February 24, 2014

Deployed Military Forces Can Get Free Tax Help

Ohio's deployed military personnel may receive free tax preparation services from volunteer tax experts.

February 24, 2014

Ohio's deployed military personnel may receive free tax preparation services from volunteer tax experts.

February 23, 2014

A couple of years ago, a reader told me that he was very perplexed. He was trying to prepare his daughter’s tax return, but was coming up with a huge tax bill. Why?

February 22, 2014

Accountants, especially during busy season, have significant demands on their time, so it's critical to understand how to balance a desire to develop deeper client relationships and work-related time constraints.

February 22, 2014

I have been preparing tax returns for a very, very long time. Yet, I usually feel as if I know nothing. So, when someone asks me a question, even when I am pretty sure of the answer, I look it up.

February 19, 2014

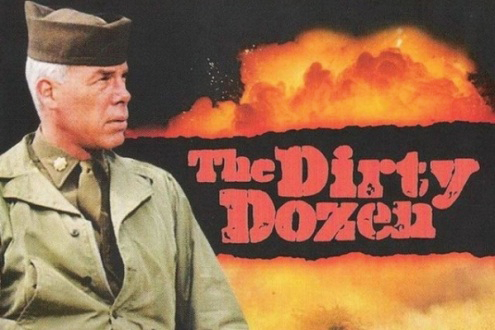

The Internal Revenue Service today issued its annual “Dirty Dozen” list of tax scams, reminding taxpayers to use caution during tax season to protect themselves against a wide range of schemes ranging from identity theft to return preparer fraud.

February 14, 2014

The federal government is set to unveil in the next few days a way for legal pot merchants to use banking services.

February 13, 2014

A new simplified method devised by the IRS for claiming home office deductions is much faster and easier to use than the unwieldy traditional method.

February 13, 2014

A push to boost tax credits for the working poor could see success in states this year, echoing a key proposal from the White House.

February 13, 2014

The Internal Revenue Service is reminding taxpayers that phone calls to the agency's support center usually start to dramatically increase following the President's Day holiday, which is this weekend. There are other options for taxpayers who have questions, of course, starting with using a tax professional such as a CPA or Enrolled Agent.

February 13, 2014

As an IRS contact representative, Sherelle Pratt was tasked with tackling confused tax filers' most complicated questions.

February 13, 2014

The specter of the dreaded new surtax on “net investment income” (NII) has turned into reality. For the first time ever, some upper-income taxpayers will have to pay the 3.8% surtax on their 2013 income tax returns. This could be a harrowing experience for some of your clients.

February 13, 2014

The 2014 version of a New Hampshire minimum wage hike bill, which would set the wage at one dollar above the federal level and then escalate it in future years, received predictable mixed reviews before a State House panel Tuesday.