Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

May 26, 2014

At $10.74 an hour, San Francisco already has the nation's highest big city minimum wage. But it could soon have company, as labor and community activists in cities from Richmond to Sunnyvale push wage increases that could turn the Bay Area into a high-wage hub.

May 26, 2014

A group of small business owners and politicians gathered at the Cullman, Alabama, Area Chamber of Commerce Friday to hear Governor Robert Bentley's pledge to bring more assistance to locally owned shops.

May 22, 2014

Competition for talent, capital and economic clout drives cities to build and maintain resilient urban communities.

May 22, 2014

The Internal Revenue Service says that more than 150,000 taxpayers used its new web-based system IRS Direct Pay to pay their tax bills or make estimated tax payments directly from checking or savings accounts without any fees or pre-registration.

May 22, 2014

Unemployment in the Tampa Bay region fell below 6 percent last month, as the state added 34,000 jobs in April, matching a national improvement in jobs.

May 21, 2014

The Ohio Society of CPAs (OSCPA) is commending Representative Jim Renacci (R-Ohio), a CPA, for his introduction of the Federal Financial Statement Transparency Act of 2014 in the U.S. House of Representatives, a bill with bipartisan support that will make for a more accountable and transparent federal government.

May 21, 2014

Tax experts from the Philadelphia LGBT practice of Marcum LLP advise that Tuesday's court ruling overturning the ban on same-sex marriage in Pennsylvania opens up important planning opportunities for these families. Marcum is the first national accounting firm with a practice dedicated to tax and estate planning for same-sex couples.

May 21, 2014

There has been a surge of American companies that have changed the address of their headquarters to a foreign country, a maneuver referred to as an “inversion” that allows them to avoid U.S. taxes. The FACT (Financial Accountability and Corporate Transparency) Coalition hails the introduction of legislation to close the “inversion” loophole,.

May 21, 2014

The Internal Revenue Service has announced that its Advisory Committee on Tax Exempt and Government Entities (ACT) will hold a public meeting on June 11, when the panel will submit its annual reports and recommendations to senior IRS executives. Ten newly appointed members of the panel (listed below) will also be introduced at the public…

May 21, 2014

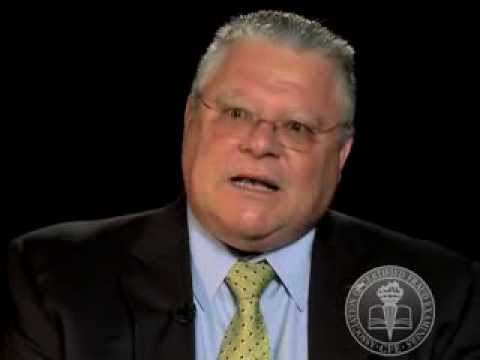

E. Michael Thomas, CFE, CPA, CIA, a partner with Crowe Horwath, LLP, discusses fraud prevention for financial institutions.

May 21, 2014

Organizations around the world lose an estimated five percent of their annual revenues to occupational fraud, according to a survey of Certified Fraud Examiners (CFEs) who investigated cases between January 2012 and December 2013. Applied to the estimated 2013 Gross World Product, this figure translates to a potential total fraud loss of more than $3.5…

May 21, 2014

The nation's largest professional association for accounting professionals, the American Institute of CPAs (AICPA), has come out opposed to the new voluntary tax return preparer regulation program that the Internal Revenue Service (IRS) is planning.