Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

April 7, 2014

According to a new study conducted by the UK-based accounting firm network UHY International, “Old” world economies charge higher inheritance and estate taxes than “New” world economies.

April 7, 2014

What will happen to the “tax extenders” that have been virtually ignored by Congress the last few months? At long last, there seems to be some movement on several fronts concerning these tax law provisions that are traditionally extended for just one or two years.

April 6, 2014

The IRS has been struggling in its efforts to close an estimated $385 billion “tax gap” between the amount that taxpayers owe and the amount they’ve actually paid. Now, to add another crushing weight, it has to ramp up Obamacare activities despite recent budget cutbacks.

April 4, 2014

Despite reports of a formal extension circulating in the media, March 31 was the last day that individuals could sign up for health insurance coverage for 2014 under the Obamacare mandate without risking a hefty financial penalty. Or was it?

April 4, 2014

The IRS Isn't maintaining its computer infrastructure adequately, according to a new report by the Treasury Inspector General for Tax Administration (TIGTA), a part of the Department of the Treasury that is tasked with overseeing the nation's tax agency.

April 4, 2014

The Internal Revenue Service has automatically extended the tax return filing and payment deadlines for victims of last month’s mudslides and flooding in Washington state. As a result, those taxpayers will have until Oct. 15 to file their returns and pay any taxes due, with no penalties or interest applied.

April 2, 2014

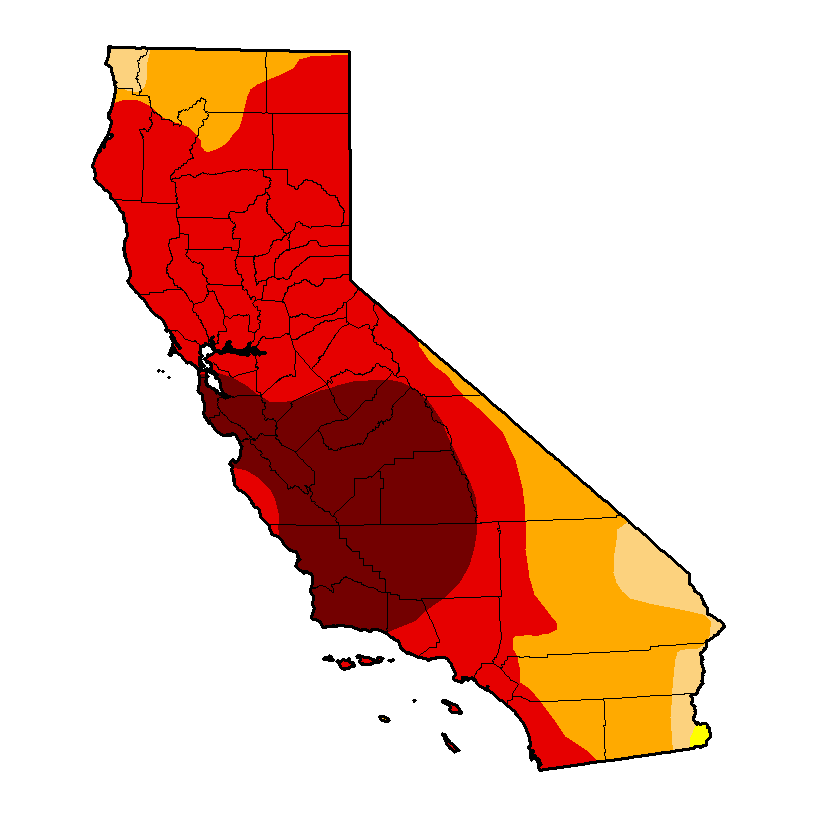

Economists said in the quarterly forecast that arid conditions in 2013, the driest year on record for the Golden State, could diminish the fishing and manufacturing sectors in the state. However, the effect depends on whether the drought is "normal" or the beginning of "a long arid period."

April 2, 2014

California remains home to the greatest number of women-owned businesses in the nation and is the only state to surpass the 1 million threshold, according to the latest American Express analysis of U.S. Census Bureau data.

April 2, 2014

A Morgan State University professor was convicted Tuesday in connection with a scheme to defraud the National Science Foundation and his students.

April 2, 2014

It’s even more difficult than before for most taxpayers to qualify for medical expense deductions now that the “floor” has been raised to 10 percent of adjusted gross income (AGI) from 7.5 percent of AGI.

April 1, 2014

According to a new report by financial education website WalletHub, the accessibility, affordability and effectiveness of available tax help varies significantly from state to state.

April 1, 2014

The Blackbaud Index showed an overall increase in charitable giving to nonprofits of 0.7 percent, while online giving increased 13.8 percent for the three months ending February 2014 as compared to the same period in 2013.