September 9, 2014

White Paper Explores 5 Ways to be a Better Tax Researcher

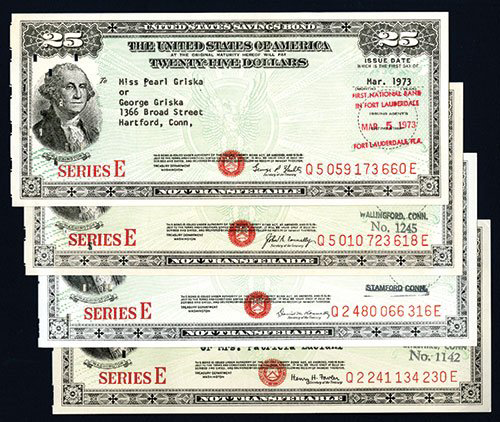

Thomson Reuters has released a new white paper for tax professionals, Unlocking the Limits of the Keyword: 5 Ways to be a Better Tax Researcher. The paper addresses key challenges practitioners face when answering complex tax questions — exploring the evolution of the tax research process from print to digital and examining the viability of…