Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Staffing January 27, 2026

These tips and practices can give your core team the best chance to deliver outstanding client service without burning out in the process.

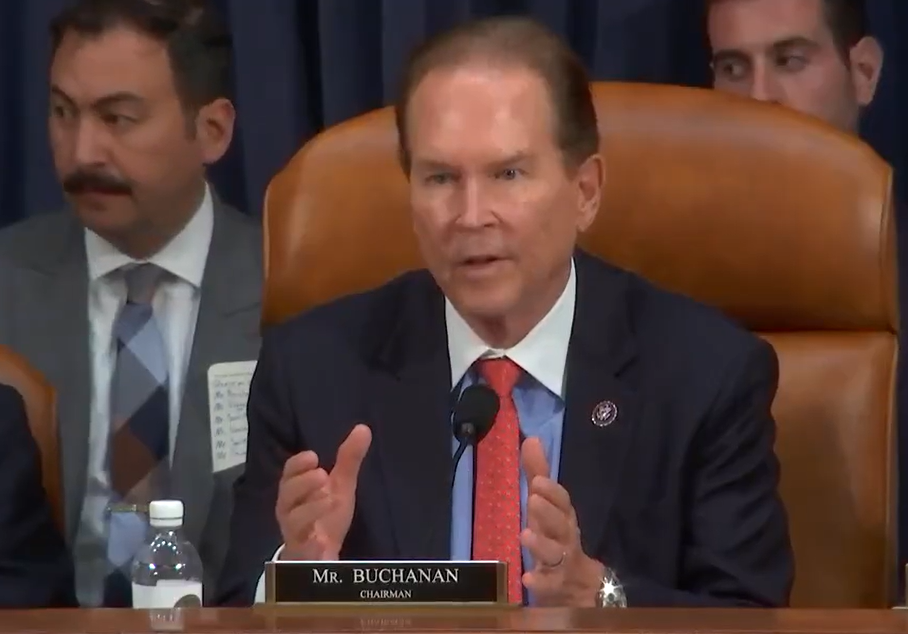

Taxes January 27, 2026

Florida Rep. Vern Buchanan, a longtime member of the tax-writing House Ways and Means Committee, said Jan. 27 that he will not seek reelection after nearly two decades in Congress.

Taxes January 27, 2026

The One Big Beautiful Bill Act increased inflation adjustments for the standard deduction, and a new bonus senior deduction will allow tens of millions of seniors to save hundreds of dollars on their taxes this year.

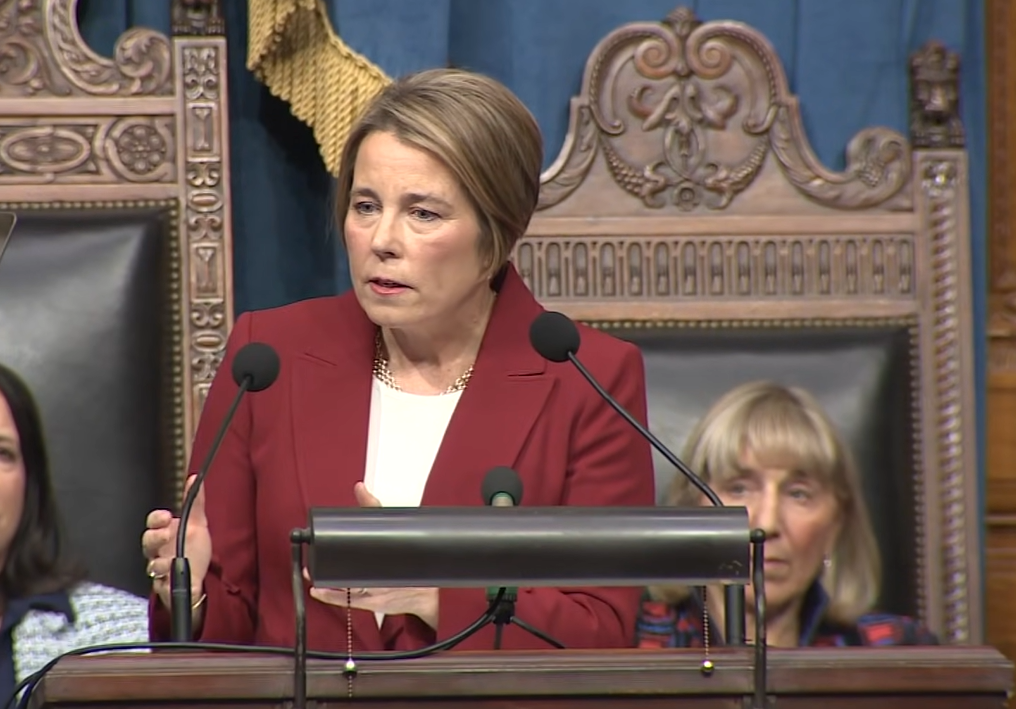

Taxes January 27, 2026

Democratic Gov. Maura Healey is seeking to blunt the impact to state coffers from changes to the federal tax code under President Donald Trump’s new tax cuts and policy law, but business groups say the move would hurt Massachusetts’ competitiveness.

Income Tax January 26, 2026

The deadline for filing individual tax returns is April 15, 2026, which is also the deadline for requesting a six-month filing extension.

Taxes January 26, 2026

The IRS today opened the 2026 tax filing season and began accepting and processing federal individual income tax returns for tax year 2025.

Taxes January 26, 2026

In the roiling debate over California's proposed billionaire tax, supporters and critics agree that such policies haven't always worked in the past. But the lessons they've drawn from that history are wildly different.

Taxes January 23, 2026

The House Rules Committee declined to advance an amendment to a larger spending bill that would restore a gambler’s ability to deduct 100 percent of losses on annual tax filings.

Taxes January 23, 2026

The Idaho Supreme Court heard arguments Friday on a challenge to Idaho’s $50 million tax credit program that directs public money toward private schools and homeschooling expenses.

Taxes January 23, 2026

The National Association of Tax Professionals announced Thursday two credentials available for tax practitioners through its new professional credentialing program.

Technology January 23, 2026

GruntWorx K-1 ADVANCED is a branded GruntWorx product designed to revolutionize tax data processing for accounting firms and tax professionals alike.

Technology January 23, 2026

Tax technology platform april has a new partnership with PayPal that allows U.S. PayPal Debit Mastercard customers to file their 2025 federal and state tax returns for free using april's DIY tax filing service.