December 21, 2015

2015 Review of Tax Research Systems

Taxation is no longer a once-a-year engagement, at least not for clients with more than a couple of W-2s and 1099s. Complex and high net worth clients require strategic tax planning, which in turn requires their professional to stay on top of changes ...

December 21, 2015

PATH Act: Obama Signs Tax Extenders Law

The PATH Act makes more than 20 tax breaks permanent in addition to retroactively extending a slew of others for two or more years. Here’s a roundup of the key individual, business and miscellaneous provisions in the new measure.

December 20, 2015

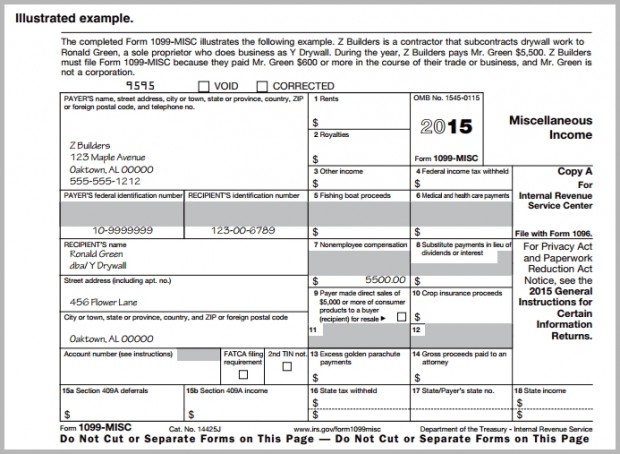

Printable IRS Form 1099-MISC for 2015 (For Taxes To Be Filed in 2016)

This IRS Form 1099-Misc is for reporting income received from Jan. 1 to Dec. 31, 2015, which the recipient will file a tax return for in 2016.

December 20, 2015

Printable IRS Form W-2 For 2015 (Taxes To Be Filed in 2016)

This IRS Form W-2 is for reporting income earned during Jan. 1 to Dec. 31, 2015, which the employee will file a tax return for in 2016.

December 17, 2015

Explaining Year-End Tax Forms and Reporting Requirements

Now is the time to start thinking about recent tax changes and how they affect your business. Even for the most organized among us, keeping the mountains of tax details straight is a tough and trying task, taking the focus off of the daily ...

December 16, 2015

Ex-Baseball Star Strikes Out on Tax Appeal

The former All-Star ballplayer, who was named MVP of the American League in 1995, was appealing the decision against him by an Ohio district court. It isn’t known yet if Vaughn will pursue the matter any further.

December 11, 2015

New Privacy Concerns with ACA Reporting for Businesses with 50+ Employees

Starting this filing season, reporting is mandatory for any company with at least 50 full-time equivalent (FTE) employees.

December 11, 2015

Businesses Face Up to $1 Million Fine for Failure to File W-2s and 1099s

This summer, the IRS increased penalties for failure to file correct information returns and failure to provide correct payee statements for information returns filed after December 31, 2015, with maximum penalties on small businesses increasing from ...

December 11, 2015

ADP Testing New W-2 Verification Code to Fight Tax ID Theft

For selected clients, ADP will include the Verification Code in a designated box of the 2015 Forms W-2 issued to its clients’ employees. ADP will generate the alphanumeric code based on select data elements on each Form W-2, and an algorithm provided ...