October 4, 2022

Deferred Payroll Taxes Are Coming Due Soon

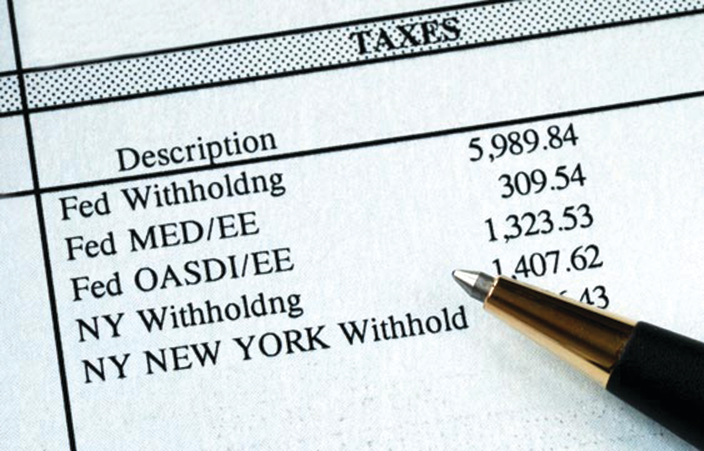

Businesses have until December 31, 2022, to meet their obligations for federal payroll taxes deferred from as far back as 2020. If a business fails to comply, it may be hit with a hefty tax penalty.