Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

May 21, 2013

A Patterson, California, tax preparer pleaded guilty Monday to one count of tax evasion and one count of structuring bank transactions in order to conceal her income, U.S. Attorney Benjamin B. Wagner announced.

May 20, 2013

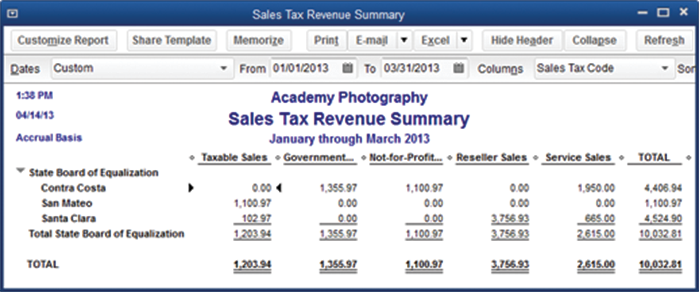

QuickBooks’ sales tax tracking features help you track the “who, what, why, where, and how much” of sales tax. The ultimate goal of QuickBooks sales tax tracking system is to properly calculate and collect sales tax and to properly report revenues tax collections, and tax payments in two two-dimensional reports called Sales Tax Revenue Summary…

May 20, 2013

The Minnesota House has passed a tax bill that could raise revenue $2.1 billion by boosting taxes on high-wage earners, smokers and corporations.

May 18, 2013

Even after the dismissal of the acting IRS Commissioner and a top deputy who oversaw the tax-exempt division, the problems at the Internal Revenue Service seem to keep growing.

May 17, 2013

A Florida investigation into a $3 million Medicaid fraud scheme surrounding an Orlando woman and her mental-health service business has led to the arrests of several of her employees, who are accused of double-billing and taking kickbacks.

May 17, 2013

The city of Akron on Friday morning notified citizens whose sensitive information, possibly including Social Security numbers and credit card numbers, was compromised in a cyber attack and posted on the Internet.

May 17, 2013

All IRS offices, including all toll-free hotlines, the Taxpayer Advocate Service and the agency’s nearly 400 taxpayer assistance centers nationwide, will be closed on those days. IRS employees will be furloughed without pay.

May 17, 2013

Higher payroll taxes and federal sequestration spending cuts are keeping the Bay State stuck in a "soft patch" of economic growth that could last until the end of the year unless federal fiscal policy changes are put into immediate action, experts said yesterday, as new numbers show the state losing jobs.

May 17, 2013

For the sixth year in a row, the accounting and consultancy firm Anchin, Block & Anchin has been recognized as one of the Best Companies to Work for in New York State.

May 17, 2013

He was sentenced to one year and one day of prison by United States District Judge Arthur J. Schwab for evading taxes on several lottery and gambling winnings. The retiree also was given a $3,000 fine and ordered to pay full restitution of $132,445 in back taxes, penalties and interest.

May 16, 2013

With the many new employer tax laws and credits that have gone into effect over the past couple of years, there's little doubt that some small businesses are still unsure of many reporting requirements. For those considering the federal Work Opportunity Tax Credit (WOTC), there's now an easier way to stay in compliance.

May 15, 2013

President Obama announced during a press conference at about 5:30 on Thursday evening that the Treasury Secretary had asked for, and received, the resignation of the acting Commissioner of the Internal Revenue Service.