Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes December 17, 2024

Savvy savers should plan ahead to help save more and avoid penalties and tricky tax situations. Here are five changes coming to IRAs and 401(k)s in 2025.

Taxes December 16, 2024

Whether the provisions in the Tax Cuts and Jobs Act are extended, modified, or left to expire, the decisions made in the coming years will shape the tax landscape for a generation.

Taxes December 16, 2024

While measures up for renewal that largely benefit individuals and households are an easy sell to voters, economists caution on the scale of economic dividend they generate. The bigger spur for investment, they say, would be cuts for corporations.

Small Business December 13, 2024

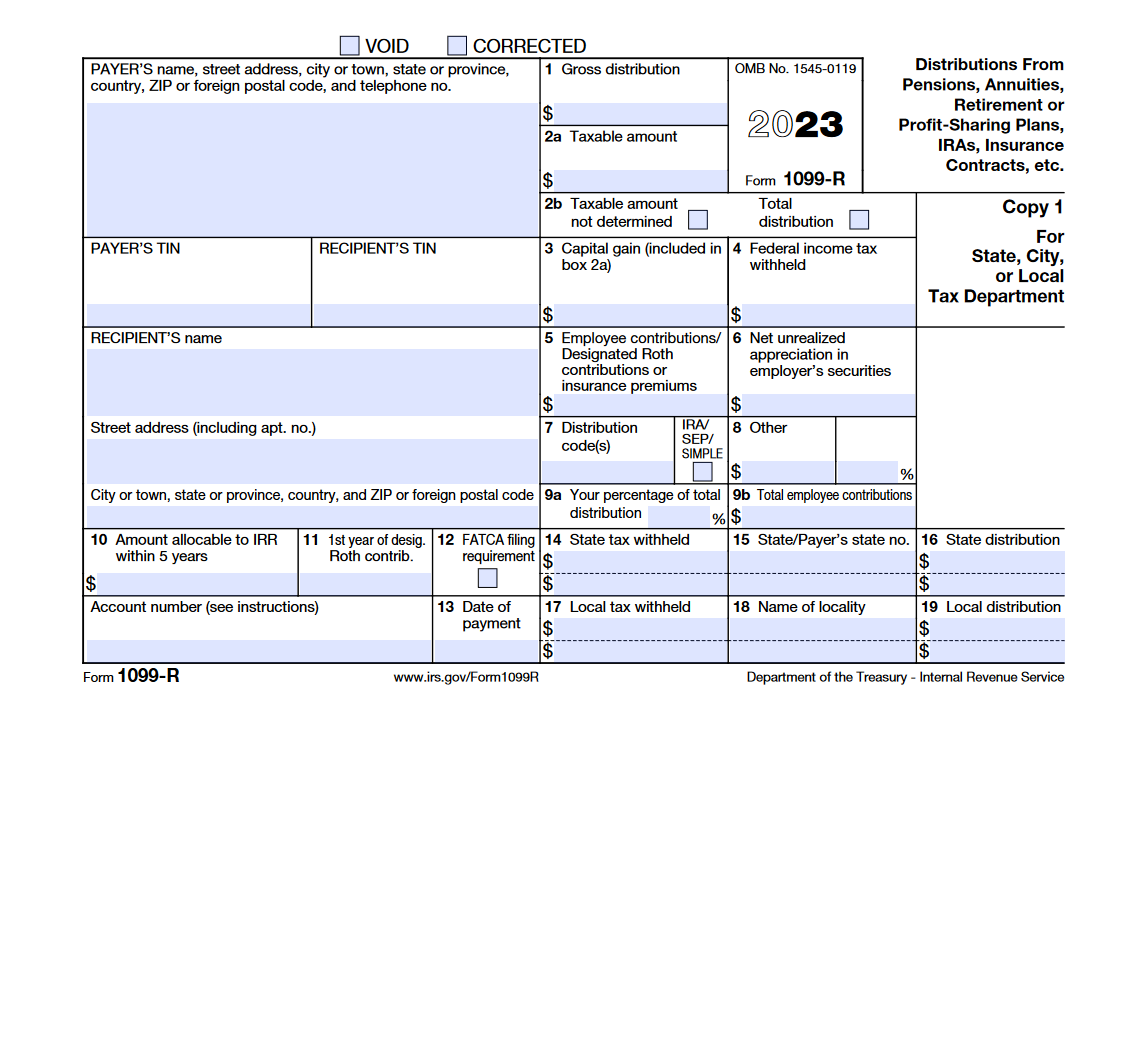

The 1099 filing offering from BILL is an all-in-one solution that enables businesses to manage their AP needs and 1099-NEC and 1099-MISC forms together from a single platform.

Taxes December 12, 2024

The update given by the IRS on Dec. 12 comes as the threat of additional budget cuts from Republicans and a potential new leader of the agency loom once Donald Trump takes office next month and both chambers of Congress are controlled by the GOP.

Taxes December 12, 2024

President Joe Biden on Tuesday warned that Republican Donald Trump’s plans to extend tax cuts and reshape global trade through tariffs risked reversing economic gains.

Small Business December 12, 2024

Tax credits, retirement, and wage and hour developments are among the top regulatory issues small and medium-sized business owners should be monitoring next year, according to the latest annual list from Paychex.

Taxes December 12, 2024

The latest expansion of the IRS business tax account makes this online self-service tool available to C corporations, the tax agency said on Dec. 12. In addition, designated officials can now access business tax account on behalf of their S corporation or C corporation.

Small Business December 12, 2024

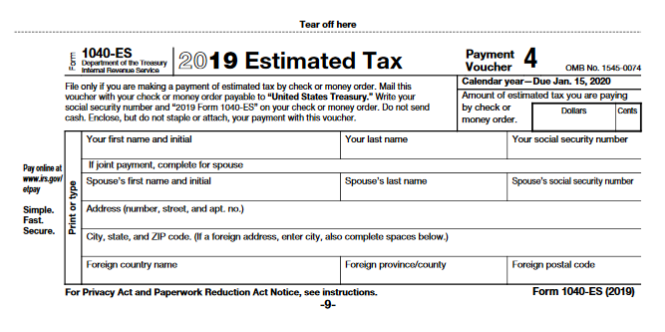

According to SCORE, 82% of small businesses fail due to issues managing cash flow. If money has not been set aside for taxes, an unexpected rise in expenses can cause their business to fail. As a result, personal savings can be wiped out, and those with small business loans can go into debt.

Taxes December 12, 2024

Trump's plan to eliminate taxes on Social Security benefits would help current beneficiaries, but future recipients may be hurt by the move.

Accounting December 12, 2024 Sponsored

Sales tax compliance can be a major challenge, especially for small businesses with limited resources. Join this webinar and discover how automation solutions can help accounting firms and businesses streamline compliance, eliminate manual processes, and expand client offerings.

State and Local Taxes December 10, 2024

Avalara has been named a Leader in three IDC MarketScape reports covering tax automation solutions for SMB, Enterprise, and VAT.