Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes July 17, 2025

The IRS released a fact sheet earlier this week describing new tax provisions—no tax on tips, no tax on overtime, no tax on car loan interest, and a deduction for seniors—in the One Big Beautiful Bill Act.

Taxes July 17, 2025

President Trump, who built a career on savvy branding, has yet to convince the public that the law’s sweeping tax cuts and reductions to social safety-net programs are good policy.

Taxes July 17, 2025

The GOP megabill staggers the rollout of its sweeping budget provisions, including tax breaks and social program cuts.

Taxes July 17, 2025

The One Big Beautiful Bill Act encompasses considerable changes to student loans and tax increases on certain college and university endowments.

Firm Management July 16, 2025

The two new tax practices at the top 100 firm are Site Selection + Incentives, led by Shelly Carmichael, and State and Local Income Tax Consulting, led by Brandee Tilman.

Taxes September 12, 2025

In today’s fast-paced tax environment, leveraging technology is key to delivering an exceptional client experience while improving efficiency within your firm.

Firm Management July 15, 2025

Stay informed about current trends in tax and advisory services. What to expect: Click here to access this free whitepaper.

Taxes July 15, 2025

Beginning on Jan. 1, companies in the U.S. will no longer be able to deduct the cost of snacks, coffee or on-site lunches provided to workers, according to a provision in the "big, beautiful bill."

![globe-flags[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2022/07/33706/globe_flags_1_.5ce342f3a9102.png)

Small Business July 15, 2025

Over the weekend, Trump said he would raise E.U. tariffs to 30% on Aug. 1, which the bloc’s trade chief Maros Sefcovic called “effectively prohibitive” to transatlantic trade.

Taxes July 15, 2025

Democrats from Maryland’s congressional delegation are calling on the Internal Revenue Service to speed up tax refunds for people facing financial challenges.

Taxes July 14, 2025

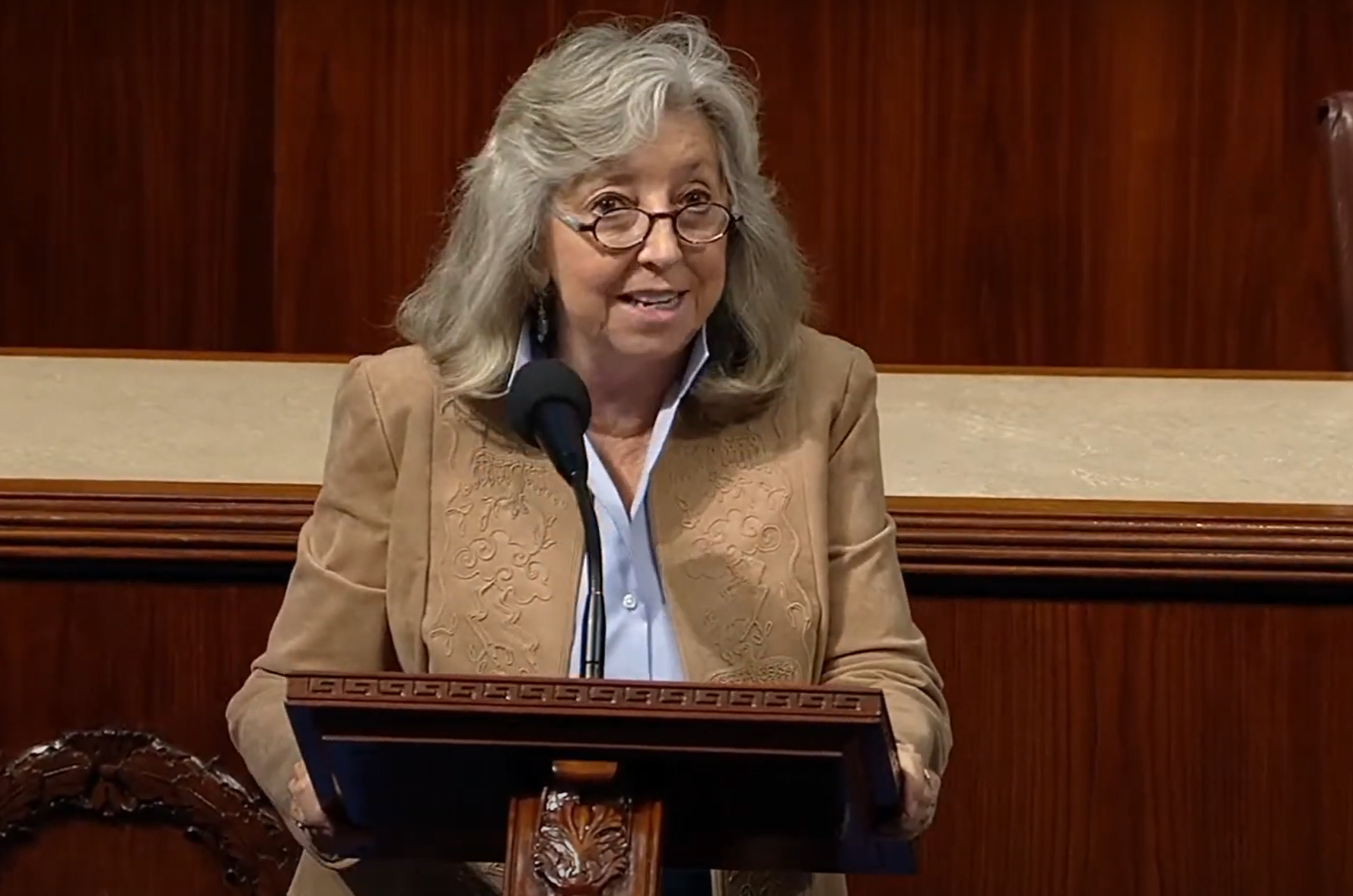

Las Vegas Democratic Rep. Dina Titus is expanding the coalition opposing a last-second provision added to President Donald Trump's "big, beautiful bill" capping how much can be deducted from gambling winnings to 90% of losses.

Taxes July 14, 2025

As part of his plea agreement, Adenisimi also admitted to fraudulently obtaining two Paycheck Protection Program (PPP) loans totaling $760,415.