Taxes September 20, 2023

IRS Establishing New Unit to Crack Down on Tax Dodging by Pass-Throughs

Group within LB&I will be tasked with holding large partnerships and other pass-throughs accountable on tax compliance.

Taxes September 20, 2023

Group within LB&I will be tasked with holding large partnerships and other pass-throughs accountable on tax compliance.

Taxes September 18, 2023

The agency is ramping up compliance efforts against high-income earners, partnerships, large corporations, and promoters.

Taxes September 15, 2023

Stakeholders have until Oct. 31 to provide feedback on the proposed changes to Form 6765 the IRS unveiled on Friday.

Taxes September 14, 2023

A rash of bogus ERC claims in recent months has prompted the IRS to put the program on hold through at least the end of 2023.

September 14, 2023

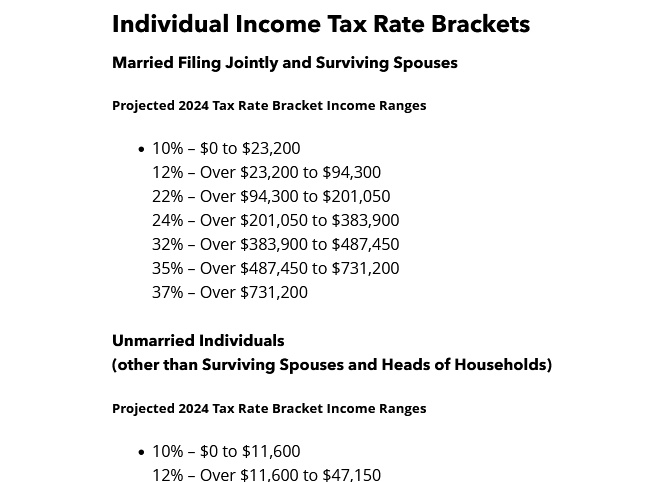

This year’s report projects that several key deductions for taxpayers will see notable year-over-year increases, with the foreign earned income exclusion ...

Taxes September 14, 2023

The AICPA has provided resources and information to its members to warn their clients of red flags that could indicate that a vendor is dishonest and discourage ...

Firm Management September 14, 2023

campaign, a collaborative effort between Feeding Georgia and the Georgia Society of Certified Public Accountants (CPAs), raised an impressive $347,537.38 - the equivalent of nearly 1.4 million meals.

Payroll September 13, 2023

Pay is beginning to catch up in the race, and since May, has been rising faster than inflation after losing ground for more than two years.

Taxes September 13, 2023

Affected individuals and businesses will have until Feb. 15, 2024, to file returns and pay any taxes that were originally due during this period.

September 12, 2023

The IRS often views business travel expense deductions with a healthy dose of skepticism. Consult with your professional tax advisor to ensure you’re on firm ground.

September 12, 2023

The guidance also provides general rules for determining a taxpayer's financial statement income and AFSI.

Taxes September 12, 2023

Notice 2023-63 includes interim rules on the capitalization and amortization of specified research or experimental expenditures.