Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Sales Tax July 9, 2025

Avi for Tax Research empowers tax and trade professionals by providing immediate, reliable, and comprehensive answers, allowing them to identify, analyze, and apply complex tax laws effortlessly and at the speed of commerce.

Small Business July 9, 2025

A group of small businesses that won an order finding President Donald Trump’s sweeping global tariffs illegal urged a federal appeals court to uphold that decision and block the trade levies.

Taxes July 9, 2025

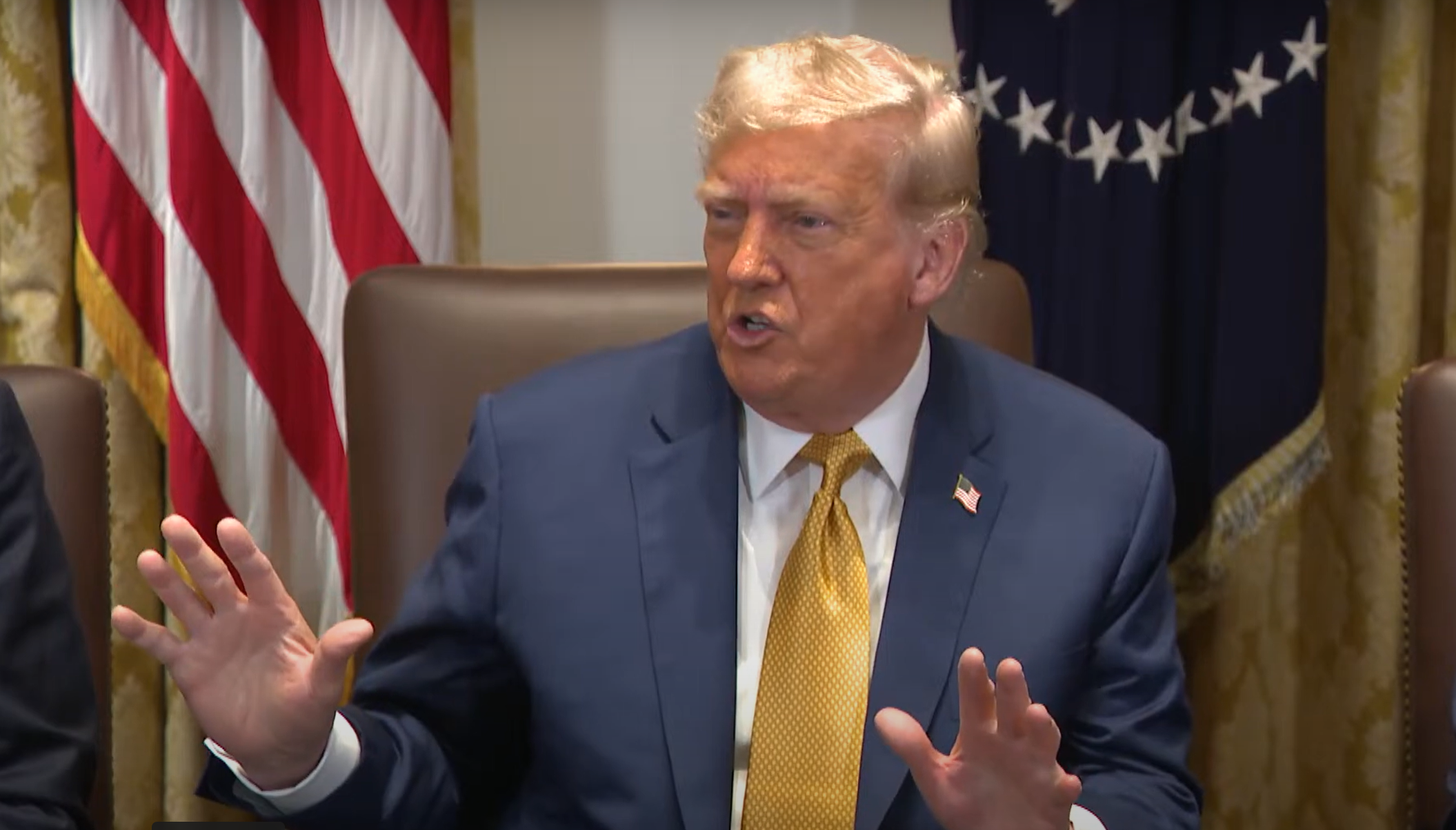

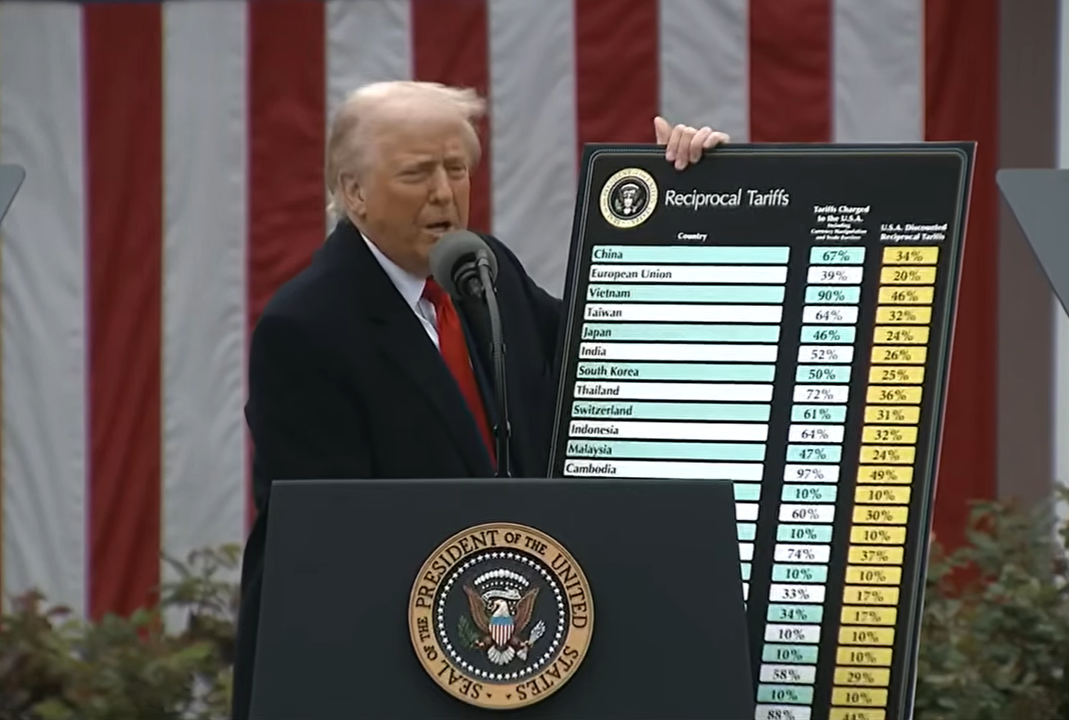

President Donald Trump vowed to push forward with his aggressive tariff regime in the coming days, stressing he would not offer additional extensions on country-specific levies set to now hit in early August.

Taxes July 8, 2025

After the bill was signed by President Trump, millions of Americans received notice from the Social Security Administration saying they no longer will have to pay taxes on Social Security benefits. The problem is, that’s not entirely accurate.

Payroll July 8, 2025

Justices let President Trump move ahead with plans to dramatically reduce the size of the federal government, lifting a court order that had blocked several departments and agencies, including the IRS, from slashing their workforces.

IRS July 8, 2025

