Special Section: Guide to 2025 Tax Changes November 12, 2025

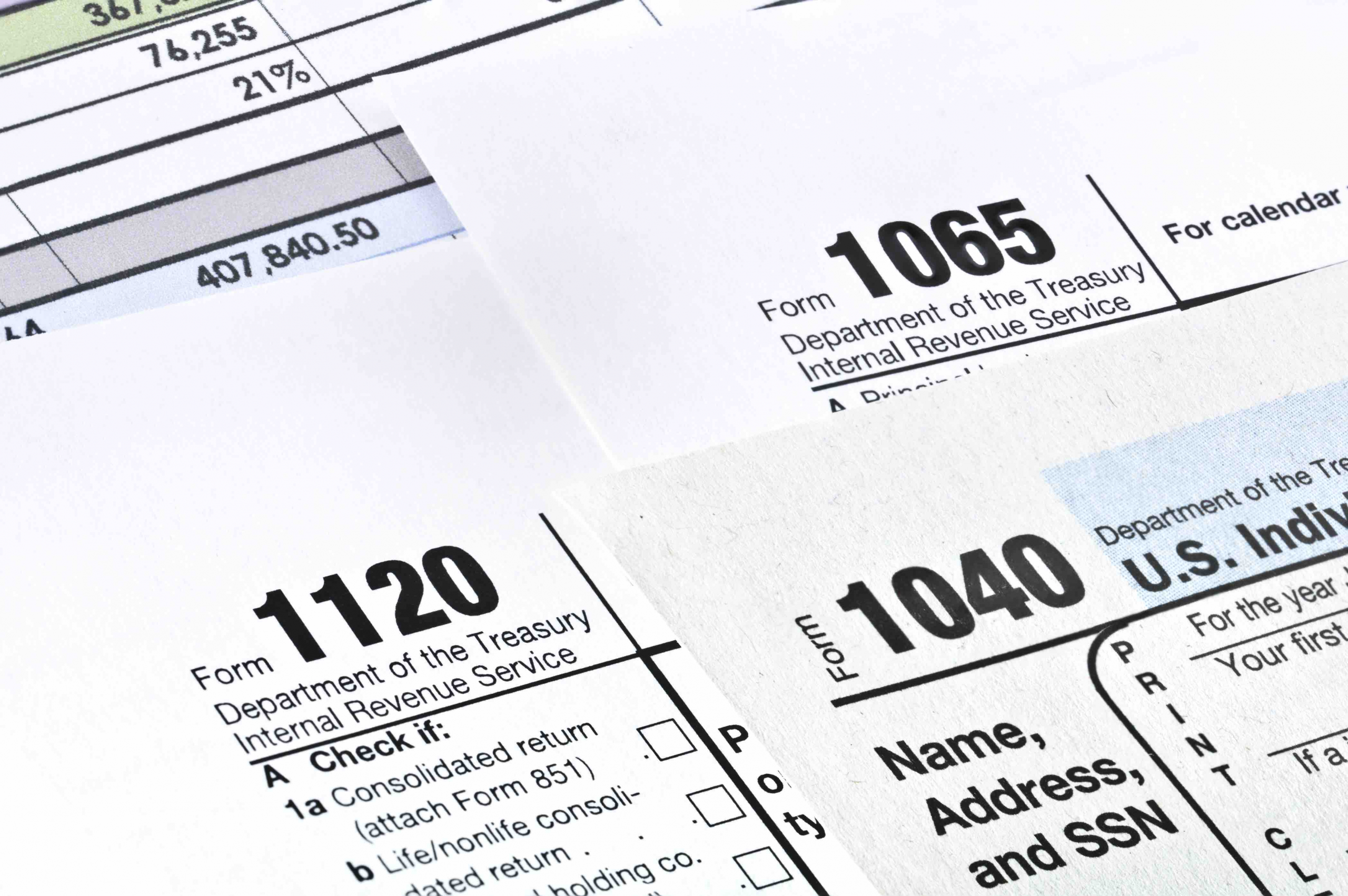

New Tax Forms for the 2026 Income Tax Filing Season – OBBBA Tax Law Changes

The OBBBA tax changes mean a major impact on 2025 tax returns that must be filed by April 15, 2026. Besides creating new tax forms, the OBBBA requires significant modifications to others.