Taxes December 17, 2025

Here’s Why Americans Could See a $1,000 Increase in Tax Refunds Next Year

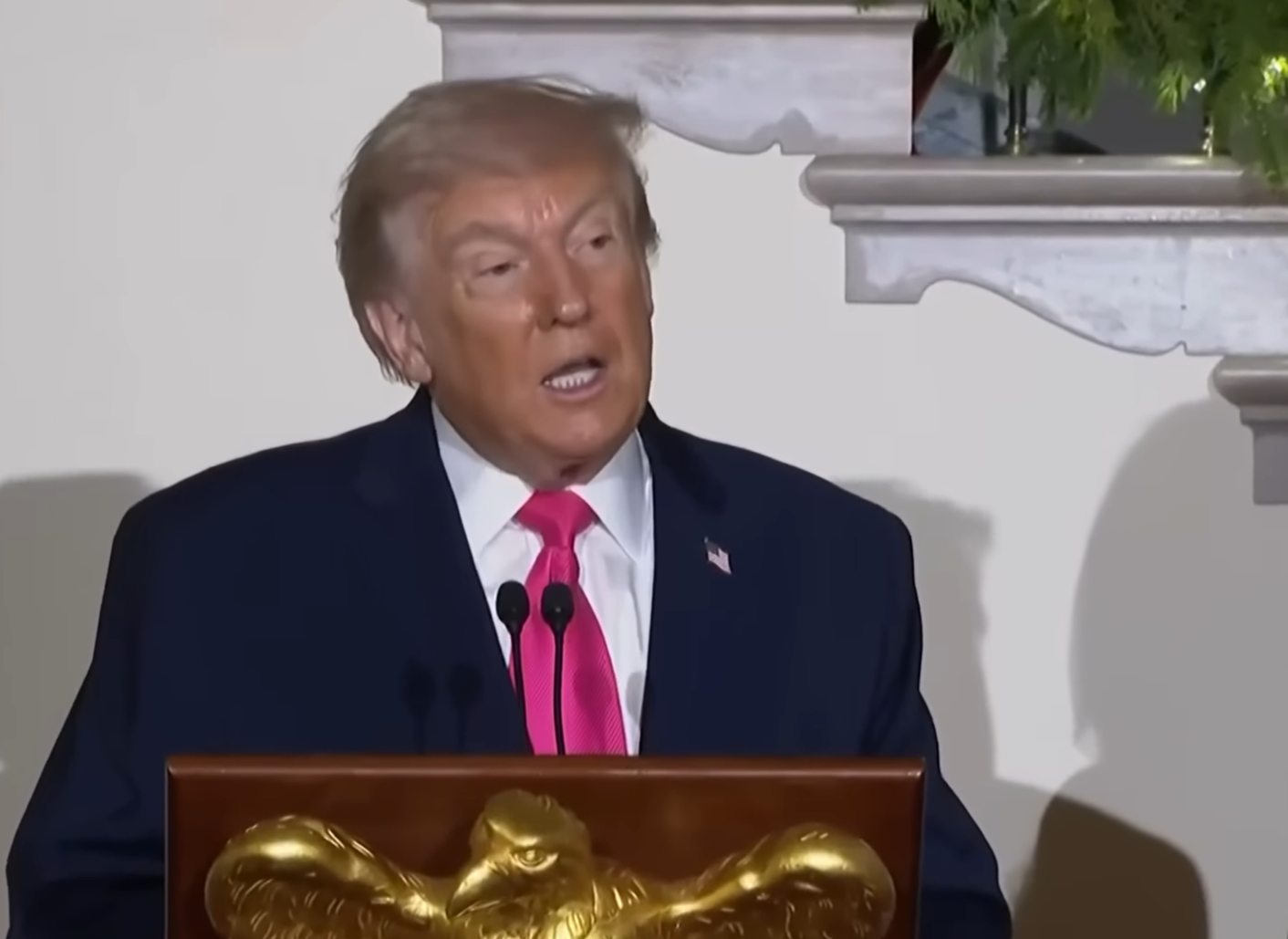

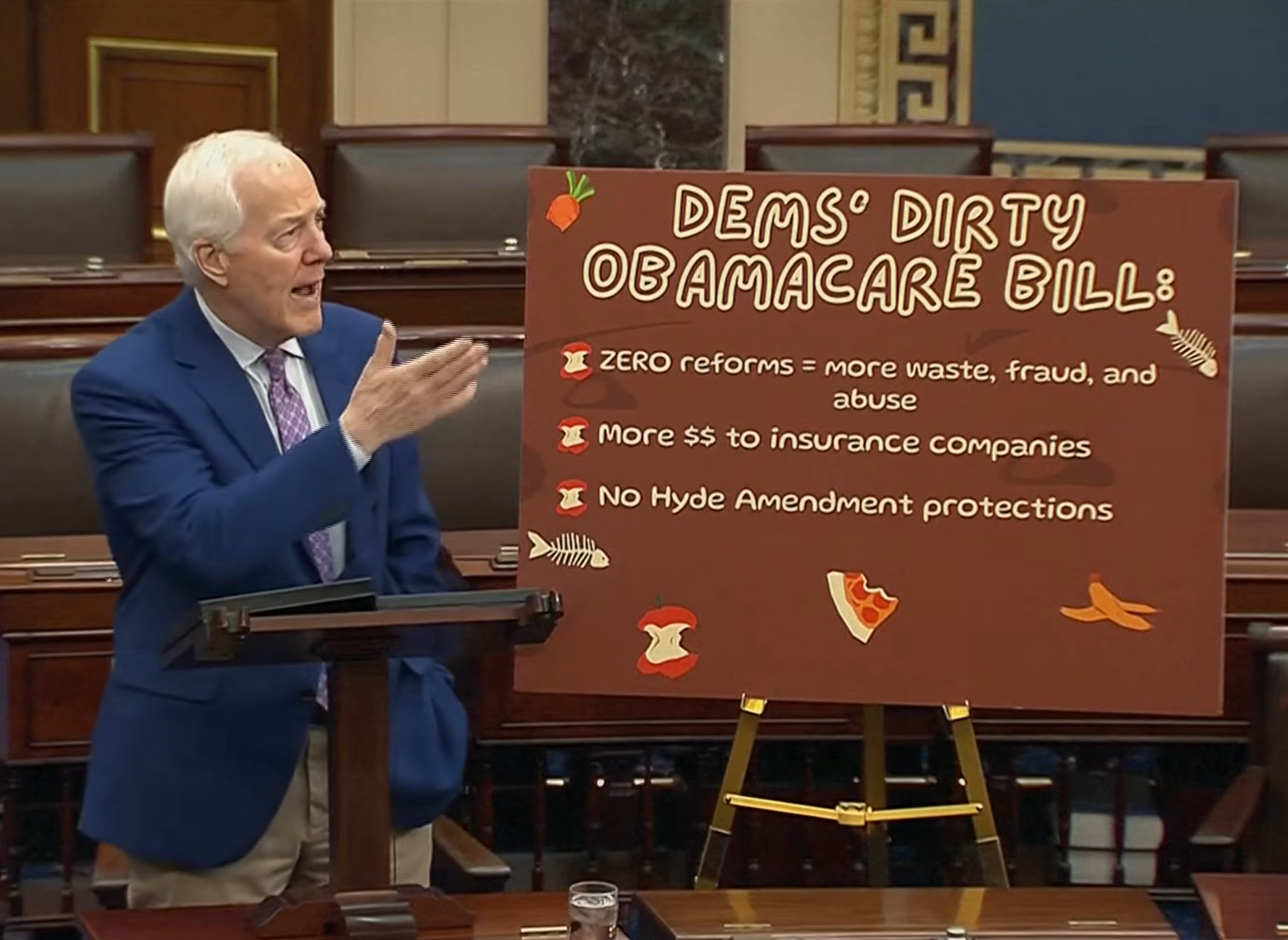

Recent tax legislation imposed by President Donald Trump and enacted by the One Big Beautiful Bill Act is at the heart of the increase, the White House said.