Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

December 17, 2013

With the end of 2013 rapidly approaching, the Internal Revenue Service is reminding individuals and businesses who make contributions to charity to keep in mind several important tax factors that have taken effect in recent years.

December 17, 2013

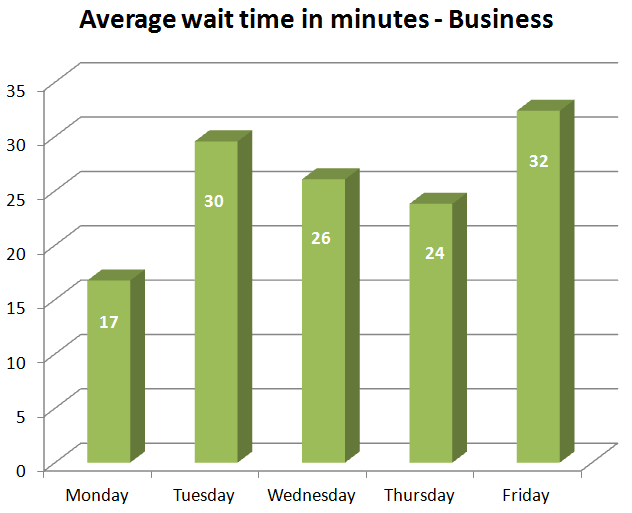

Anyone who has ever tried to call the Internal Revenue Service knows what to expect first ... a wait. Sometimes a really long one. For tax professionals who need to reach the IRS more frequently, this can be a waste of precious time and productivity.

December 17, 2013

Virginia Governor Bob McDonnell's proposed budget for the next biennium totals nearly $96 billion, an increase from the $86 billion for the current two-year cycle that runs through June 2014.

December 15, 2013

Restaurants adjust to IRS plan to enforce taxes on automatic tips

December 12, 2013

Taxpayers looking to hire a professional to complete their 2013 tax return can expect to pay an average of $261 for an itemized Form 1040 with Schedule A and a state tax return, according to the National Society of Accountants (NSA).

December 12, 2013

Having to run payroll for foreign nationals seems like a remote possibility for most payroll service providers. And it's true that only 14% of Thomson Reuters tax and accounting software users who process payroll reported paying foreign nationals in a recent survey.

December 12, 2013

Thomson Reuters Checkpoint Releases Special Report for Tax Professionals on New Capitalization Regulations

December 11, 2013

With January only a few weeks away, business owners should already be thinking about year-end tax planning, and there are five significant tax regulations and credits they should evaluate before the New Year, according to Paychex.

December 10, 2013

Report says the IRS needs to do more to prevent fraud committed using stolen EINs.

December 10, 2013

Whether it's to a veterans group, a medical foundation, a faith-based organization or other charity, donating a used car can be both useful to the organization and its mission, as well as a potential tax-saving benefit to the giver

December 9, 2013

Enhanced W-2 and 1099 Online Reporting Tool Offers New Form Retrieval Option, TIN Truncation Support and Additional New Features

December 9, 2013

Bloomberg BNA has named that Paul Frankel as the recipient of the 2013 Franklin C. Latcham Award for Distinguished Service in State and Local Taxation. Frankel is senior counsel with Morrison and Foerster's State + Local Tax Group and former Chairman of Bloomberg BNA's State and Local Tax Advisory Board.