Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

June 2, 2014

Under fire for its handling of the data breach, Target's board is now defending itself to shareholders in advance of next week's annual meeting.

June 2, 2014

Drake Software is a tax software solution designed for quick data entry and return processing. A unique aspect to Drake Software is the all-inclusive pricing model. This allows tax practitioners to process unlimited federal, state and electronic filing at a known, fixed rate with no additional function modules to purchase. Drake’s software system includes built-in…

June 2, 2014

The IRS isn’t backing off on its tough stance involving the “once-a-year-IRA rollover” rule. In the aftermath of a new case tightening the restriction for IRA owners (Bobrow, TC Memo 2014-21), it recently announced it intends the follow the Tax Court’s lead on this issue. However, showing some leniency, the IRS now says it won’t…

June 2, 2014

Fresh off signing a $77 billion budget into law, Gov. Rick Scott made a pit stop in Panama City Monday as part of his Let's Keep Small Business Working Tour and campaign for re-election.

May 30, 2014

An income tax preparer in the Miami, Florida suburb of Plantation has pleaded guilty to filing $22 million in false refund claims with the federal government.

May 30, 2014

Internal Revenue Service investigators have charged a Northeast Portland woman of filing as many as 173 fraudulent tax returns claiming more than a $1 million in refunds.

May 30, 2014

It’s a common practice during the summer: After a spring cleaning, people try to sell the household items they no longer need or want in a “garage sale” (known as a “lawn sale, “tag sale” or some other name in parts of the country). But what do they do with those items that are left…

May 29, 2014

The ITC is not simply a deduction, explained Parker. It is a tax credit good for up to 30% of the cost of the project, and is often an incentive that can only be enjoyed by entities with substantial passive income and a large tax appetite. Passive losses can only be offset by passive income.

May 28, 2014

State regulators in Massachusetts and others around the country are taking a close look at virtual currencies as bitcoin continues to grow in popularity.

May 27, 2014

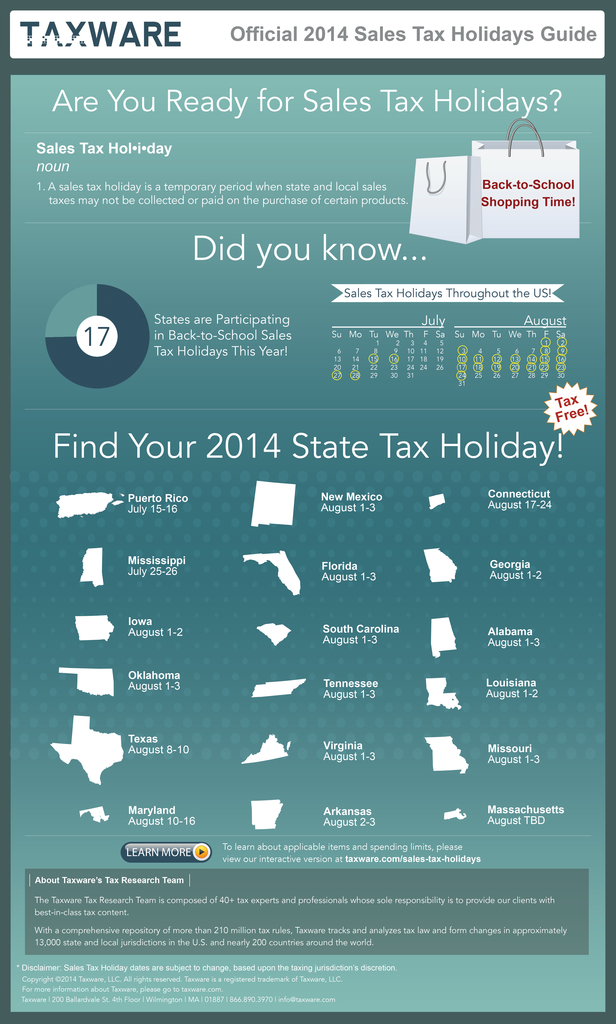

Sales tax compliance is one of the most volatile issues that many businesses have to deal with, with more than 8,000 taxing jurisdictions across the country. From the state and county-level, to cities and special purpose zones like metro transit authorities.

May 27, 2014

Congress keeps threatening to close some of the long-standing loopholes in the tax law. But one key tax break for business people has remained on the books despite numerous efforts to repeal it. It’s the special tax provision for certain heavy-duty vehicles.

May 27, 2014

Employers can’t get around the Obamacare “shared responsibility” provision simply by giving employees tax-free cash to pay for health insurance from a state-run exchange. In effect, this would pump up a worker’s pay and dump them in the marketplace. According to a new question and answer (Q&A) posted on the IRS website, as initially reported…