Taxes November 20, 2025

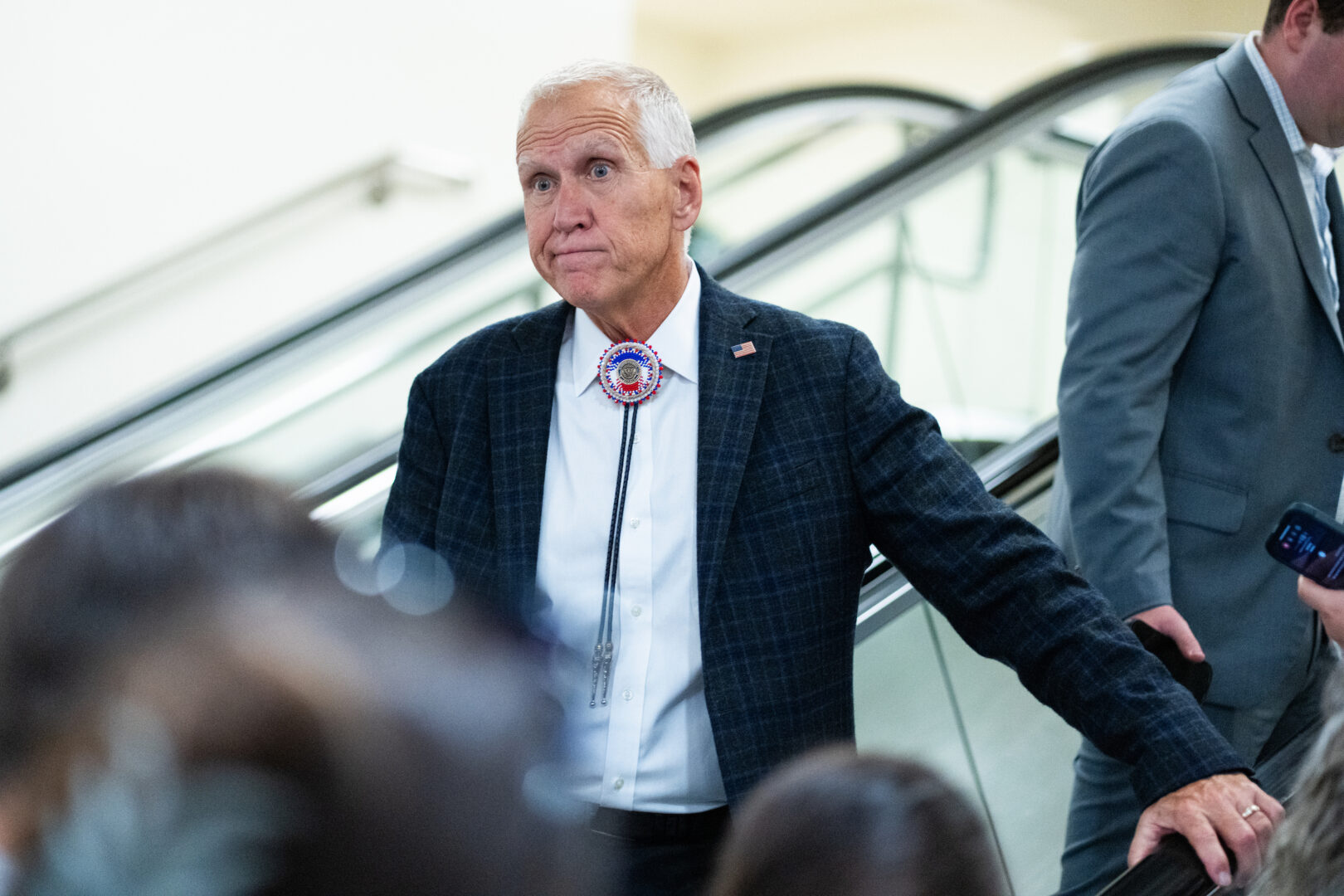

Missouri Gov. Says He Plans to Phase Out State’s Income Tax

Missouri Gov. Mike Kehoe has offered no specifics about his plan but said it revolves around offsetting the $10 billion generated by the state’s 4.7% income tax rate, which represents about 63% of the state’s general revenue.