Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Sales Tax January 20, 2026

SKIMS has agreed to pay a $200,000 civil penalty to New Jersey to settle allegations that it collected sales tax on tax-exempt clothing items sold to New Jersey customers.

Taxes January 20, 2026

U.S. Reps. Chris Pappas (D-N.H.) and Mike Lawler (R-N.Y.) are proposing a temporary 75% federal tax credit for moderate-income families that pay more than 3% of their annual income on energy costs.

Taxes January 20, 2026

The Facilitating Useful Loss Limitations to Help Our Unique Service Economy Act would restore the long-standing rule allowing gamblers to deduct 100% of their gambling losses against their winnings.

Income Tax January 20, 2026

Every taxpayer’s situation is different depending on how they earn taxable income, so here’s a list of the most common forms to watch for.

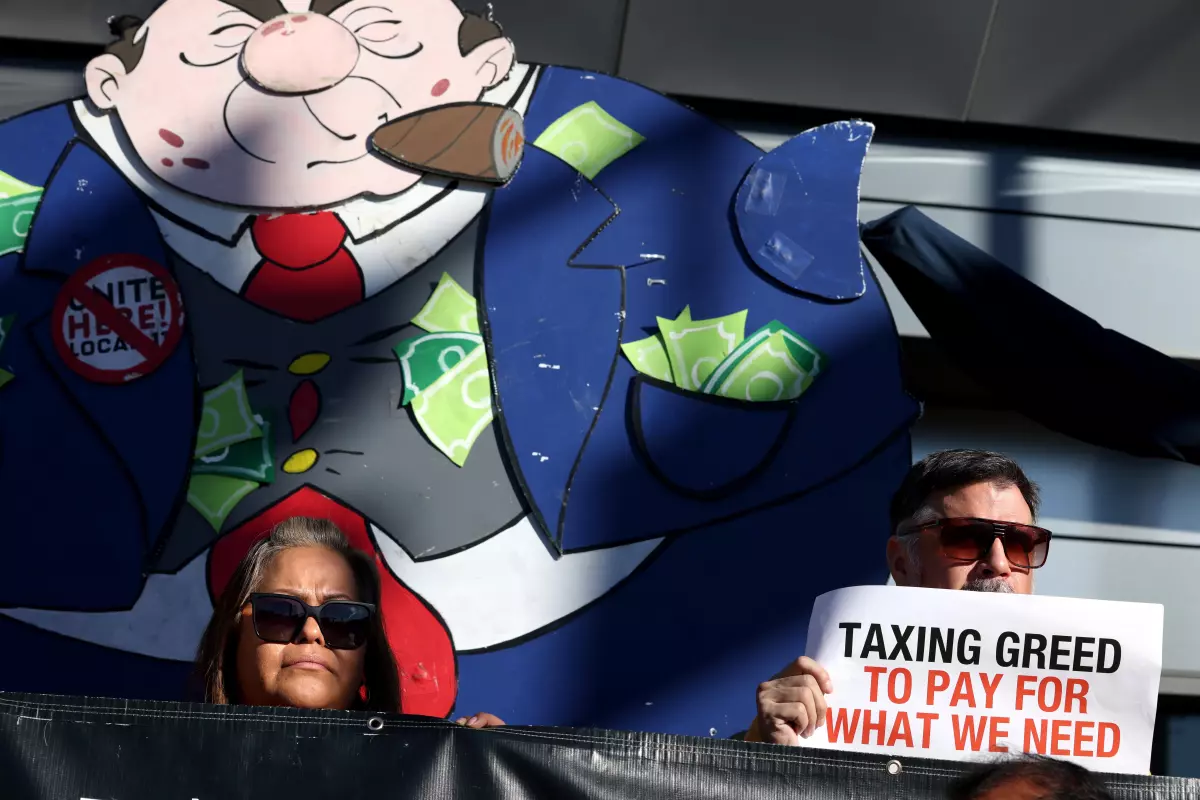

Taxes January 20, 2026

The battle over a new tax on California's billionaires is set to heat up in the coming months as citizens spar over whether the state should squeeze its ultra-rich to better serve its ordinary residents.

Taxes January 20, 2026

“The tariff functions not as a tax on foreign producers, but as a consumption tax on Americans,” researchers from the Kiel Institute for the World Economy wrote in a new report.

Taxes January 19, 2026

With a huge amount of tax dollars at stake, it is important to strictly adhere to the rules for qualified appraisals. Don’t be overly greedy.

Taxes January 19, 2026

Far-right gubernatorial candidate James Fishback is looking to institute a so-called “sin tax” of 50% on income generated from OnlyFans, the popular online streaming service known for adult content.

Technology January 18, 2026

Canopy has announced the addition of AI-powered tax preparation to its accounting practice management software through a new integration with AI tax prep platform Filed.

Taxes January 18, 2026

This chart makes it easy to estimate when you will probably get your 2026 IRS income tax refund, based on when you file. No need to enter data.

Taxes January 16, 2026

Intuit says it plans to launch nearly 600 Expert Office locations, and 20 new TurboTax stores in locations across the nation.

Taxes January 16, 2026

Stadium deals in Washington, D.C. and Kansas— both involving relocations within the same metropolitan area—have set separate records for taxpayer subsidies to sports teams.