Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes October 22, 2024

While the actual percentages will remain the same, the income levels of each bracket change annually to adjust to inflation.

Taxes October 21, 2024

The IRS provided new guidance to taxpayers using the safe harbors for the SAF credit that were outlined by the agency last April.

Taxes October 21, 2024

All current preparer tax identification numbers expire on Dec. 31, and the fee to renew or obtain a PTIN for 2025 is $19.75.

Small Business October 21, 2024

The enhancement provides a comprehensive solution built into AvaTax that is designed to automate tax calculation and compliance for purchases.

Taxes October 21, 2024

Charles Littlejohn pulled off what’s been described as the greatest heist in IRS history and was sentenced to five years in prison.

Tax Planning October 18, 2024

The event on Oct. 25 is geared toward firm owners looking to start offering or enhance their existing tax planning and advisory services.

Taxes October 17, 2024

Deep ideological differences could make striking an agreement on expiring tax breaks difficult if there is divided government.

Income Tax October 17, 2024

The ad tells Americans they should have a "tax break up" with their professional preparer by using one of TurboTax's live experts.

Small Business October 16, 2024

Halloween can be a scary time for retailers. In addition to inventory issues and trends, figuring out whether and how to charge sales tax on candy can be frightening.

Taxes October 15, 2024

The former president and GOP nominee vowed to "bring the companies back" to the U.S. during an interview in Chicago on Oct. 15.

Taxes October 15, 2024

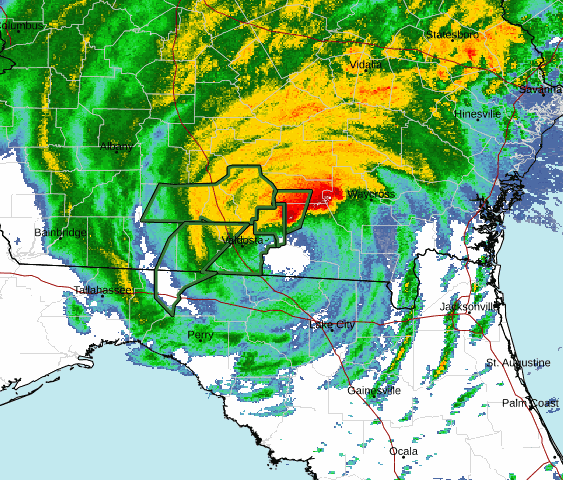

Scammers commonly set up fake charities to take advantage of peoples’ generosity during natural disasters and other tragic events.

Taxes October 15, 2024

The moral of the story is that you should not run risks with so much at stake. The cost of an accurate qualified appraisal from a reputable source is money well spent.