Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

June 11, 2014

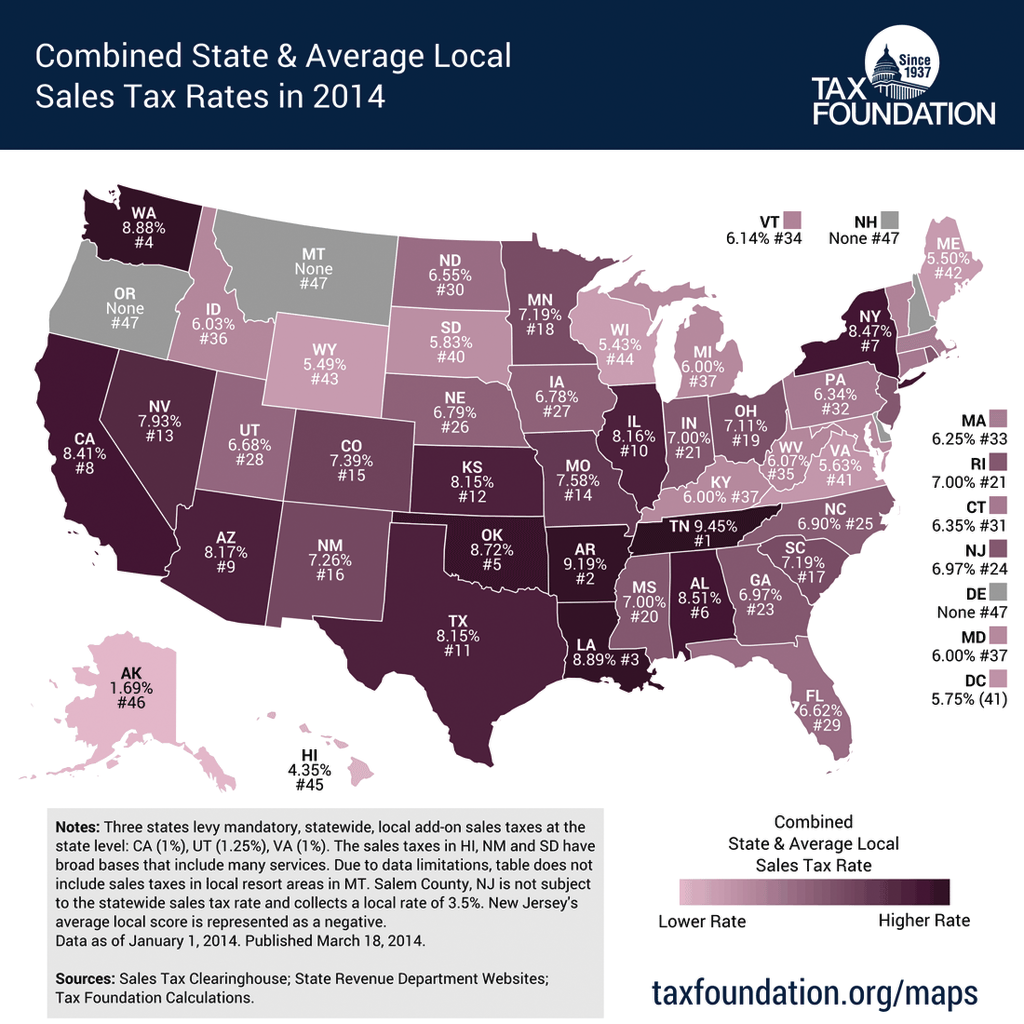

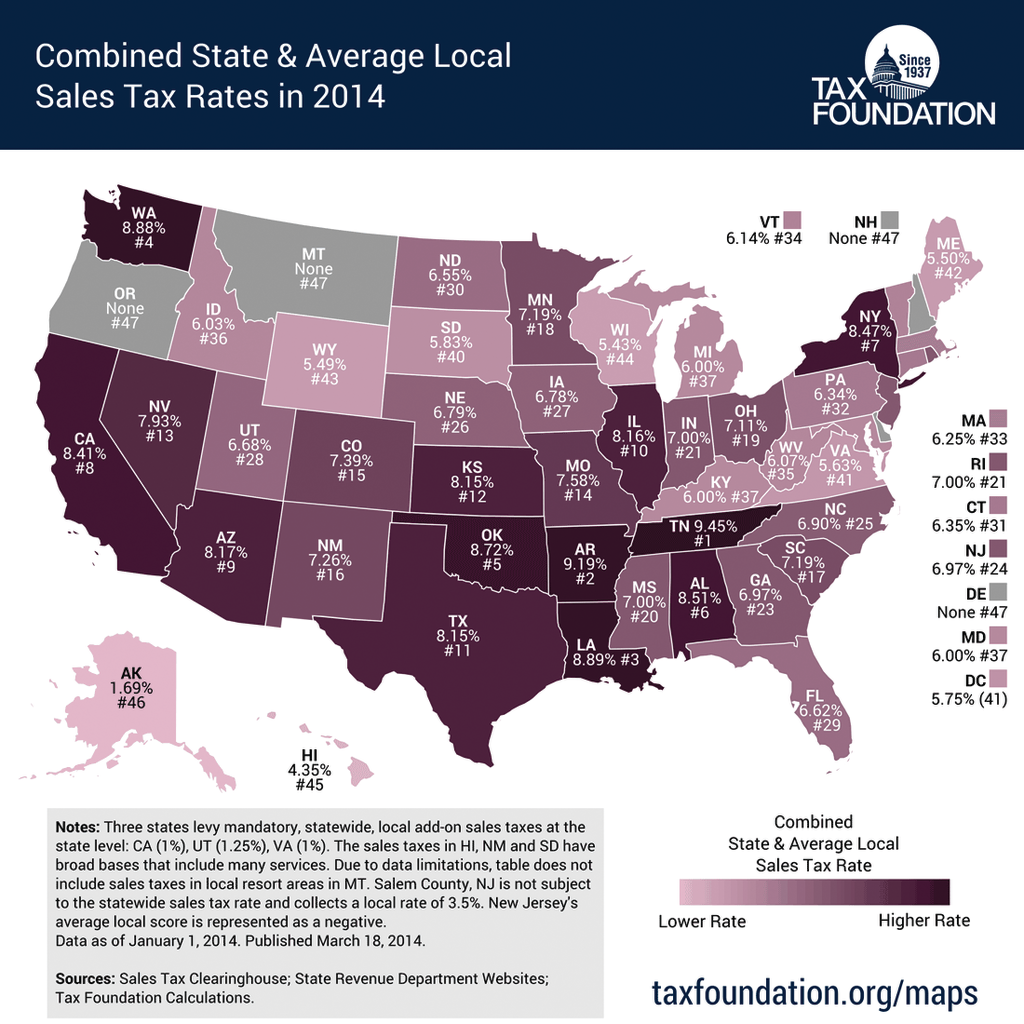

Sales and use tax is a key source of government funding in most states. Unlike property tax and state income tax, however, the legislators and regulators have adopted a patchwork of different rules which affect the taxability of the items. In addition to dealing with statewide tax rates in 45 states, 38 states levy sales…

June 11, 2014

In addition to its publishing products, Bloomberg BNA offers two software tools which are designed to help companies and practitioners stay up to date on tax rates and prepare accurate forms.

June 11, 2014

CCH’s sales tax compliance applications are priced based on a range of factors, including the number of entities, the number of returns, and the features purchased. Specific pricing is available upon request.

June 10, 2014

The National Society of Accountants has announced that Internal Revenue Service Commissioner John Koskinen will deliver the keynote address at the organization's 69th Annual Meeting, which will be August 20-23, 2014 at the Hyatt Regency Inner Harbor in Baltimore, Maryland.

June 10, 2014

The Internal Revenue Service has created a "Taxpayer Bill of Rights" that will become a cornerstone document to provide the nation's taxpayers with a better understanding of their rights.

June 10, 2014

Thomson Reuters has launched its next generation online tax research system, Checkpoint Catalyst, which features multi-jurisdictional content, embedded tools and an enhanced search engine. Catalyst is built on the Checkpoint platform, and is designed to help tax professionals more quickly find research results.

June 9, 2014

