Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

July 29, 2013

In the closing days of the Legislature last year, California Governor Jerry Brown helped forge a compromise on a sweeping overhaul of the workers' compensation insurance system and persuaded Democratic and Republican lawmakers to pass it into law.

July 29, 2013

After a tradition of some 40 years of subsidizing local taxes, Gov. John Kasich and Republicans in the Ohio House and Senate applied the brakes.

July 29, 2013

Rising focus on board governance, enterprise-wide systems, risk and technology; operational risk deemed area that needs further attention

July 29, 2013

In recent years, the IRS has stressed its commitment to protecting taxpayers from tax-related identity theft. As part of this commitment, the IRS enhanced the Electronic Fraud Detection System (EFDS).

July 29, 2013

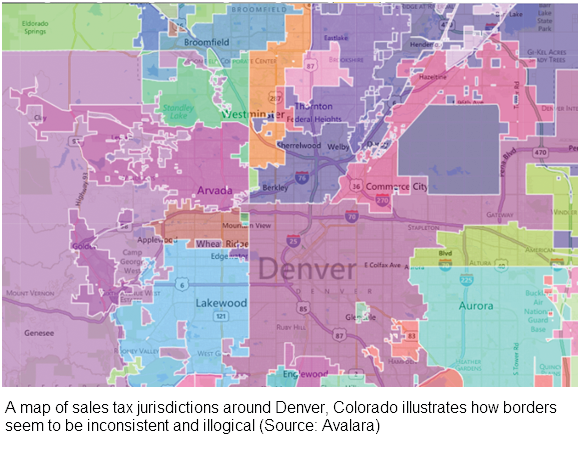

Sales and use tax is one of the three primary areas which legislators use to fund state and local government (the other two major areas are income taxes and property taxes). The concept is relatively simple: if you buy something tangible, you pay a fixed percentage to the local government as a tax.

July 26, 2013

Investor groups say the upcoming expiration of a state tax credit designed to spur investments in early-stage businesses will make it harder for young technology companies to raise the capital they need to survive and thrive.

July 26, 2013

The IRS announced today that it plans to retire two major e-Services incentive products used by CPAs, attorneys and enrolled agents to file authorizations and resolve IRS account problems.

July 25, 2013

Thomson Reuters, provider of tax and accounting software, recently announced the integration of the 2013 back-to-school tax holidays into its ONESOURCE Indirect Tax Software.

July 25, 2013

In efforts to help back-to-school shoppers, CCH, a Wolters Kluwer business, has updated the 2013 state tax holidays, providing information on which states offer the tax holidays, what items are covered and when the holidays take place.

July 25, 2013

Additional Savings on Energy-efficiency Purchases

July 25, 2013

A new employer health insurance survey from HealthPocket and HealthCareReform.com finds that 87 percent of businesses located primarily in New York, New Jersey and Pennsylvania will not change their hiring decisions in response to health reform.

July 25, 2013

Twenty-four governments and six school districts across Ohio are under state supervision to help them avoid a fate similar to what befell Detroit last week when it became the largest U.S. city in history to declare bankruptcy.