Taxes September 5, 2025

Tariffs Leave U.S. Business Tied Up in Costly Red Tape

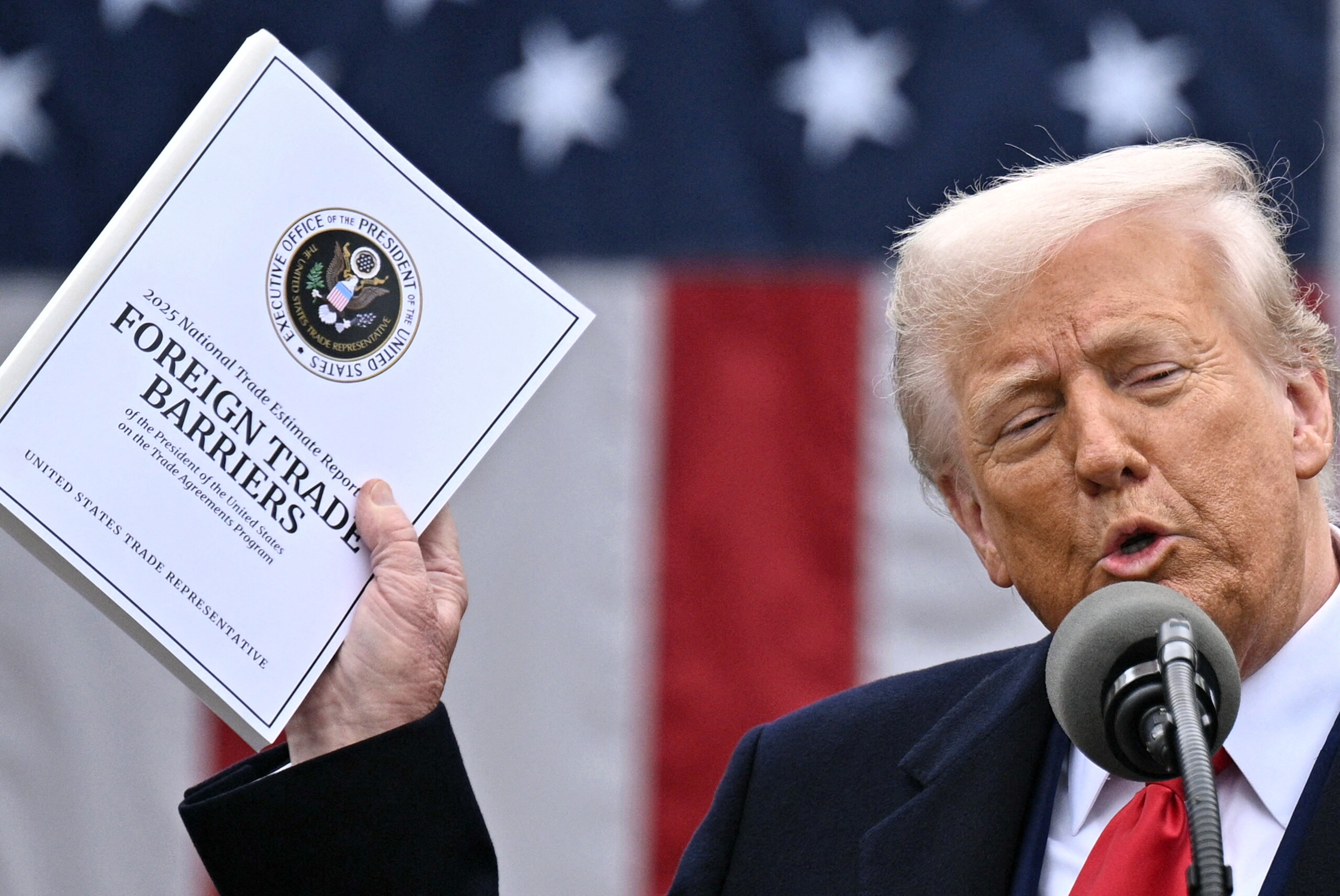

Donald Trump promised to slash red tape for business. His tariff regime has gotten American companies increasingly tangled up in it.

Taxes September 5, 2025

Donald Trump promised to slash red tape for business. His tariff regime has gotten American companies increasingly tangled up in it.

Small Business September 4, 2025

National hourly earnings growth for small business employees reached its lowest level since December 2020 at 2.58%, continuing to trend below 3% for the 10th month in a row, according to Paychex.

Technology September 4, 2025

This new phase of their partnership, which began earlier this year, brings Coupa’s AI platform for total spend management into CoreTrust’s ecosystem.

Taxes September 3, 2025

The Trump administration will ask the Supreme Court for an expedited ruling in hopes of overturning a federal court decision that many tariffs were illegally imposed, arguing it is essential to keep the president's trade policy intact.

Small Business September 2, 2025

The legal fight over President Donald Trump’s global tariffs is deepening after a federal appeals court ruled the levies were issued illegally under an emergency law, extending the chaos in global trade.

Small Business September 2, 2025

U.S. consumer spending rose in July by the most in four months, indicating resilient demand in the face of stubborn inflation.

Small Business August 29, 2025

As 85% of consumers begin summer shopping in late winter, businesses face a new peak season – and a growing need for automated tax technology to manage product complexity and compliance

Small Business August 29, 2025

The latest levies have sent importers scrambling and are likely to raise prices for America’s millions of coffee drinkers.

Human Resources August 28, 2025

A human resources expert explains how to assess resume gaps with context rather than bias to avoid losing top talent.

Small Business August 27, 2025

The Dancing Numbers study ranks all 50 states on business-friendliness using seven key factors, including survival rates, access to capital, tax climate, and startup costs.

Small Business August 27, 2025

A former business systems consultant explains why traditional risk assessment methods are inadequate for addressing modern business threats like cyberattacks and technology failures.

IRS August 26, 2025

The IRS released a draft W-2 form for 2026 on Aug. 15 that takes into account tax provisions in the One Big Beautiful Bill Act for deductions related to tip income and overtime pay.