Accounting Technology Lab Podcast February 6, 2026

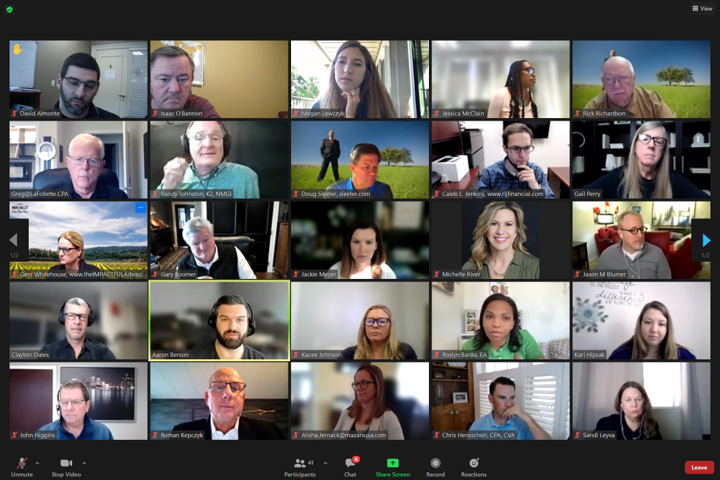

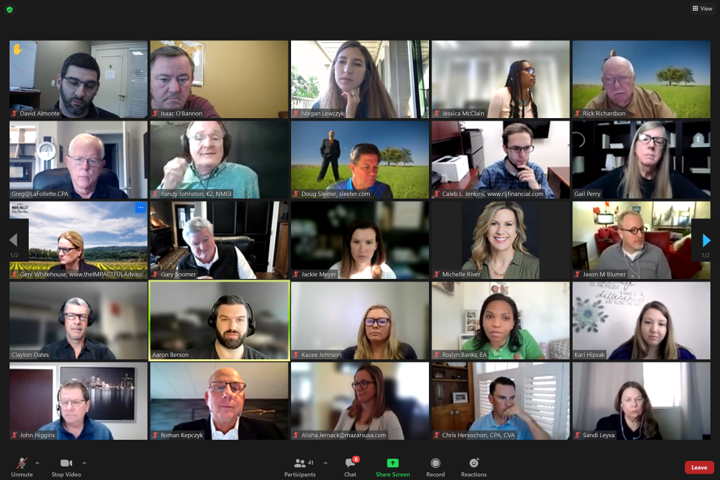

Acumatica Summit Recap – The Accounting Technology Lab Podcast – Feb. 2026

Randy Johnston and Brian Tankersley recap their firsthand experience at Acumatica Summit 2026 in Seattle, framing it as a year of evolution rather than revolution for the cloud ERP platform.

![WorkMarket[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2022/04/WorkMarket_1_.62548b4ae1586.png)

![11016930-citrin-cooperman[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2022/04/11016930_citrin_cooperman_1_.6254368d868c8.png)