With less than a month to go, California businesses are eager to qualify for a new state income tax credit. The "California Competes" program, administered by the state Office of Business and Economic Development, is handing out $30 million to encourage companies to grow here and not leave the state. The pot will expand to…

June 6, 2014

The Year in the Life of a State and Local Tax (SALT) Accountant series is being created with the practitioner in mind. In cooperation with Avalara, each month we'll provide you with the latest news relating to state and local tax issues, updates on federal legislation, checklists and tips for building and improving your SALT…

June 6, 2014

When I started my accounting career as a Deloitte tax accountant, we were each expected to choose a niche. I wanted to focus on agriculture clients, but it seemed the Chicago area didn't provide enough to keep me busy in that area, so instead I found myself getting the small business clients, and in particular,...…

June 5, 2014

It all has to do with the current tax rules for business entertainment. To be deductible as entertainment that is “associated with” your business, the activity must take place immediately before or after a substantial business discussion. Usually, this means the discussion has to be on the same day as the entertainment, but it could…

June 5, 2014

CCH has launched a new online research tool called “Quick Answers.” The system features more than 2,000 answers to questions most often researched in IntelliConnect, CCH's research platform for tax and accounting professionals. In addition, the company is previewing CCH IntelliConnect Direct, a new universal platform research tool that provides clear and intuitive access to…

June 5, 2014

Imprisoned former Rep. Jesse Jackson Jr.'s projected release date is now Sept. 20, 2015, more than three months earlier than listed previously, federal officials confirmed Monday.