professionals from diverse…

August 26, 2014

An airline is looking into coming to Idaho to set up a maintenance facility in Boise that would create 100 new jobs with salaries of close to $50,000 a year, Idaho's state commerce chief says, in part because of a new tax incentive law.

August 26, 2014

As with domestic travel (i.e., travel within the 50 U.S. states and the District of Columbia), you can deduct all of your travel expenses if the trip is entirely for business purposes. Otherwise, you’re entitled to travel deductions only if the primary purpose of the trip is business-related. Again, the days spent on business versus…