Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

January 21, 2014

The Financial Accounting Foundation (FAF) today released an updated print edition of the Financial Accounting Standards Board’s FASB Accounting Standards Codification, the single, authoritative source of U.S. Generally Accepted Accounting Principles (U.S. GAAP) for public and private companies and not-for-profit organizations.

January 21, 2014

You probably know that non-exempt employees are covered under FLSA, which imposes requirements for overtime and other aspects of employment. Exempt employees, on the other hand, are not subject to FLSA.

January 21, 2014

Unless you’ve been living under a rock the last few years, you’re well-aware that the massive health care legislation known informally as “Obamacare” by both its detractors and proponents remains the law of the land.

January 21, 2014

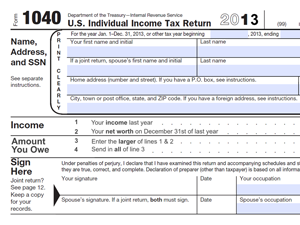

A printable version of the IRS Federal income tax return (Form 1040) can be viewed and printed from our website by clicking the download button at: http://cpapracticeadvisor.com/11297334.

January 20, 2014

Starting this year, the credit goes up to 50 percent for for-profit entities, and 35 percent for tax-exempt ones.

January 20, 2014

I visited Arizona last summer, where the temperatures hit 119 degrees in the afternoon and didn’t much cool at night. They call it “dry heat.” I called it Apache Territory.

January 19, 2014

Responding to a Freedom of Information Act request, the IRS has released a series of documents, including training materials used by agents relating to how it recognizes and treats exempt organizations like nonprofits.

January 18, 2014

The IRS recently said that the 2014 tax filing season for individual returns won’t kick off until January 31, a delay of ten days due to the government shutdown last October. But taxpayers using the IRS’ Free File program can still get a head start.

January 18, 2014

Three more suspects pleaded guilty in federal court in Miami Friday for their roles in a $7 million scheme that used the identities of dead people to file fraudulent income tax refund claims, U.S. Attorney Wifredo A. Ferrer said.

January 17, 2014

It isn’t quite as significant as the president’s State of the Union address, but National Taxpayer Advocate (NTA) Nina Olson released a new report to Congress on January 9 (IR-20140-3).

January 16, 2014

The American Institute of CPAs (AICPA) said in a letter today to Senate Finance Committee Chairman Baucus and Ranking Member Hatch that it “strongly supports the efforts by the Senate Committee on Finance on tax administration reform and simplification.”

January 16, 2014

A new foreclosure rescue scam promises to help distressed homeowners keep their homes through the use of a "securitization audit." "The only problem, according to investigative firm Mortgage Fraud Examiners: These "hucksters" are charging fees for information that's free to anyone for the asking, and knowing who owns the note won't save anyone's home."