Now in its 10th year, the campaign is part of a larger effort by the Security Summit coalition—which includes the IRS, state tax agencies, and the nation’s tax community—to help practitioners combat tax-related identity theft.

Taxes July 8, 2025

In an executive order signed on July 7, President Donald Trump instructed the Treasury Department to strictly enforce the termination of the clean energy production and investment tax credits in the tax code for wind and solar facilities.

Taxes July 8, 2025

President Donald Trump unveiled the first in a wave of promised letters that threaten to impose higher tariffs rates on key trading partners, including levies of 25% on goods from Japan and South Korea starting next month.

Taxes July 7, 2025

A Nevada lawmaker has proposed a bill that would restore a gambler’s ability to deduct 100 percent of losses on annual tax filings, which was altered in the One Big Beautiful Bill Act signed into law last week.

Taxes July 7, 2025

Commercial property taxes are a major line item on the balance sheet — something that’s often misunderstood, miscalculated, or simply overlooked when it comes to potential savings.

Taxes July 7, 2025

From flagging regulatory risks to modeling tax scenarios in real time, GenAI is changing the expectations around what’s possible—and what’s expected—in tax planning and compliance.

Taxes July 4, 2025

President Donald Trump held an outdoor signing ceremony at the White House on Friday, formally enacting a major tax and spending bill that passed through the Senate and House earlier in the week.