Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes January 22, 2025

The Senators also claimed Bessent, "... avoided paying nearly $1 million in Medicare taxes on your hedge fund earnings over the course of three years by reporting on your tax returns that you were a “limited partner” ...

Small Business January 21, 2025

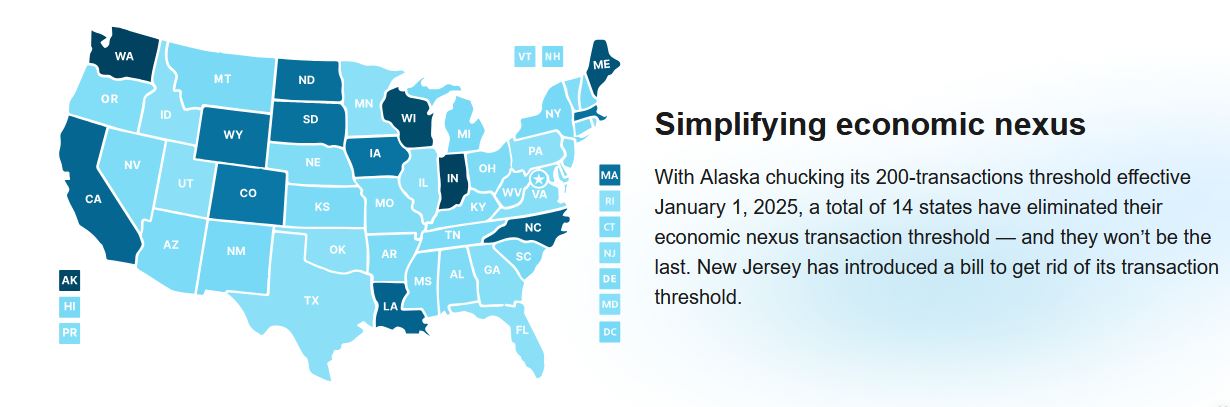

A handful of home rule states − Colorado, Alabama, Louisiana, Arizona, and Alaska – are making moves toward simplification. Still, businesses selling into home rule states continue to face an onerous tax compliance burden.

Taxes January 21, 2025

With President Donald Trump back in the White House for a second term, Americans can expect to see major tax law changes in the years ahead.

Taxes January 21, 2025

Both Eston Melton and his wife, who once worked as a secretary at Miami-Dade County Hall, are registered as lobbyists with the county.

Small Business January 21, 2025

Gov. Tim Walz is pitching his first budget under the new Trump era as a counterweight to the incoming president’s threats to impose tariffs, which he says will raise costs on everyday Minnesotans.

Taxes January 21, 2025

The tax agency has launched a probe into whether financial services firm Trident Trust Group helped well-heeled Americans evade taxes.

![natural_disasters_list_1_.56117a5e5df03[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2021/12/natural_disasters_list_1_.56117a5e5df03_1_.61c1db14bf0ea.png)

Taxes January 21, 2025

The current statute requires the IRS to wait for a federal disaster declaration, which cannot happen until after the disaster occurs, in order to grant deadline extensions.

Taxes January 21, 2025

The IRS recently released guidance on the income and employment tax treatment of contributions and benefits paid in certain situations under a state paid family and medical leave program, as well as the related reporting requirements.

Taxes January 21, 2025

The IRS updated frequently asked questions about the Energy Efficient Home Improvement Credit and the Residential Clean Energy Property Credit in Fact Sheet 2025-01 on Jan. 17.

Taxes January 21, 2025

Both Canada and Mexico have said they’d retaliate against American goods if Trump slaps tariffs on them. The USMCA is up for review in 2026.

Taxes January 20, 2025

Senate Finance ranking member Ron Wyden and other committee Democrats are pressing Scott Bessent to submit to an IRS audit and release his tax filings ahead of the panel’s vote on his nomination Tuesday.

Small Business January 19, 2025

AkuCalc is part of AkuSuite, a suite of tax software solutions created and serviced by indirect tax professionals. AkuSuite also includes AkuCert for exemption certificate management and AkuLicense for business license compliance.