Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes August 11, 2025

Massachusetts collected $43.7 billion in the budget year that ended on June 30, driven by healthy collections from the state’s Millionaire’s Tax and a new capital gains tax, state data show.

IRS August 8, 2025

Treasury Secretary Scott Bessent will add acting IRS chief to his duties until Long's replacement is installed.

Technology August 8, 2025

Through this partnership, BitGo clients gain direct access to Ledgible’s tax information reporting and accounting solutions, built to meet the demands of enterprises, fund managers, and financial institutions.

Taxes August 7, 2025

On MSNBC’s “Morning Joe,” Eugene Robinson walked Treasury Secretary Scott Bessent through addressing the “confusion” when it comes to whether a U.S. importer or another country would have to pay for tariffs.

OBBBA Tax Act August 7, 2025

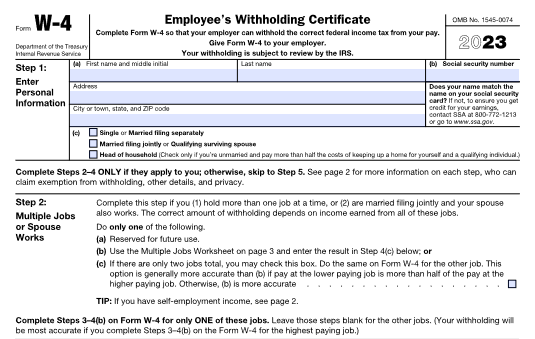

The Internal Revenue Service recently stated that, as part of its phased implementation of the One Big Beautiful Bill Act, there will be no changes to certain information returns or withholding tables for Tax Year 2025 related to the new law.

Taxes August 7, 2025

Taken together, President Trump’s actions will push the average U.S. tariff rate to 15.2%, well above 2.3% last year and the highest level since the World War II era.

Taxes August 7, 2025

The One Big Beautiful Bill Act (OBBBA) has introduced several changes with important implications for businesses.

Sales Tax August 7, 2025

Sales tax risk is a silent disruptor. For finance leaders, it’s about time lost, strategic momentum drained, and avoidable exposure creeping in. But it doesn’t have to be.

Taxes August 7, 2025

Multinational tax teams face mounting pressure to manage increasingly complex compliance requirements while maintaining accuracy in their tax provisions.

Taxes August 6, 2025

Former Republican House Speaker Paul Ryan discussed President Donald Trump’s tariff agenda during a TV appearance on Aug. 5, warning that he sees “choppy waters ahead.”

Taxes August 5, 2025

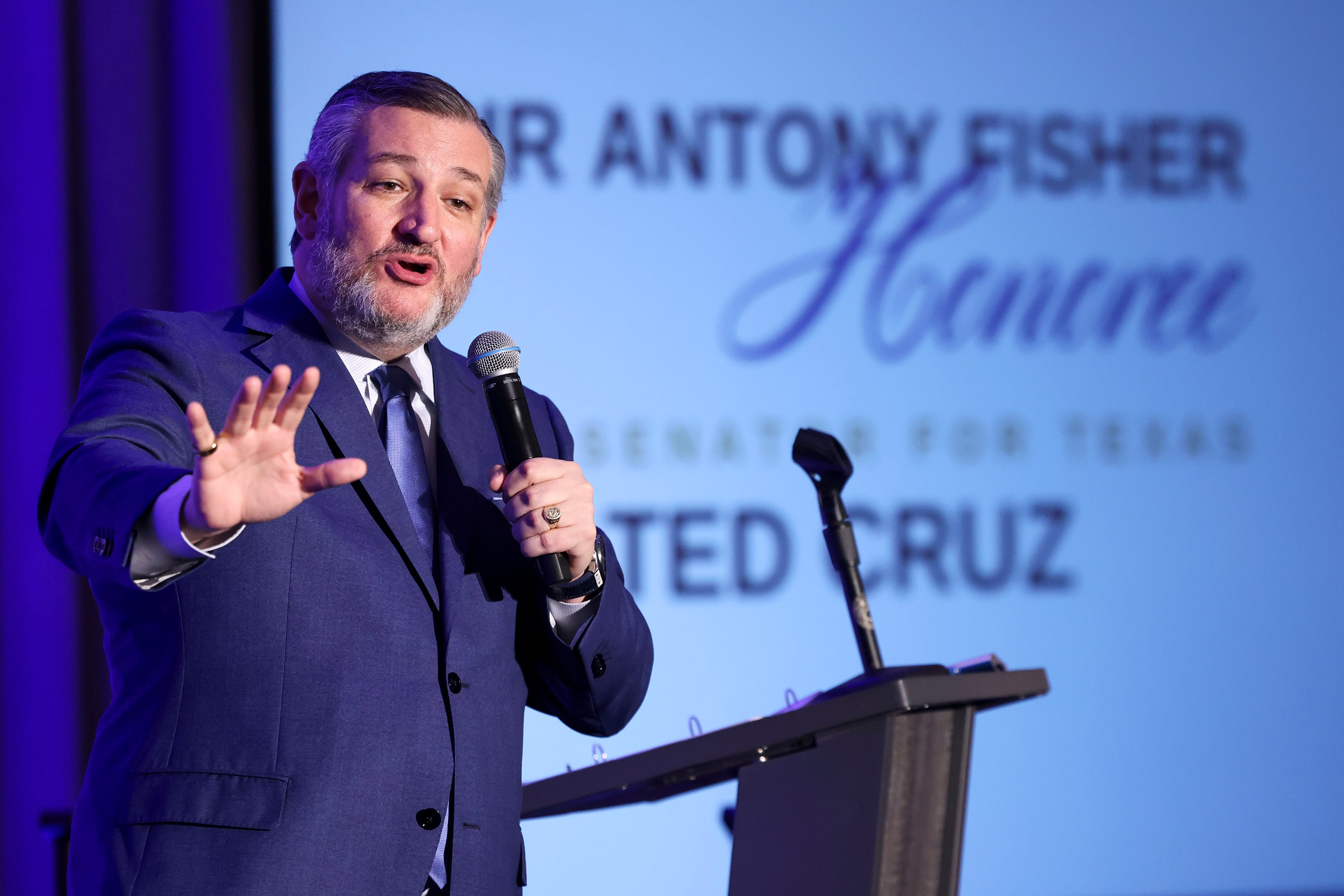

The Republican Texas senator has joined with Nevada Democrats on legislation to restore the full deductibility of losses, saying it’s a matter of basic fairness for professional players who depend on their winnings to pay their bills.

Taxes August 5, 2025

Politicians and state leaders say they're focused on fast-tracking permitting decisions and working with regulators to ensure projects can connect to the grid before the tax credits phase out.