Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

May 5, 2014

May 15 is the filing deadline for most tax-exempt organizations, and those who miss filing may risk the loss of their tax-exempt status.

May 5, 2014

Today's new home buyers want larger dwellings with plenty of options, according to a panel of Maryland builders.

May 5, 2014

Although the actual risk is very low that most Americans will face an IRS audit of their taxes, the fear of that potential is a strong factor that keeps most taxpayers on the level, according to a new report from WalletHub, a financial management and information website for consumers.

May 4, 2014

Reminder for small tax-exempt organizations to file IRS Form 990-N annually to stay in compliance.

May 4, 2014

Suppose one of your clients has his or her sights set on obtaining an MBA or another advanced degree. Usually, it takes significant time and effort to achieve this goal, especially if the degree candidate is currently working on a full-time or part-time basis. But earning the degree could be well worth the “blood, sweat…

May 4, 2014

Due to recent advances in technology, you can now talk face to face with someone halfway across the country without even budging from your desk. Yet it’s still important at times for business people to “press the flesh” or meet in person with an associate to conduct meetings or consummate a deal. At least, a…

May 1, 2014

In a letter to House Ways and Means Committee Chairman Dave Camp, the American Institute of CPAs (AICPA) has voiced strong opposition to draft legislation that would limit the use of the cash method of accounting for pass-through entities and personal service corporations.

April 30, 2014

Online accounting software maker Xero has partnered with H&R Block, Inc. to offer the Xero system as the core small business online accounting platform in H&R Block's Small Business Program suite of services.

April 29, 2014

The online sales and use tax automation provider Avalara, Inc., has acquired the entire line of Zytax energy-related tax automation solutions for U.S. and international jurisdictions. Incorporating Zytax’s products now provides retail fuel and energy companies with a single source for all their transactional tax processing needs. Avalara acquired the Zytax offering from FuelQuest, a…

April 28, 2014

Two bills introduced in February call to impose a 1-cent-per-ounce excise tax on sugar-sweetened beverages. For a 12-ounce can of soda, the tax would add 12 more cents. The price of a twelve-pack would increase by $1.44 and another $2.88 would be added to the cost of a 24-pack.

April 28, 2014

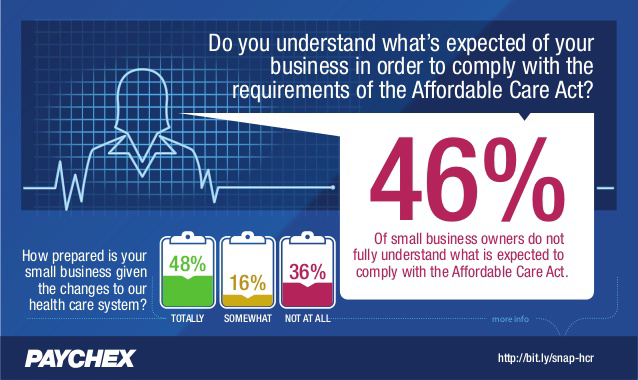

A new survey shows that, four years after being signed into law, about half of businesses understand and are prepared for the implications of the Affordable Care Act, also known as ObamaCare.

April 27, 2014

Now that this year’s tax filing season for individuals is over, it’s time to concentrate on saving taxes in 2014. All too often, professional tax advisors don’t reach out to their clients until the very end of the year when it might be too late for them to implement meaningful tax planning strategies. Break up…