Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

June 27, 2012

Maintaining a healthy balance between career and family is important for long-term success in both areas.

June 27, 2012

Seattle-based Avalara, which offers automated online sales tax compliance, has announced that it has received $20 million in growth financing from Battery Ventures.

June 18, 2012

Even small businesses can benefit from sales tax automation, from the headaches of keeping up with constantly-changing rates, to the perils of audits and penalties.

June 14, 2012

Thomson Reuters has released mobile versions of Thomson Reuters Checkpoint, the online system that provide tax, accounting and financial professionals with research, news, analysis, and productivity tools.

June 13, 2012

Professionals can now get the popular CCH magazine TAXES - The Tax Magazine on their iPad.

May 29, 2012

A record 36.4 million tax returns were transmitted this year by CCH, a Wolters Kluwer business, and CCH Small Firm Services, a Wolters Kluwer business, electronic filing solutions.

May 24, 2012

Avalara, cloud-based sales tax automation solution, announced today that its geolocation sales tax engine will now be integrated into Intuit’s GoPayment, an application that allows small business owners to use their mobile devices to accept credit card payments.

May 1, 2012

BNA Software, a Bloomberg BNA business, recently launched a web version of its BNA Income Tax Planner software.

April 27, 2012

Claimants submitting an economic loss or property damage claim under the BP Settlement who need to hire an accountant to help prepare the claim may receive reimbursement for those services.

April 11, 2012

A survey of 500 accountants reveals the top mistakes small businesses make at tax time.

March 28, 2012

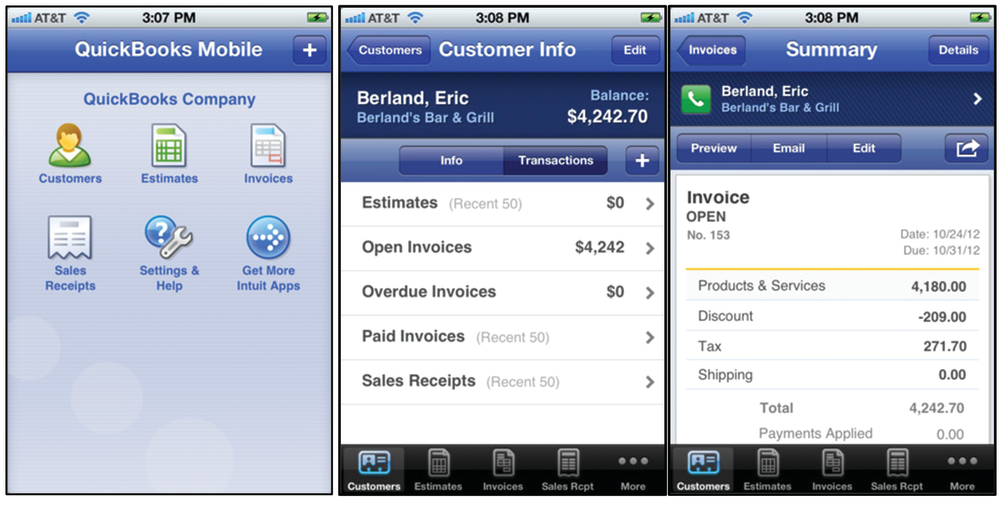

Intuit — Intuit Tax Onlineproadvisor.intuit.com/product/intuit-tax-online866-676-9674 Strengths Web-based, anytime access No IT management or updating required Pay-Per-Return pricing, no startup costs Instant ramp-up/down with any number of users PC and Mac friendly Mobile app for checking status, client information, securely emailing returns From the makers of Lacerte and ProSeries Potential Limitations Lacks integration with accounting programs...…

March 28, 2012

Intuit — ProSerieswww.proseries.com800-934-1040 From the May 2012 review of professional tax compliance systems (traditional workflow). Best Fit: Small to mid-sized firms focused on large 1040 client bases, but also with the need for varied business compliance. Firms who require workflow solutions and integration with QuickBooks. Strengths Optional scan and organize system, plus direct download of...…