Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Small Business March 3, 2025

Two polls signaled that President Donald Trump risks putting off Americans worried about the economy and inflation with the broad flurry of measures during his first weeks in office.

Small Business March 3, 2025

President Donald Trump is on the verge of slapping new tariffs on Canada and Mexico while doubling a levy on China, moves that would dramatically expand his push to reshape the US economy, tap new revenues and upend ties with the biggest US trading partners.

IRS March 3, 2025

Dismissal notices went out Saturday to about 85 employees of 18F, a federal agency that works on improving government technology—effectively shutting down an office hailed a decade ago as Uncle Sam’s new tech startup.

Taxes February 28, 2025

Still waiting on your 2025 income tax refund? This chart can help you estimate when you will receive your refund, even with the changes at the IRS.

Small Business February 28, 2025

Avalara, Inc., a provider of tax compliance automation software, has released its updated connector for Salesforce’s Revenue Cloud, now available on Salesforce AppExchange, a leading enterprise cloud marketplace.

Taxes February 28, 2025

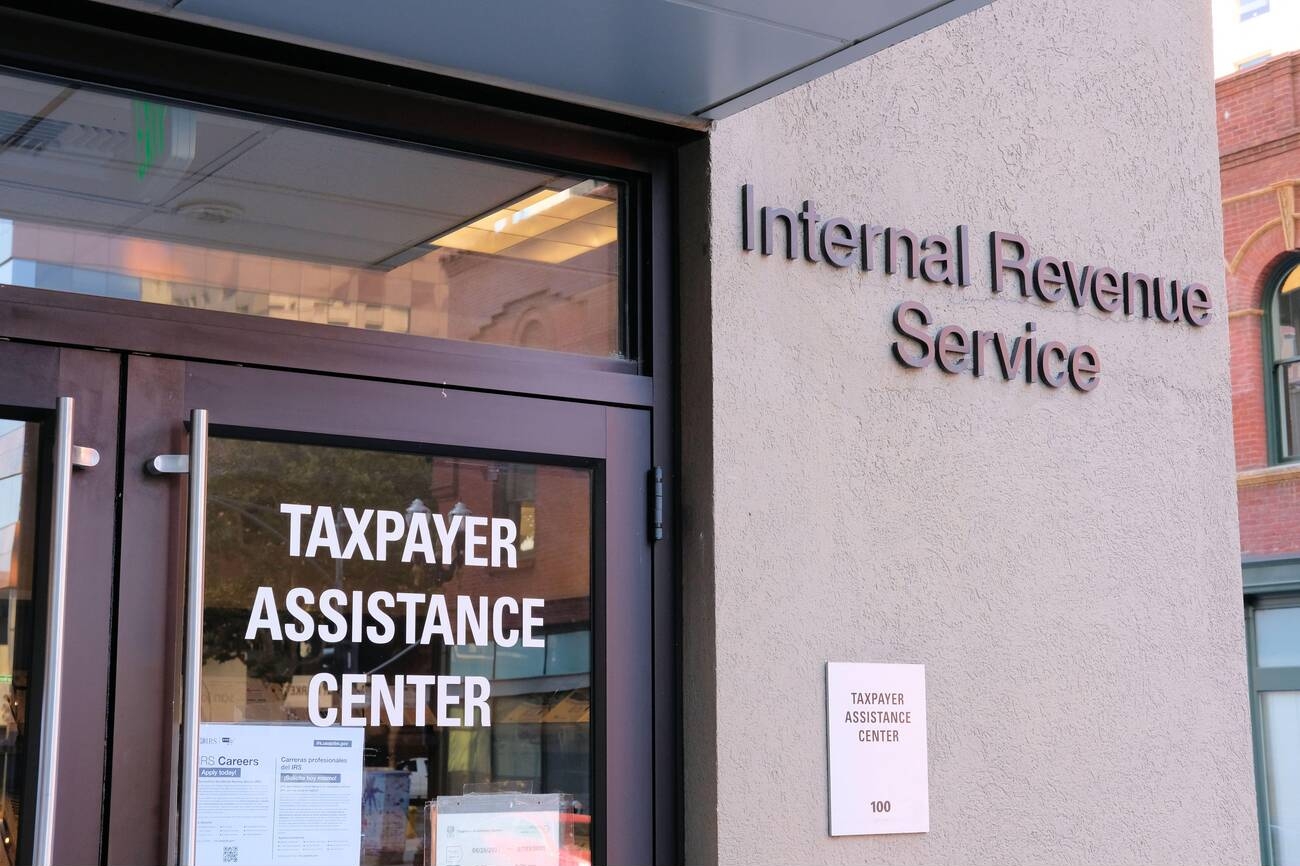

More than 100 IRS offices that host taxpayer assistance centers appear to be on the chopping block as the Trump administration continues efforts to cut waste from the federal government. But any closures likely won't take place until after tax season.

Taxes February 28, 2025

A Florida man pleaded guilty today to orchestrating a nearly decade-long scheme to promote an illegal tax shelter and commit wire fraud. He also pleaded guilty to assisting in the preparation of false tax returns for tax shelter clients.

Taxes February 28, 2025

Each year, the Internal Revenue Service puts together a Dirty Dozen list warning taxpayers, businesses, and tax professionals of tax scams to watch out for, and common schemes that threaten their tax and financial information.

Taxes February 28, 2025

Most farmers and fishers who chose to forgo making estimated tax payments by January that they must generally file their 2024 federal income tax return and pay all taxes due by March 3, 2025.

Taxes February 28, 2025

Taxpayers who file electronically can typically use the Where’s My Refund? tool to check the status of a tax refund within 24 hours of filing. It takes about four weeks for the same information to be available for those filing paper returns.

Taxes February 27, 2025

With the current staffing shortage in the accounting profession, more and more firms are turning to technology to maintain productivity and service quality.

Taxes February 26, 2025

The tax data was stolen and leaked to the media by Charles Littlejohn, a former government contractor who was convicted and sentenced last year to five years in prison.