Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Idaho Supreme Court rejected a challenge to Idaho’s $50 million tax credit program that directs public money toward private schools and homeschooling expenses.

Taxes January 28, 2026

Dozens of public school advocates gathered outside of the Governor’s Office in the West Loop Tuesday morning, demanding that Pritzker choose not to participate.

Taxes January 23, 2026

The Idaho Supreme Court heard arguments Friday on a challenge to Idaho’s $50 million tax credit program that directs public money toward private schools and homeschooling expenses.

Taxes January 20, 2026

U.S. Reps. Chris Pappas (D-N.H.) and Mike Lawler (R-N.Y.) are proposing a temporary 75% federal tax credit for moderate-income families that pay more than 3% of their annual income on energy costs.

Taxes January 13, 2026

In a letter to the chairmen and ranking members of both tax-writing panels in Congress, ADP says it supports a five-year extension of the WOTC, which has been proposed in legislation by lawmakers in the House and the Senate.

Taxes January 12, 2026

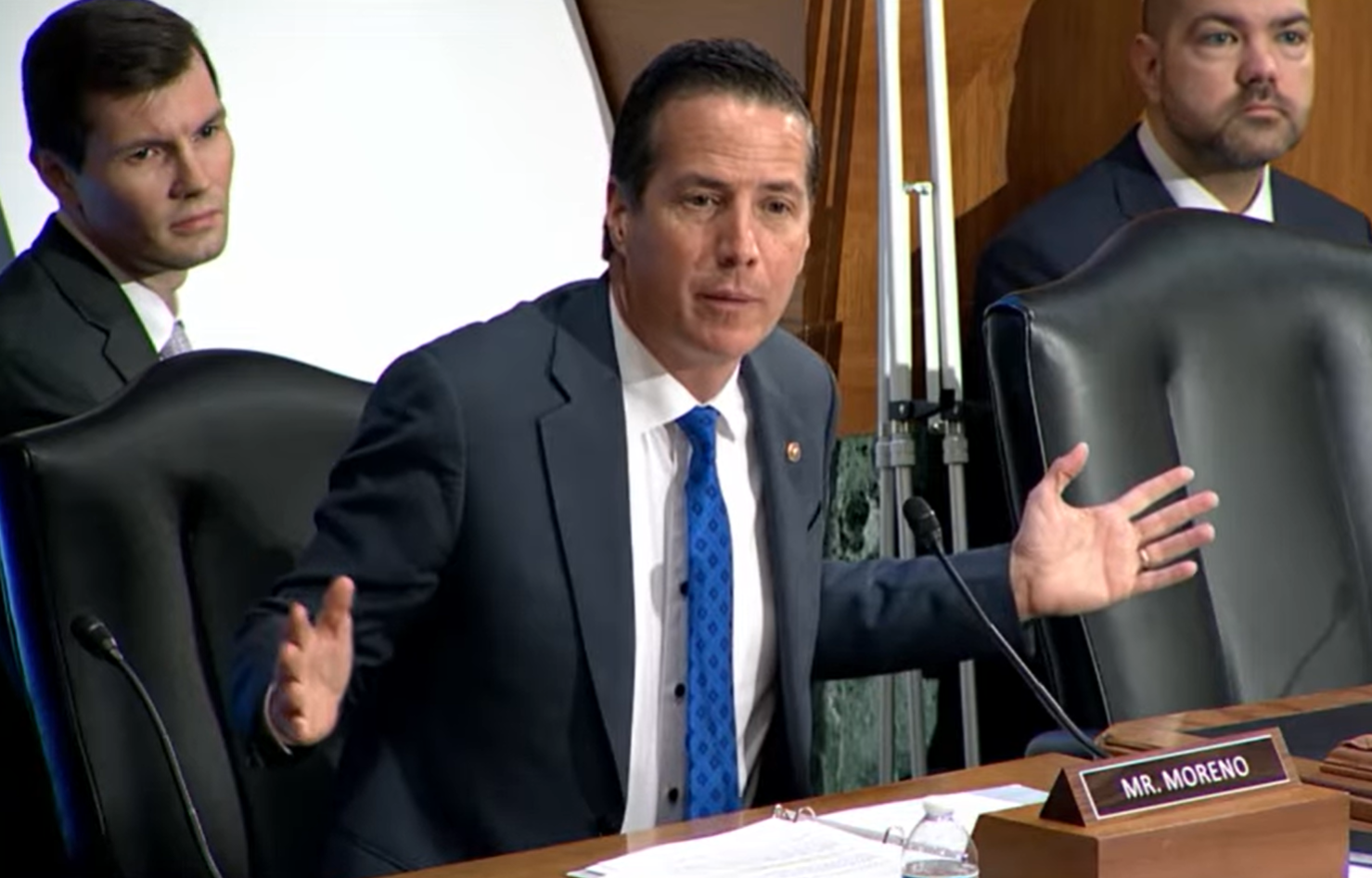

Sen. Bernie Moreno, R-Ohio, is one of approximately a dozen senators who're participating in talks to extend Obamacare credits that lapsed on Jan. 1, according to Politico.

Taxes January 12, 2026

Gov. Gavin Newsom on Jan. 9 doubled down on California’s commitment to electric vehicles with proposed rebates intended to backfill federal tax credits canceled by the Trump administration.

Taxes January 9, 2026

The House voted 230-196 Thursday to send a three-year extension of the expired tax credits to the Senate. Seventeen Republicans supported the measure.

Taxes January 7, 2026

Swing-district Republicans defied party leaders to join Democrats in advancing legislation Wednesday to revive expired Obamacare subsidies for three years.

Taxes January 5, 2026

With a Dec. 31 deadline to connect solar panels before a significant federal tax credit for homeowners expired, installers were racing to mount panels before the incentive evaporated.

Taxes December 22, 2025

Notice 2026-01 provides a safe harbor for businesses that wish to claim the Section 45Q tax credit for qualified carbon oxide captured and disposed of in secure geological storage occurring during calendar year 2025.