Firm Management March 14, 2023

Your Firm and Your Technology Stack

Think carefully about the areas where you can improve your operations. What is taking most of your team's time? Where can we make evolutionary and revolutionary changes?

Firm Management March 14, 2023

Think carefully about the areas where you can improve your operations. What is taking most of your team's time? Where can we make evolutionary and revolutionary changes?

Taxes March 14, 2023

The new law enhances the benefits of making “qualified charitable distributions” (QCDs) from a taxpayer's IRAs.

Taxes March 14, 2023

Tax season may be in full swing, but there’s still time to make a smart money move that often goes overlooked by taxpayers.

Payroll March 14, 2023

The credit is for businesses with up to 100 employees, but the credit is reduced by 2% per employee over 50 employees earning less than 100,000/year.

Payroll March 13, 2023

For gig workers, Prop 22 preserved flexible schedules associated with remaining a contractor but took away protections giving gig workers classification as employees.

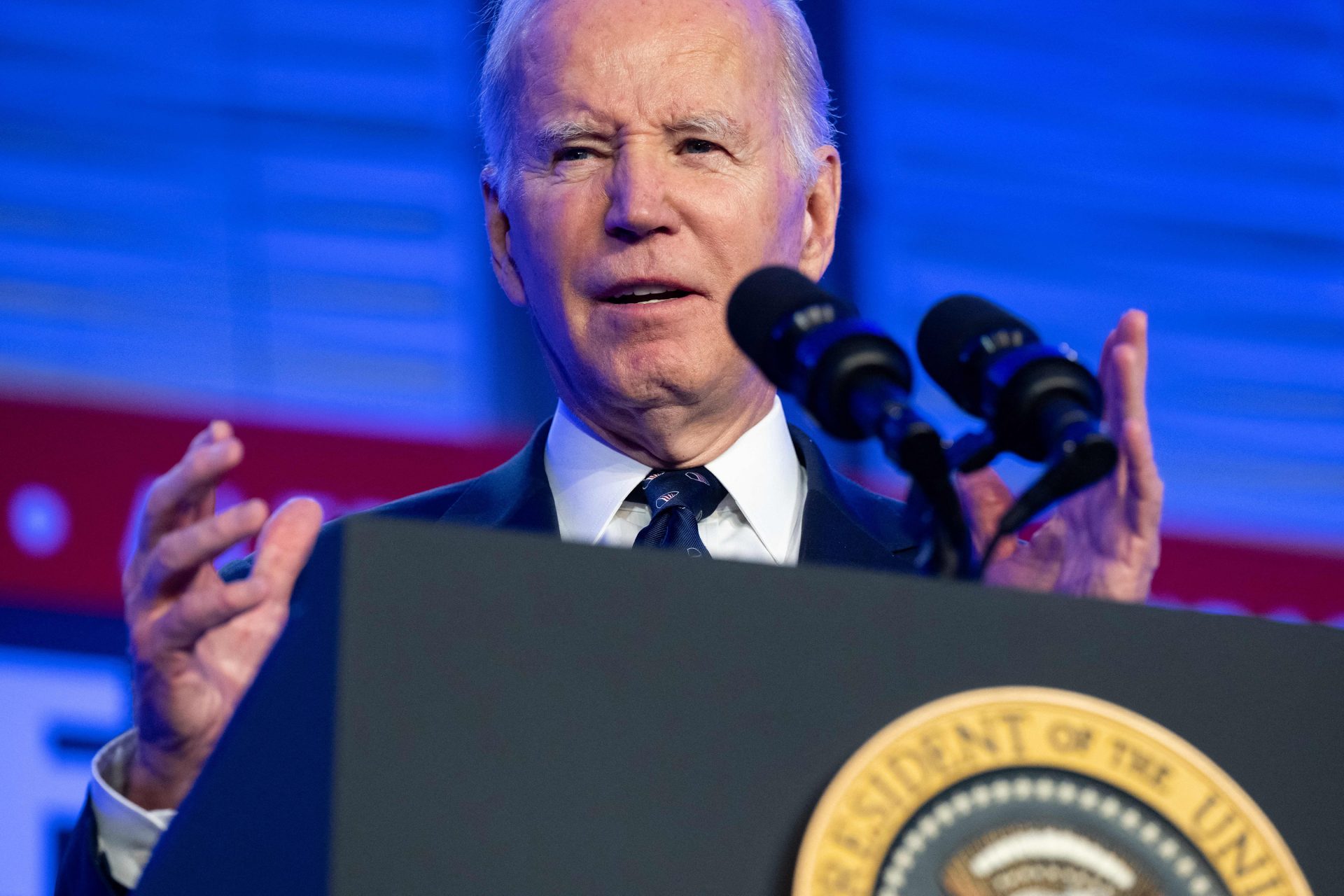

Taxes March 13, 2023

Republicans on the Ways and Means Committee gave the president’s latest budget request an icy reception.

Payroll March 13, 2023

Demand for international pensions and savings vehicles is continuing to grow as employers try to optimize their benefits packages for different groups within their global workforce.

Advisory March 10, 2023

Having insights into payroll also can allow accountants better insight into tax credits that clients may qualify for.

Accounting March 9, 2023

BMO Bill Connect, powered by BILL, is a bill pay and invoicing platform that helps customers pay and get paid in a simpler, faster and more secure way.

Firm Management March 8, 2023

Employee Appreciation Day was a good opportunity for leaders to reflect on how they can improve employee retention.

Accounting March 7, 2023

There will be a new infrastructure, new discipline sections, and a greater emphasis on technology throughout.

Taxes March 7, 2023

The president’s budget proposes raising Medicare taxes from 3.8% to 5% on annual income above $400,000.