March 22, 2020

The Fastest Way to Get Relief Funds to Workers and Businesses – AICPA Proposal

The AICPA is proposing a system to help make sure small businesses can continue paying their employees quickly, efficiently and safely.

March 22, 2020

The AICPA is proposing a system to help make sure small businesses can continue paying their employees quickly, efficiently and safely.

March 22, 2020

A coalition made up of the American Institute of CPAs (AICPA), the International Franchise Association (IFA) and two leading payroll processing companies, Paychex and Intuit, issued the following open letter to President Donald J. Trump, U.S. Treasury Sec

March 18, 2020

The American Institute of CPAs’ (AICPA) president and CEO, Barry Melancon, CPA, made the following statement in response to the Treasury’s recent statement on tax payment relief:

January 14, 2020

AICPA News is a roundup of recent announcements from the AICPA.

August 10, 2016

The AICPA has announced the winners of the Notable Contributions to Accounting Literature Award, presented at the American Accounting Association Annual Meeting. The AICPA-sponsored honor was presented to a team of highly-regarded accounting academic ...

August 9, 2016

The AICPA also has presented Paul Curtis, CPA, of Waldorf, Md., with the 2016 Outstanding CPA in Government Impact Award at the federal level and Kristen Scalise, CPA, CFE, of Green, Ohio, with the 2016 Outstanding CPA in Government Impact Award at the lo

July 20, 2016

A featured speaker at Digital CPA will be business strategist Daniel Burrus, who champions the concept of the “Anticipatory Organization,” one that can analyze long-term trends and move quickly to take advantage of opportunities that come from change.

June 20, 2016

A supermajority of AICPA members who voted supported the proposal, 86.5 percent to 13.5 percent, according to the independent tabulator Survey and Ballot Systems. CIMA members also overwhelmingly endorsed the proposal 89.7 percent to 10.3 percent ...

May 24, 2016

I've been reporting on the accounting profession since Andersen was in the Big Five, Sarbanes and Oxley were just drinking buddies in DC, Enron was a company where great careers were made, and the PCAOB wasn't even a figment of anyone's imagination.

April 19, 2016

A panel of young members and students discuss the impact of diversity and inclusion on the profession. For more young CPA resources, visit http://www.aicpa.org/InterestAreas/YoungCPANetwork/Pages/YoungCPANetwork.aspx

February 1, 2016

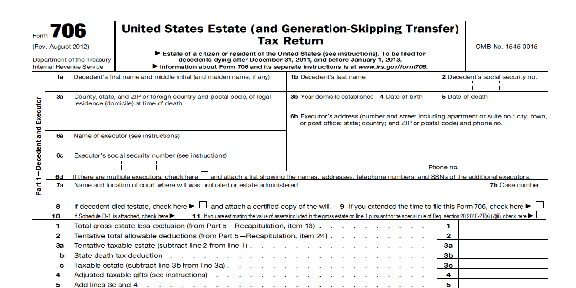

The American Institute of CPAs (AICPA) has submitted comments to the Internal Revenue Service (IRS) and U.S. Department of the Treasury about IRS draft Form 8971, Information Regarding Beneficiaries Acquiring Property from a Decedent, and draft ...

January 12, 2016

This award honors individuals who have made an important mark on management accounting education, research and practice. Professor Haka was recognized for her numerous years of research on the role of accounting systems in business processes and ...