Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

April 17, 2013

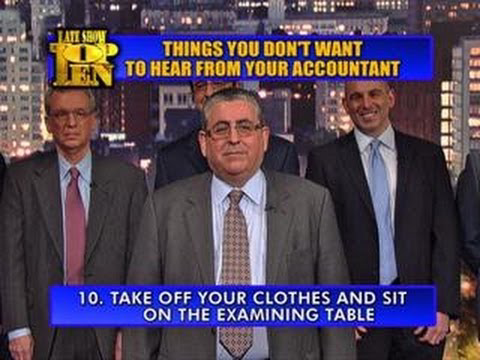

"Top Ten Things You Don't Want to Hear from Your Accountant" from April 9, 2013.

April 17, 2013

WASHINGTON — In response to the Boston Marathon terrorist act, the Internal Revenue Service has announced a three-month tax filing and payment extension to Boston area taxpayers. This relief applies to all individual taxpayers who live in Suffolk County, Mass., including the city of Boston. It also includes victims, their families, first responders, others impacted...…

April 16, 2013

A former IRS agent who opened a tax preparation business was sentenced Friday to nearly 24 years in prison for defrauding clients out of more than $11 million and then attempting to hire a hit man to kill four of them.

April 16, 2013

Lawmakers renew push for legislation to prevent $5 billion tax ID fraud

April 15, 2013

While succeeded in obtaining a federal judge's permission to plead his own case, the court rejected a lengthy habeas corpus motion in which Dr. Unger disavowed the court's jurisdiction and used numerous Biblical references to support his effort to seek release pending trial.

April 15, 2013

Some in Ohio are working to get the Earned Income Tax Credit to more people as a means to both fight poverty and boost the economy.

April 15, 2013

State house is looking to boost revenue by cracking down on the ability of Internet retailers such as Amazon to ship goods into Ohio without collecting the tax.

April 15, 2013

Michigan taxpayers take their anger out on Gov. Rick Snyder

April 14, 2013

It's no secret that professional athletes can earn big paychecks. But in most cities and states they visit, they leave little pieces of them behind.

April 13, 2013

The Internal Revenue Service today announced that its Office of Professional Responsibility (OPR) obtained the disbarment of Certified Public Accountant Anthony A. Tiongson for charging unconscionable fees, giving irresponsible advice to clients and making false statements to federal and state authorities, among other things.

April 12, 2013

More than half of all tax returns filed with the Internal Revenue Service are prepared by professionals. That’s a substantial number of returns, so it is sad to see the number of preparers who make significant errors.

April 12, 2013

April 11, 2013 — Small businesses rebuilding in the aftermath of Hurricane Sandy will get both immediate and long-term help laying a foundation for economic recovery and resiliency thanks to expanded services funded by a $19 million emergency appropriation. Small businesses can take advantage of free expanded counseling, training and technical assistance from the U.S....…