September 21, 2015

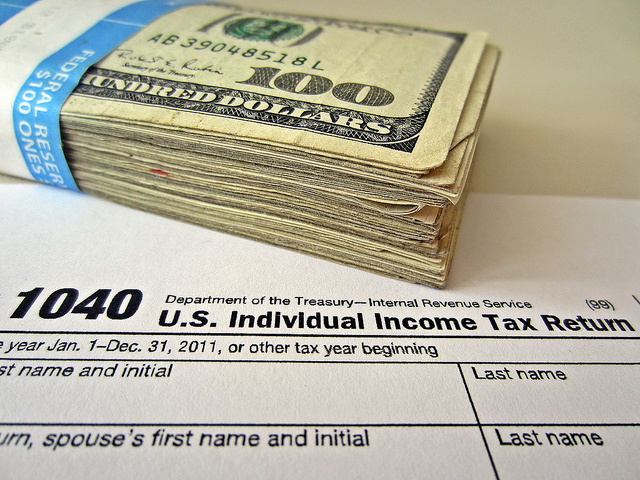

Average Income Tax Refund for 2015 Increased to $2,701 – IRS Caught $908 Million in Fraudulent Refunds

The IRS issued more than 100.3 million refunds totaling more than $270.9 billion, compared to nearly 101.2 million refunds totaling more than $272.4 billion in 2014. The average refund increased slightly to $2,701 in 2015, compared with ...